|

| By Kelly Green |

As I foreshadowed to last week, I have in fact been spending most of my free time reading earnings announcements.

There are a number of sites that lay out what earnings are happening over the course of the week. I don’t have a favorite, but I’ll frequently find myself looking at Nasdaq’s Earnings Calendar or Kiplinger’s. I’ll generally just head over to Google and type in “earnings this week.”

I turn to Google partially because I don’t have a go-to website, and that’s partially because I want to also see the top stories that pop up in my search results.

The combination of the two lead me to check in with what is going on with the trends in semiconductors.

I immediately started wondering if we still had to attach a second word onto semiconductor: shortage. That phrase was all the buzz last year.

It was the reason that there was never a Ford (F) Super Duty on the lot through 2021 for me to test drive. And the reason it took 12 weeks to get my truck after placing a custom order.

Last October, Apple (AAPL) claimed that it had lost $6 billion to chip shortages and manufacturing delays in just one quarter.

The shortage isn’t over… in fact, many think that it will continue into 2024.

My thought, however, is that there’s clearly a demand that companies are working hard to fill. Which, in the end, should equate to revenues … which then turn into dividends or share price appreciation for shareholders.

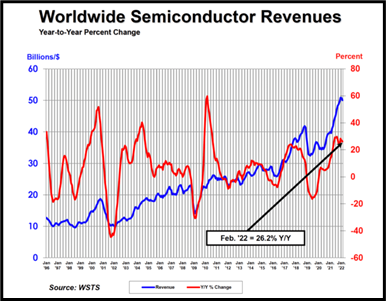

The most recent semiconductor numbers I could find were from the beginning of April, when the Semiconductor Industry Association (SIA) announced that global semiconductor sales were $52.5 billion in the month of February. That was up 26.2% over February 2021.

Source: Semiconductor Industry Association

Monthly sales data is compiled by the World Semiconductor Trade Statistics organization (WSTS).

John Neuffer, SIA president and CEO, commented that “Global semiconductor sales remained strong in February, increasing by more than 20% for the 11th consecutive month on a year-to-year basis. Sales into the Americas continued to outpace other regional markets, increasing by 43.7% year to year in February.”

The more important question is whether that is turning into shareholder return.

The Big 2

Advanced Micro Devices (AMD) just released its most recent earnings on Tuesday.

The company reported record quarterly revenue of $5.9 billion. This was an increase of 71% compared to the previous year.

AMD also completed the largest acquisition in the history of the semiconductor industry by acquiring Xilinx. Plus, it announced a definitive agreement to acquire Pensando for approximately $1.9 billion.

Good earnings, good strategy for the future … but are shareholders benefitting?

The earnings announcement also included that the board of directors approved a new $8 billion share repurchase program. That’s on top of the already announced $4 billion share repurchase program. Less shares on the market means that each share is worth a bigger piece of the pie. So, share repurchases are good for investors.

AMD does not pay a dividend to its shareholders, so we don’t have to look through the earnings for information about that.

How about share price?

We know that share price is always dependent on when investors got in. Shares are up 1% over the past week and 11% over the past year. However, shares are down 24% over the past 60 days and down 29% year to date.

If you bought at the top of this last slide, you may not be a happy camper right now. However, if you want to buy shares of AMD, this last slide creates a discount.

What about rating?

AMD currently receives a Weiss Rating of “C+.” The interesting part about its rating comes when looking at the historical rating. The company never saw a “Buy” rating until February 2020. It had spent plenty of time in the “Sell” range, and plenty in the “Hold” range.

That pop up to a “Buy” in February 2020 only lasted two weeks. That changed in October 2020 when the company reached a “B-.” By February 2021, it climbed all the way to a “B+.” And although it would bounce around the “B”-range, it held on until just recently.

Many companies saw their ratings go down during the pandemic, but AMD saw it go up!

At the end of April, however, it was back in as a “Hold.”

Taiwan Semiconductor Manufacturing (TSM) saw a similar pattern with its ratings.

TSM was used to having a “Buy” rating, but in mid-2018, it slid to a “Hold.” This reversed in August 2020. Then in February of this year, it moved back to a “Hold.” Right now, it’s sitting at a solid “C.”

The company released its Q1 earnings back on April 14 — five days before its most recent downgrade. First quarter revenue increased 35% while net income and diluted earnings per share (EPS) both increased 45%. That’s not a bad start to the year, but the ratings saw something different.

The ratings system triggered a decline in the total return and volatility indices, which caused a decline in TSM’s rating.

If you’re looking to add a semiconductor to your portfolio, shares of TSM have a similar “discount” opportunity right now.

Shares are down 22% over the past 60 days and down 20% over the past year. The company does pay a modest 1.58% dividend to shareholders, but that won’t offset losses if you bought shares at their recent highs.

Semiconductors are in everything. And the demand is only going to continue to go up.

That’s why I’m going to add these two to my watchlist. Because, as soon as those ratings start to climb again, it just might be time to buy.

Best,

Kelly Green