The Robots Are Here. And the Markets Like That!

|

| By Jon Markman |

The AI revolution is coming, complete with a big productivity payoff. Investors should get ready.

News broke Monday on Reddit that Duolingo (DUOL) is offboarding some 10% of its contractors. The company operates a free mobile application platform for music, math and language learning certification.

Now, the company needs fewer humans to create that content.

The stock went UP on the news Tuesday and continued higher during Wednesday’s session. It’s no wonder, really.

After all, social scientists have predicted for years that the robots would come to take our jobs. As my colleague Sean Brodrick pointed out yesterday, the robots are here.

Yet, they are not what most people expected.

It is far more complicated. The robots are algorithms, software. And the displaced workers are not welders and mechanics. They are software writers, information technology workers and, in the case of Duolingo, translators.

Executives at the Pittsburgh-based company claim they can use AI to perform most of the tasks now being performed by language contractors. Given this, far fewer humans are required, leading to the headcount reductions.

Those cuts could amount to 10% of the workforce, according to a Bloomberg report.

The magnitude of the cuts flies in the face of claims made in 2023, when Duolingo introduced its Max premium subscription service.

Max uses GPT-4, the large language model from OpenAI, to create custom language exercises. This benefit was supposed to make the platform more accessible.

In a blog post last September, executives noted that AI wasn’t being used to replace humans. Rather, the goal was to produce better outcomes.

PCMag gives Duolingo five stars, so the latter part seems to be accurate. But as for the former, not so much.

Duolingo is an interesting case study because it promised to democratize education.

The AI-based software would allow teachers to get certified in language proficiency where no testing facilities existed. It would also give students access to quality education in places where qualified instructors and schools were in short supply.

It now seems Duolingo is prioritizing cutting headcount. And it’s possible to do this because of AI.

Investors should not be alarmed about this trend, though.

Broken Silos & a Monster Partnership

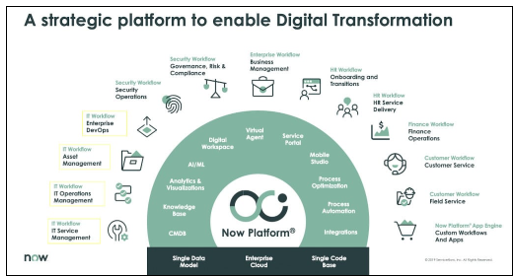

ServiceNow (NOW) makes an operating system software for entire enterprises. Its Now platform digitizes every aspect of a corporation.

Everything moves within the platform, from human resources and marketing to productivity software suites. Better still, all of the silos are broken down.

Much of this is possible thanks to AI. ServiceNow uses this technology to boost productivity, create content, analyze data and more. Not just within its own company, but across every industry imaginable.

Its products also integrate effortlessly with software tools from Workday (WDAY), Salesforce (CRM) and Microsoft (MSFT).

The Now platform is in use at 7,700 corporations worldwide. This includes 85% of the Fortune 500.

And the renewal rate is 99%, so customers clearly like the product.

These factors alone make NOW shares attractive. But I see a big boost to come. Why?

Because AI is about to supercharge the business.

Executives announced in May 2023 that ServiceNow will partner with Nvidia (NVDA) to build enterprise workflow automation tools using AI.

Workflow automation is the holy grail of enterprise software. That’s because it increases productivity by systematically removing processes.

Every operation eliminated increases profitability. The software pays for itself.

Nvidia builds the world’s best AI hardware. And its CUDA software platform is beloved by academics and developers alike for its standardization.

Using Nvidia tools, ServiceNow is developing custom LLMs to work specifically with the Now platform. New uses cases for generative AI will be deployed across IT departments, customer service teams, employees and developers.

To simplify the user experience, enterprises will be able to customize chatbots with proprietary data to create a customizable central chatbot that will remain on topic while resolving requests.

The similarity to the Duolingo GPT-4 experience is no accident.

Nvidia is foundational to the LLMs developed by OpenAI. These same tools make ChatGPT think. Investors should embrace these AI algorithms. They are about to become widespread across thousands of enterprises, thanks to ServiceNow.

It is a big opportunity that’s still not quite reflected in the share price.

ServiceNow shares have pulled back a bit from the record high at $720.60. They trade at 54 times forward earnings and 16.7 times sales.

The stock is not cheap. However, the growth from its AI initiatives is also not being factored into current valuations.

Shares could jump back to even higher than their recent record highs. If you’ve been worried that the robots really are coming for your job, this is one way to combat that … and profit from it.

All the best,

Jon D. Markman