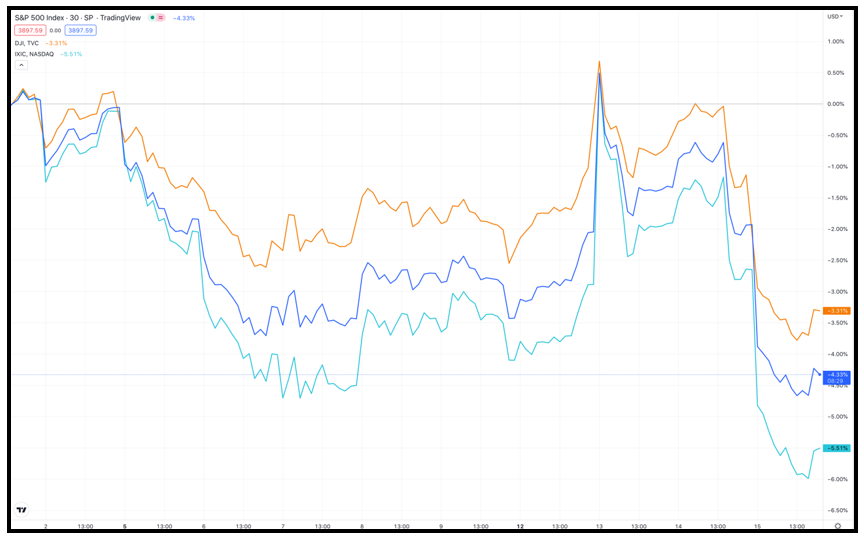

The year-end rally many hoped for in 2022 isn’t playing out as they wished:

• The S&P 500 has shed about 4.3% since the start of December.

• The Dow Jones Industrial Average is down nearly 3.3%.

• And the Nasdaq Composite has lost nearly 5.5%.

Though there have bright spots in sectors like utilities (up 6.13%) and healthcare (up 5.05%), this year’s surefire bet — the energy sector — dropped nearly 9% so far this month, dragging its year-to-date gain down to around 54%.

Click here to see full-sized image.

There have, however, been glimmers of hope this month, which could portend further success as we transition into 2023.

• Precious metals are in the midst of a big-time bounceback.

• Alternative assets like non-fungible tokens are still rewarding investors.

• And a trend in deglobalization and reshoring suggests strength for a swath of American companies as they transfer their operations back home.

To understand more, here are this week’s top stories from your favorite Weiss Ratings experts.

VIDEO: NFT Art Is Breaking New Ground

Despite the bear market in digital assets this year, some NFT projects are soaring. One piece has spiked 181% since NFT Analyst Joel Kruger made his recommendation. In this segment, he and Financial News Anchor Jessica Borg discuss what's hot in digital art and what has staying power.

2 Stocks Poised to Prosper From Deglobalization

In 2022, investors have contended with a messy war in Eastern Europe, worldwide inflation and supply-chain bottlenecks. It’s been a tough slog, yet better days are ahead. According to Pulitzer Prize winner Jon D. Markman, the emerging trend in deglobalization offers opportunities in two stocks specifically.

A Week of Speculation, Expectations & Drama

This week, a fresh stream of economic data and another interest rate hike caused investors to throw a collective fit. Analyst Kenny Polcari details the market drama, inflation and interest rate hikes and how the Fed can fix the mess.

Silver: The Next Precious Metal to Soar

Since October, silver has rallied about 20%. Senior Analyst Sean Brodrick discusses three reasons why the rally is likely to continue, and a way for investors to play the surge in the precious metal.

VIDEO: Market Minute with Kenny Polcari

This week, we saw a Consumer Price Index report come in with lower-than-expected inflation. That was coupled with Wednesday’s decision by the Federal Reserve to lower its interest rate increase to 50 basis points. Kenny Polcari, host of Wealth & Wisdom, breaks down what these macro data points mean for the market.

Santa Claus, Sweet Jerome & the Stock Market

History shows that December is a very good month for the stock market. The S&P has gained an average of 1.6% in the month December … more than double the 0.7% gain of every other month.Senior Editor Tony Sagami reports on the Santa Claus rally,and how investors can profit from its effect.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily