Editor’s note: Below, I lay out why biotechnology stocks are soon going to boom.

I even give you an easy way to invest in a broad selection of them for cheap.

But if a little more risk/reward is your style, you’ll want to watch this.

My colleague and startup specialist, Chris Graebe, just discovered a pre-IPO biotech that has the best team he ever found behind it.

Get the details on how to own shares BEFORE it even goes public here.

|

| By Sean Brodrick |

Biotech is the Rodney Dangerfield of the stock market. It gets no respect at all.

That’s fine because respect is around the corner.

And if you act now, you can buy biotechs on the cheap.

Why do I say biotech gets no respect?

So far, the S&P 500 is up 9.3%. In comparison, the SPDR S&P Biotech ETF (XBI) is DOWN 2.92%.

That’s a huge disconnect, because biotech has so much going for it.

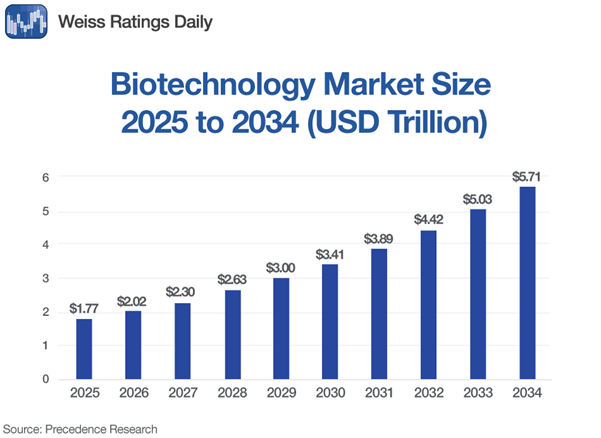

After a bruising 2022–24 stretch, the global biotechnology market is now forecast to quadruple over the next decade. It could climb from about $1.8 trillion this year to as much as $5.7 trillion by 2034.

That’s a 13.9% compound annualized growth rate (CAGR).

Compare that with the global software market, expected to grow at a CAGR of 11.3% …

Or IT services, forecast to have an 11% CAGR …

Or business software, at 12.1%.

So, why aren’t more investors piling in?

They’re still fighting the last war.

Biotech’s last down cycle — roughly 2021 through 2024 — was one of its worst in decades, as a multitude of problems combined to beat biotechs into dust.

Now, that rough environment is changing fast.

Here’s why now may be your shot to get in before the herd.

Bargain-Bin Biotech

We’re now at the front end of a 3–5-year innovation cycle.

And the market is pricing in none of it.

Pipelines are rich.

Cash burn is down.

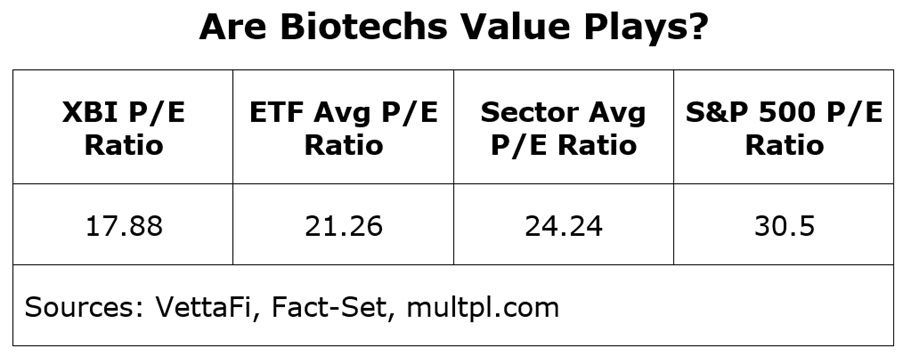

The XBI’s valuation, as measured by price-to-earnings, is below that of the average ETF, S&P 500 sectors and the S&P 500 as a whole.

Sometimes way below.

To be clear, there are cheaper sectors, industries and ETFs on a P/E basis.

But few of them have biotech’s high market growth.

Kiplinger points out that this is one of the rare times you can buy high-potential biotech at prices not seen since the last major upswing.

This is the classic setup: low expectations, depressed valuations and a massive wave of innovation just starting to crest.

An Innovation Wave Built on CRISPR & AI

This is not your old-school biotech story of “hope and hype.”

We’re in the early innings of a multi-platform revolution, with CRISPR gene editing, mRNA cancer vaccines, cell therapies and especially AI-fueled drug discovery.

You’ve heard the stories about AI systems making drug discoveries that would have taken human researchers years, and maybe decades.

Generative AI is accelerating the entire biomedical R&D pipeline. It’s doing so with faster target ID, cheaper preclinical testing and shorter time to first-in-human trials.

As a result, AI is transforming biotech into a high-velocity sector. And the clinical pipelines reflect that.

Wired reports that a biotech company, Strand Therapeutics, has initiated what’s believed to be the first clinical trial of programmable mRNA.

This is next-gen medicine.

And it’s already out of the lab.

Policy Winds at Biotech’s Back

Washington has a role in this rebound.

The National Biotechnology Initiative Act is designed to streamline regulatory hurdles, harmonize agency guidance and position the U.S. as a global leader in biotech innovation.

That means faster approvals, more straightforward guidelines and less red tape for emerging platforms.

In addition, the National Security Commission on Emerging Biotechnology has recommended at least $15 billion in federal biotechnology funding over five years to maintain the U.S.' competitiveness with China.

Finally, pharma giants like AstraZeneca (AZN) are pledging tens of billions in new U.S. R&D spending, fortifying the domestic ecosystem and building out the infrastructure needed for biotech’s next leg up.

How You Can Play It

There are multiple funds to play the likely rally in biotech.

The XBI is the biggest.

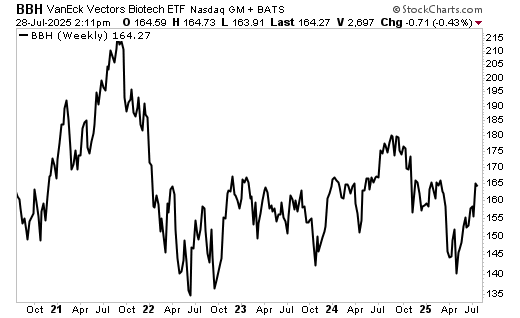

However, I’d recommend the VanEck Biotech ETF (BBH).

It’s smaller, but it’s still plenty liquid.

And it has a higher Weiss Rating — a “C” compared to the XBI’s “D+.”

Importantly, the BBH concentrates on the larger biotechs. And this market seems to favor large- and mega-cap stocks at this time.

Here’s a weekly chart of the BBH …

You can see how biotech fell off a cliff in 2021 and spent the next couple of years dragging bottom.

Its last sell-off was during the broad market drop in April. Now, it’s recovering nicely.

In my opinion, it’s a bargain and nicely set up for a big rally.

Biotech is growing faster than every other tech vertical, powered by breakthroughs in gene editing, AI and cellular therapeutics.

It’s underpriced, under-owned and underappreciated.

It gets no respect — no respect at all.

But that should change soon enough.

If you're looking for growth in a booming market, biotech might be the most asymmetrical opportunity in tech today.

All the best,

Sean

P.S. If you want to hear my views on another area of the market with explosive growth — and get my top picks — tune in to my live presentation at the MoneyShow’s Virtual Expo on Aug. 5.

Registration is free, and my picks are going to be loaded with even more profit potential than biotechs are right now!