The 3 Investments You Need to Beat the Hackers

|

| By Jon Markman |

Some digital transformation trends are undeniable. Cybersecurity continues to grow as more sensitive data migrates online.

This is a huge opportunity for investors.

Hackers claimed last week to have access to 1 million data points, presumably stolen from DNA registry company 23andMe (ME). The information was on sale for $1 to $10 per account.

Stories like this are why I’m recommending you consider getting in on three cybersecurity firms. More on them in a moment …

Let’s be clear. The cybersecurity problem is huge.

Hackers are getting smarter with experience, and they are developing more sophisticated tools to penetrate online data troves.

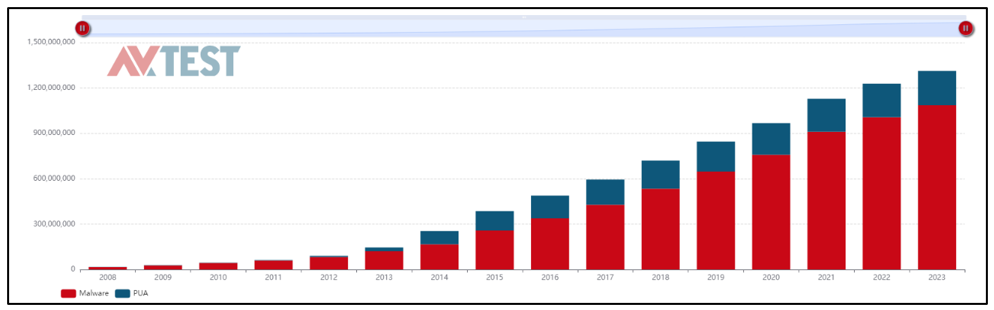

Analysts at independent security institute AV-TEST noted in March that 153 million new malware samples were discovered between March 2021 to February 2022, up 5% year over year. And a staggering 90% of these variants were polymorphic, meaning they have the ability to constantly change to avoid detection, according to another study.

Large corporations and small businesses are under attack from all directions … at the network level, in the cloud and at endpoints — like laptop computers, smartphones and Internet of Things devices. Attacks on all these “threat vectors” are increasing in complexity and intensity.

At the same time, the consequences to businesses for cybersecurity lapses has never been higher.

The Real Cost of Hackers

Cybersecurity Ventures notes that ransomware is expected to cost businesses $10.5 trillion annually by 2025. These threats at the corporate level are devastating shareholder wealth.

In a filing with the Securities and Exchange Commission in September, executives at Clorox (CLX) noted that cyberattackers targeted the firm’s information technology systems.

IT is the nervous system for Clorox, with reach into supply chain management, sales and manufacturing. Once the breach was discovered, manual protocols were introduced, drastically reducing operational efficiency.

Executives at Clorox reported last week that the attack caused revenues and profits during the quarter to shrink dramatically. They warned that sales will fall 23% to 28% short of forecasts. Losses for the quarter will be 35 cents to 75 cents per share. Total cost of the attack might be as high as $593 million.

It’s still far too early to know the true extent of the hack at 23andMe, however. Executives said in a statement that there is no evidence internal systems have been breached. Rather, they believe that attackers gathered data by guessing the login credentials of a group of users, then scraping information from DNA Relatives, a site feature.

DNA Relatives is the glue that binds 23andMe. Users voluntarily share their DNA information to help other members locate previously unidentified relatives. Unfortunately for 23andMe, a leak of that data — real or perceived — could cause significant reputational harm.

This presents an opportunity for cybersecurity firms.

Companies can’t afford to have data breaches of any kind. Companies have become gatekeepers to sacred digital data. Failing to protect this information causes great reputational and, in many cases, operational harm. If the data is held for ransom, operations are necessarily curtailed.

The need for cutting-edge cybersecurity protection has never been higher. Here’s how I recommend you take advantage …

3 California Cybersecurity Solutions

Palo Alto Networks (PANW) is the undisputed leader across multiple cybersecurity segments, including network, cloud and traditional endpoint security operations. The Santa Clara, California-based company sells AI-based security services to all the Fortune 100 and 75% of the Global 2000 firms. Its land-and-expand business model has allowed sales managers to consistently grow billings from existing clients by bundling products.

Click here to see full-sized image.

CrowdStrike (CRWD) is a fast-growing Sunnyvale, California-based company that operates a cloud-based cybersecurity platform. CrowdStrike Falcon collects threat data simultaneously across all devices connected to the client’s network, analyses the information using artificial intelligence, then seamlessly updates all endpoints. Protecting these endpoints is critical to overall network safety. This is often where hackers are gaining entry.

Click here to see full-sized image.

Zscaler (ZS) builds next-generation firewalls. The twist is the San Jose, California-based company is building those firewalls around data, not the larger applications and systems. Traditional firewalls surround complete systems. The idea is to intercept threats before they reach applications and data. Unfortunately, hackers have been able to crack this antiquated defense by getting inside applications, attacking the system from within.

Click here to see full-sized image.

Palo Alto, CrowdStrike and Zscaler have all performed well in 2023, rising 44.4%, 72.8% and 52%, respectively. These companies are built to win cybersecurity at the network, cloud and endpoint levels.

I recommend you consider building positions in these three stocks on any dips from their current price points.

The bottom line is that they are crucial to the ongoing digital transformation we’re seeing in all aspects of our lives.

That’s all for today. I’ll be back with more soon.

All the best,

Jon D. Markman

P.S. Cybersecurity is only one aspect of the digital transformation that is powering big market gains. In fact, we recently introduced an all-powerful technology to our Weiss Ratings system you need to know about. Click here to find out about this enhancement.