|

| By Gavin Magor |

The banking industry is facing its biggest challenge in over 15 years, and you need to make sure your money is safe.

Each day, there seems to be new twists to the banking failure saga, and the story gets more interesting but also more worrisome.

It all began with three “isolated” failures. Analysts linked the downfall of Silicon Valley Bank and Silvergate to risky business practices, a lack of oversight and catering exclusively to tech startups and cryptocurrency firms, respectively.

Then, New York State closed Signature Bank, also tied to crypto, after ongoing criminal investigations suggested alleged money laundering by clients.

The failure of these three banks didn’t hit close to home for most people because those institutions served niches. As a result, the failures didn’t cause fear about a 2008-style financial meltdown. Nor should they have.

Like I told members of All-Weather Portfolio early on:

“I have faith in the banking system at large, and you should, too. We are living in a new world with new problems developing, like tech bank runs where people have the ability to move money in seconds, but panicking is the last thing you should do.”

I also warned about the likelihood of serious issues popping up — the difficult-to-predict variety. And right on cue, Credit Suisse — with more than $1 trillion in assets as the 45th largest lender in the world — became part of the saga.

After 167 years in business, the bank finally succumbed to ongoing losses. Bitter rival U.S. Bancorp (USB) came in and bought the bank for a $3 billion bargain.

It might be easy enough to dismiss the recent collapses (even Credit Suisse) as anomalies. However, the old-as-dirt accounting practices used by each (and contributing to their demise) are also used across the spectrum of banks — regional, national and global.

And my team of analysts and I just spent countless hours researching some 4,700 banks to examine their financial strengths and weaknesses and exposure to risk.

The research will culminate in my team issuing each bank a safety rating or grade from “A” (Excellent) to “E” (Very Weak). We’ve been at it since 1987, so people like you can check the stability of the bank you’ve trusted over the years.

Eye-Opening Results

When my team shared the initial results with me, I was alarmed.

Far too many banks are taking far too many risks with your money. And I anticipate more banks slipping down a notch or two when we release our newest ratings.

I was alarmed … but not surprised. That’s because all banks use the same industry-wide practices that contributed to the downfalls of SVB, Silvergate, Credit Suisse and others.

Let me show you what I mean with three charts created by Weiss analysts, which are based on all the data we collected and studied.

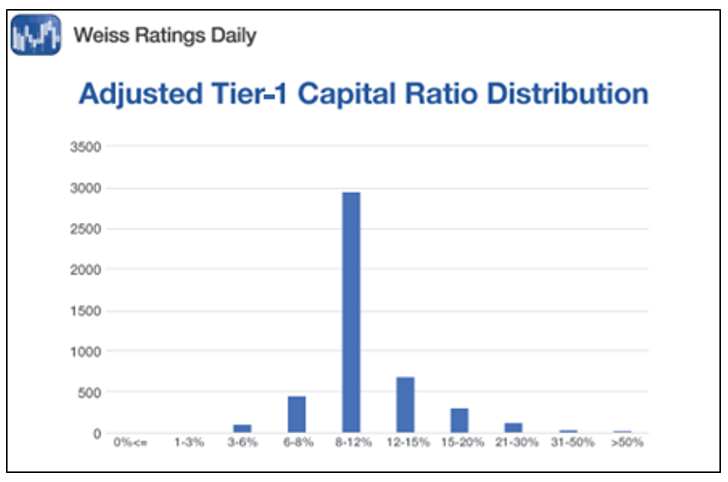

- The first shows how many banks have unacceptable adjusted Tier-1 capital ratio distributions.

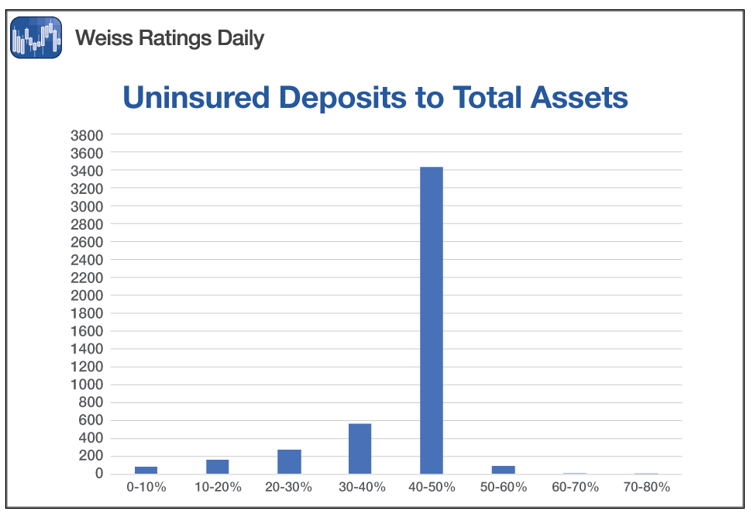

- The second reveals large amounts of uninsured deposits to total assets and total loans.

