|

| By Sean Brodrick |

It’s been a month since I last wrote about gold. Since then, the yellow metal tumbled lower, then rebounded hard.

Now, I think an opportunity is in the making. One that could hand you a golden ticket for an opportunity to make real wealth.

The trigger that sparked the recent rally in gold was the terrorist attack in Israel … and the world is bracing for more trouble in the Middle East. But that’s not the only driver. Let’s look at what else is driving gold — and how you can play it.

1. Interest Rate Expectations

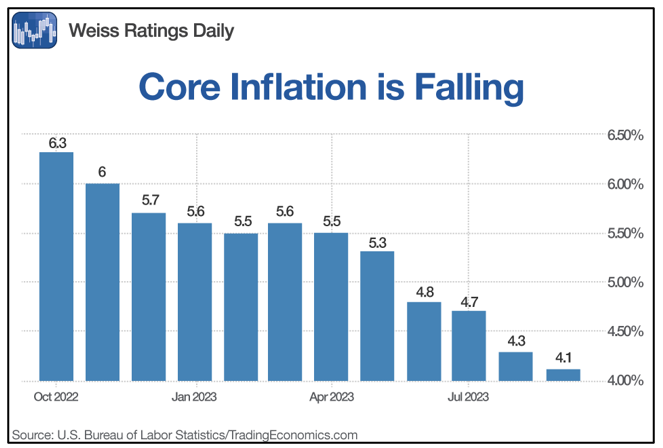

I’ve told you that the Fed has its eye on a 2% inflation target. The latest inflation report last week was not good — there was an uptick in headline inflation to 3.7%. But core inflation, which the Fed bases its decisions on, fell to 4.1% in September from 4.3% previously, as you can see on the following chart …

This leads traders to believe the Fed is done with rate hikes. The U.S. dollar was rallying furiously, thanks to those rate hikes. Now, with the end in sight, the dollar is starting to cool. That makes it easier for gold, which is priced in dollars, to rally.

The Fed has paused at the past two meetings. Maybe traders are right. As long as the market is optimistic on this, there’s room for gold to go higher.

Both Philadelphia Federal Reserve President Patrick Harker and Chicago Fed President Austan Goolsbee have noted inflation is cooling, giving more hope to the bulls. But that’s not all …

2. Trouble in China

Economic headwinds in China have many investors there eager to move their money out of that country. With money draining out, the government restricted cash outflows. But that only makes people more desperate to flee with bags of money.

A report from UBS showed that 6.2 million Chinese had assets worth more than $1 million at the end of last year. That’s a lot of dough-re-mi! Some of it is apparently moving into gold. China’s wholesalers are snapping up gold, and the Shanghai/London gold premium surged to a record high in September.

But no one holds a candle to the People’s Bank of China, which added 26.1 metric tonnes of gold in September. That’s on top of a 29-metric-tonne gold purchase in August and extends the buying streak to 11 months — making China the biggest buyer of gold among central banks this year.

3. Trouble in the U.S.

America is running up against the Nov. 17 deadline to continue funding the federal government. Many Washington watchers say there simply isn’t enough time to get another funding bill passed. That worsens fears of instability, which adds more fuel to the fire under gold.

4. Are the Big Cycles Falling into Place?

Months ago, I told you that my target on gold for next year was $2,931. That was due to my cycles work. It sure looked like the Fed’s monomaniacal obsession with hiking rates until we get 2% inflation was going to delay gold’s rally.

But if the Fed is done hiking, then the path is open for the cycles to power gold higher.

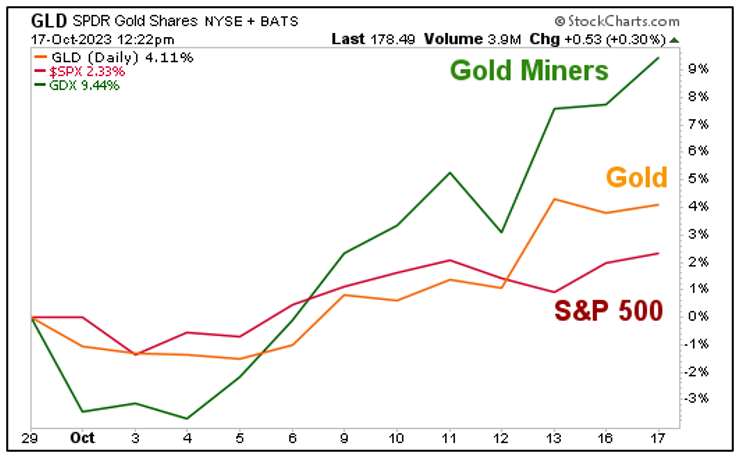

And if that’s the case, select stocks could outpace the market. That’s what’s happening now. Look at this performance chart since the start of the month …

Click here to see full-sized image.

You can see that the S&P 500 is up more than 2%. Gold is up 4.16% at the same time, nearly doubling the S&P’s performance. But the real outperformance comes in miners — exactly what you expect to see in a real gold bull market.

The VanEck Gold Miners ETF (GDX), a basket of the best and biggest gold miners, is up a whopping 9.44% so far this month, more than DOUBLE the move in gold and more than FOUR TIMES the performance of the S&P 500.

You can potentially get even more outperformance by purchasing individual mining shares. That’s what I just recommended to my Resource Trader Members.

But if you don’t want to roll up your sleeves and do the homework in picking individual stocks, the GDX, which has an expense ratio of 0.51%, is a great way to play this rally.

To me, it seems obvious that a gold rally is here. When this metal rallies, it can rally hard and send select stocks skyrocketing. You don’t want to miss out on this golden ticket.

P.S. I’ll be speaking at the New Orleans Investment Conference Nov. 1-4. This is a great conference in the heart of all the music, food and fun of “the city that care forgot.” Don’t miss this chance to attend. You’ll get my hottest picks in metals, and there is a parade of excellent and famous speakers. Space is limited, so check it out now and reserve your seat by clicking here.