This 2,329% Gold Target Is Not a Crazy Prediction

|

| By Nilus Mattive |

Yesterday, I showed you why I think we’ll easily see $6,000 gold someday soon.

And I left you with why $15,000 an ounce is actually reasonable based on past bull runs in the metal.

But if you think that’s crazy, you might not want to read on. (But I suspect you do.)

You see, there are at least two other things that bolster the case for $15,000 and suggest it could even still be too conservative a forecast.

First, there are very large fundamental forces driving this current run.

One of the biggest is central bank demand.

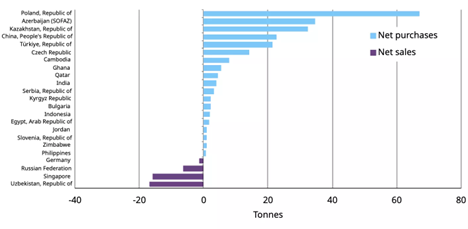

According to the latest available data from the World Gold Council, central banks added a net 19 tonnes to their global reserves in August.

And it’s not even the countries you might be thinking of that are hoarding gold.

Kazakhstan’s National Bank was the largest buyer.

The National Bank of Bulgaria and the Central Reserve Bank of El Salvador started buying as well.

Meanwhile, the National Bank of Poland was the largest gold buyer over the first eight months of the year and recently increased its target allocation to the yellow metal.

Could higher prices become a headwind? Possibly.

But this appears to be a fundamental shift away from fiat currencies — particularly the U.S. dollar — and into hard money that can’t be printed or frozen on demand.

And it’s happening across all segments — from regular citizens to governments themselves.

Which brings me to one other point …

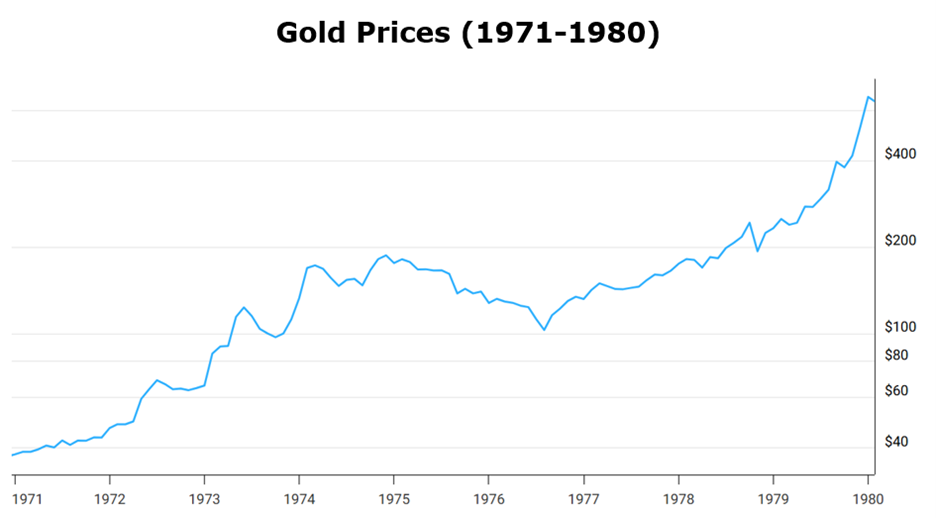

The 2000-’10 gold run — which suggests $15,000 gold — pales in comparison to what we saw in the 1970s.

And that rally was driven by some of the same forces we have in place right now.

I don’t have enough space here to get into everything that was happening at that time.

However, in 1971, the U.S. stopped backing its currency with gold and allowed the metal to trade freely.

Meanwhile, the nation was struggling with both a slowing economy and rising prices — a so-called “stagflation” environment.

Adding fuel to the fire was general concern over the validity of paper money, geopolitical problems and rising government debt loads.

Sound at all familiar?

If gold went on the same type of run it did in the 1970s, it would go from $2,000 an ounce in January 2024 to $48,571 inside of a decade.

That’d be a rise of 2,329%!

I’m not saying that’s going to happen.

But when you consider the way gold behaves, it’s easy to see why calling for $6,000 an ounce … or even $10,000 an ounce … is actually quite reasonable.

Especially since we seem to have a 1970s economy coupled with a late 1990s stock market in place at the moment.

Even if all this is too far-fetched for you, at the bare minimum, I’d stick with your resource expert’s opinion. Sean Brodrick has his eyes set on $6,900 gold in the not-too-distant future.

As I told you yesterday, it is NOT too late to get into an ETF like the SPDR Gold Shares ETF (GLD). It tracks the price of gold.

But personally? That’s not even my favorite way to take part in this historic rally.

I’ve developed a proprietary income strategy that has consistently delivered instant payouts from gold.

That’s right, a metal that does not typically offer ways to collect income.

Just this year, I’ve shown readers how to collect payments of $828, $973, $884 and $1,040 from gold and silver.

Last year, we did even better — payments of $1,160, $1,000, $1,071 and $1,075 from precious metals.

And as you’ll see in our event today at 2 p.m. Eastern …

This strategy can generate consistent payouts in any market condition — up, down or sideways.

So don’t miss out — click here to reserve your spot and get a reminder sent to you before the event goes live in just seven hours.

Best wishes,

Nilus Mattive