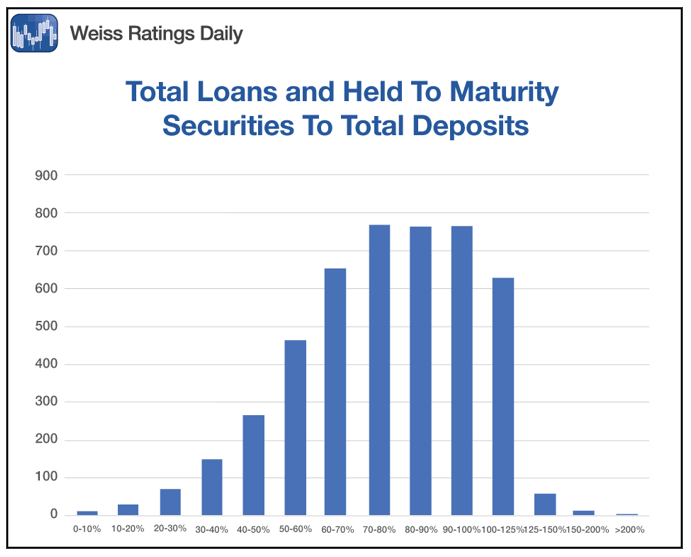

- The final one shows the ratio of hold-to-maturity securities to total deposits are at a staggeringly high percentage.

Here’s the first chart:

Click here to view full-sized image.

The Tier-1 capital ratio is a metric used to determine if a bank holds enough capital to prevent insolvency.

Under the Dodd-Frank Act, a bank is considered "well-capitalized" if it has a Tier-1 ratio of 6%. At Weiss, following the stricter Basel III guidelines, we use 8% as our barometer. SVB only had an adjusted ratio of equity capital to total assets of 5.8% as of Dec. 31, 2022.

On the other hand, another regional bank of similar size to SVB is not under any financial distress with its 11.6% adjusted of equity capital to total assets.

You can see from the above chart that at least a few hundred banks in our database are in high-risk categories (below 8%).

We see a similar upward trend on uninsured deposits to total assets in the next chart:

Click here to view full-sized image.

This chart reflects the number of banks for which the percentage of deposits in accounts is estimated to be uninsured.

Generally, each account with less than $250,000 is insured by the FDIC. So, when things go wrong, bank customers can rely on getting all their money back (up to $250,000), unless there are special scenarios, like what happened with SVB.

This prevents classic bank runs, where everyone worries their money is locked up and they all pull the cash at once.

According to S&P Global Market Intelligence, large U.S. banks held nearly $8 trillion in uninsured deposits at the end of 2022. So, no … Uncle Sam will not be extending lifelines to all those customers like they did for SVB.

At the end of last year, SVB had $151.5 billion worth of uninsured deposits versus total deposits of $173 billion. That means potentially 88% of all SVB deposits were uninsured by the FDIC. This is far greater than most banks, which makes sense given the bank’s niche client base, and it’s a big reason it failed when so many started to withdraw their deposits.

On top of that, when the bank run started, SVB owned too many “hold-to-maturity” assets — like long-term U.S. Treasury bonds — and couldn’t cover the losses, which brings me to our final chart:

Click here to view full-sized image.

Now, it’s completely fine to hold bonds to maturity; it’s an extremely common practice in banking. Doing so is usually safe because their value is measured at acquisition cost, even if they lose value.

The only time that can spell trouble is when a bank is forced to sell them prior to maturity to cover losses — like in the case with SVB.

The bank took a big hit on its long-term bond portfolio that sank in value in the face of rising interest rates. As a result, the bank couldn’t raise enough funds to counter its losses.

In other words, no rational bank would sell and take a major loss unless it had no other choice. There is a reason why you need to be sure that your bank is focused on security and strength and not in a potentially risky position like SVB.

In fact, I read a JPMorgan Chase (JPM) article saying that “since 2019, SVB’s hold-to-maturity book grew from $14 billion to $99 billion.” That is yet another …

Disturbing Trend, Especially

Among Large Banks

Those with more than $700 billion in assets have placed nearly 68% of their bond portfolios in held-to-maturity assets, more than double from three years ago.

At Weiss Bank Ratings, you can find out if your bank is riding that negative trend or other trends. Just plug in the name, and its rating pops up along with key metrics like liquidity, stability, asset quality, etc. You can also view a bank’s ratings history to learn if it’s growing stronger or weaker.

It’s a good idea to monitor the ratings regularly for any red flags or warnings we might alert consumers about. We have been pretty spot-on over the years.

Make sure your hard-earned money is in a safe spot. Find out now how your bank rates now.

Until next time,

Gavin Magor

P.S. According to my friend, colleague and Weiss Ratings Startup Investing Specialist Chris Graebe, the recent banking panic is already driving promising companies to equity crowdfunding, an alternative funding that allows regular, nonaccredited investors to invest in early, pre-IPO companies. This presents a huge opportunity for Weiss Members. This week, Chris is unveiling one such opportunity that is well positioned to disrupt a $100 billion industry. Click here to learn more about how to claim an early stake.