|

| By Nilus Mattive |

Based on the numbers coming out before its last meeting, I thought the Federal Reserve should have held off cutting interest rates at all.

But they didn’t even go the more conservative route and cut by a quarter point.

Instead, they fired both barrels and did a half-point cut as the “easy money crybabies” cheered them on.

In doing so, I believe they have opened the door to a whole new round of inflation.

This is the way it always goes because lower rates benefit borrowers — especially our deeply indebted government.

Same with inflation.

And at whose expense?

Responsible people looking to get good, low-risk returns from their savings … especially older Americans living on fixed incomes.

More on that in a minute.

First, let me support my argument that the Fed is being too aggressive with rate cuts …

The Fed’s Phony Dual Mandate

The Federal Reserve has always told us it has two main goals. In its own words …

“The Fed's modern statutory mandate, as described in the 1977 amendment to the Federal Reserve Act, is to promote maximum employment and stable prices. These goals are commonly referred to as the dual mandate.”

Of course, they don’t really mean “stable prices.”

What they mean is an amount of inflation that they deem reasonable — currently defined as 2% annually.

That’s problematic enough because it means that your money buys 2% less stuff each and every single year.

Moreover, that 2% compounds each and every single year, too … creating a snowball effect.

And that only gets worse when inflation starts running much higher than 2% a year … like we’ve been seeing recently.

At age 47, I am now old enough to know how truly devastating this all is.

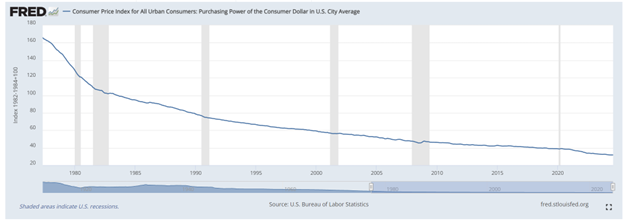

Indeed, here’s a chart — from the Fed itself using the official Consumer Price Index (CPI) — that shows how much purchasing power our money has lost just since I was born in 1977 …

As you can see, $165 given to me on the day of my birth would buy less than $32 worth of stuff today.

So, our money has lost about 80% of its purchasing power over my lifetime.

Put another way, prices have gone up about 419% since I was born.

Does that sound like stability to you?

Fast forward to just before the Fed meeting, when we learned that the August CPI increased 2.5% year over year.

Sure, that was down from the 2.9% year-over-year inflation reported for July … a continuation of a general cooling trend. But it’s also still 25% higher than the Fed’s stated target.

On that metric alone, the Fed should not have been thinking about cutting rates yet.

Now let’s look at the jobs side of the equation …

Everyone threw a fit when the July employment numbers came in.

The Labor Department said the U.S. economy added 114,000 jobs, which represented a big slowdown from the month prior and far less than the 175,000 economists expected. The unemployment rate also ticked up from 4.1% to 4.3%.

This news was enough to send the stock market reeling and convinced investors that a September rate cut — probably half a point — was going to happen.

The August jobs report kept the theme going. I present the following headline from Forbes:

But was it really that chilly?

Economists were expecting 160,000 new nonfarm jobs and only got 142,000, while the unemployment rate actually started going back down.

Indeed, you could say the overall picture — even including the July numbers — really wasn’t that bad at all.

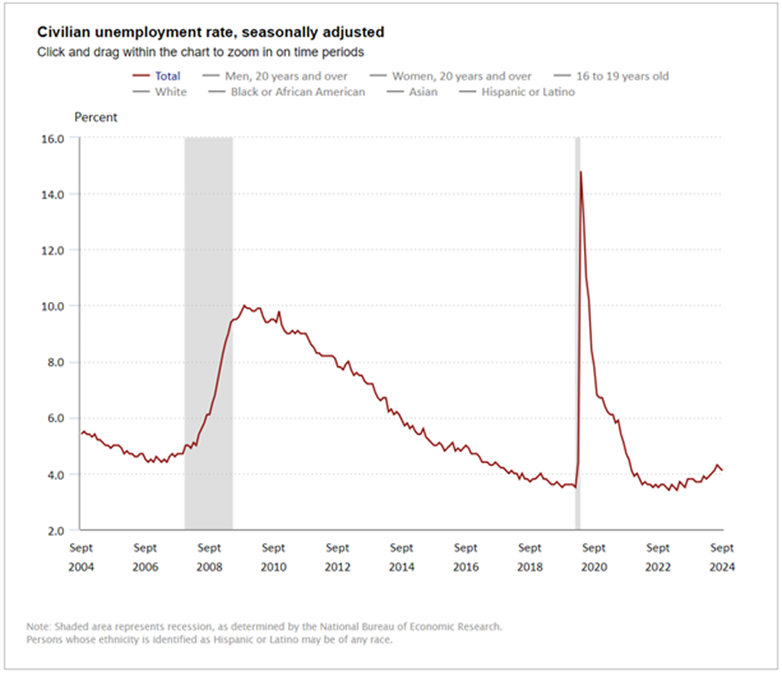

To put this in perspective, here’s a longer-term chart showing monthly unemployment rates going back to 2004 …

As you can see, recent unemployment rates are still extremely low by historical standards. Over the last 20 years, in fact, we never saw a lower unemployment rate prior to 2018.

If you put this together, it’s easy to see why I think the Fed was wrong to make such an aggressive cut last month.

Inflation is still running well above their stated target and unemployment, while starting to tick up a bit, remains relatively low by historical standards.

Never forget: This all goes hand in hand because a strong job market means strong wages and strong wages support higher prices.

Also never forget that the Fed was way behind the curve as inflation was soaring … telling us all that it was temporary and “transitory.”

Now, it seems as though they are getting way ahead of the curve.

The risk, as I said, is that they just stoke a whole new wave of inflation.

And the odds of that happening have only increased since the September meeting.

Reason: We just got a new jobs report that showed a massive 254,000 new jobs were added versus economist expectations for just 140,000.

The unemployment rate also continued going back down and now stands at 4.1%.

We also recently learned that the U.S. economy expanded 3% in the second quarter of the year, which was better than expected.

The craziest part?

Everyone is STILL clamoring for additional rate cuts and the Fed looks like it will continue obliging.

This spells major trouble ahead for anyone looking to get solid income without taking big risks!

Which is precisely why Martin Weiss and I are holding a landmark Income Solution Summit today at 2 p.m. Eastern.

In it, we reveal:

- Three forecasts that should strike fear in the hearts of even the most secure investors and the biggest retirement accounts.

- The three steps you need to take now to defend yourself from the ravages of this undeclared war on you and your retirement.

- Plus, a little-known “instant income” strategy that may be your greatest weapon to defend yourself against the government’s wrong-headed war on retirees.

All you have to do is click here to watch it at 2 p.m. Eastern today.

The best part is that you’ll learn my No. 1 strategy …

A breakthrough, income-generating powerhouse with a four-year history of delivering consistent payouts of $1,000 or MORE — nearly every week of the year.

And when I say “consistent” I mean it …

Over the past four years, investors had the chance to close out 93% of these “instant income” investments for wins … better than nine out of every 10 trades.

I already personally use this strategy myself and so does my retired father (after I taught him how).

You can start using it right away, too.

Again, all you have to do is click here before the event goes live.

Best wishes,

Nilus Mattive