|

| By Sean Brodrick |

When I last wrote about the big trend in uranium on Sept. 27, the spot price for the metal was $70.37 per pound. Now, it is $106 per pound. That’s a 50% surge in less than four months. Wow! Or should I say … BOOM!

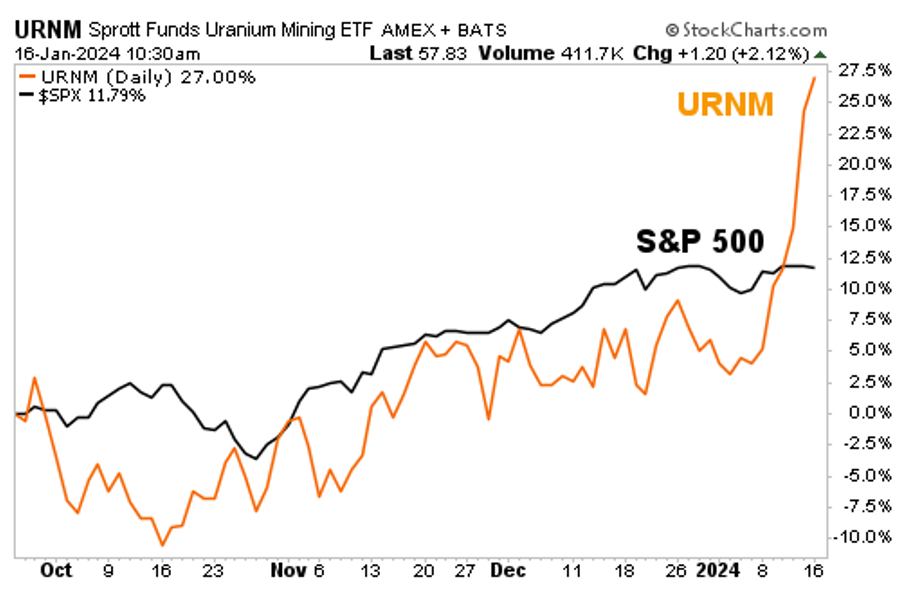

This has sent uranium stocks and funds soaring. If you’d bought the fund I’d recommended on Sept. 27, the Sprott Uranium Miners ETF (URNM), you’d be up 27%! That’s more than double the nearly 12% gain in the S&P 500, as you can see from this performance chart. Individual uranium stocks did much better.

So, is it time to take uranium profits? Or does this energy metal bull have more room to run?

Calamity in Kazakhstan!

The price of uranium miners surged on Friday. That’s because Kazakhstan’s Kazatomprom said it expects its 2024 production will likely be lower when it previously said it would go higher.

Kazatomprom is the world's largest producer of uranium, with 20% of supply. So, this sent the price of uranium ballistic. Already over $100 per pound, the spot price of uranium soared to $106.

Kazatamprom said that difficulty in obtaining sulfuric acid, as well as delays in construction at new deposits, bring “challenges” to raising its 2024 production volume to its previously stated goal.

The Kazatamprom news is the spark for uranium’s latest move, but there are plenty of other bullish forces …

Supply Is Tight. Kazatamprom is the third uranium company to announce lower production this year. Cameco (CCJ) and French miner Orano (which has operations in Niger) have both lowered production targets for this year. Also, the Sprott Physical Uranium Trust (SRUUF) has been buying up any uranium that isn’t nailed down.

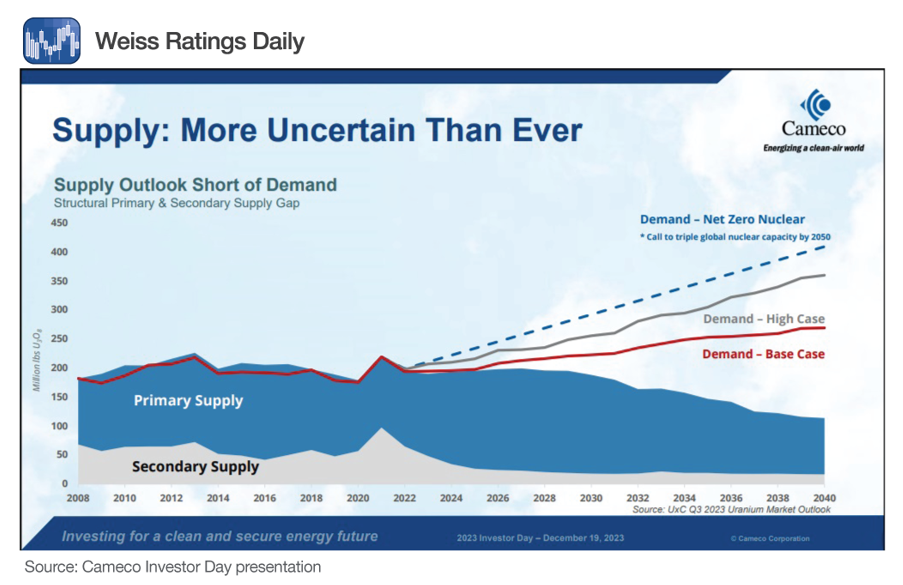

Squeeze Will Get Worse. There are 57 new nuclear reactors under construction (China is building 22 of them). Another 110 are in the planning stages worldwide. The recent United Nations’ annual climate meeting (COP28) saw more than 20 countries, including the U.S., pledging to triple nuclear energy capacity by 2050 as a crucial step toward achieving global net-zero emissions. This is going to boost uranium demand even more!

With supply already tight, this is going to worsen a supply/demand gap that is being filled — for now — by dwindling stockpiles.

Sure, it takes a long time to build new atomic power plants.

Shorter term, Japan operates 10 atomic plants, having closed the rest after an earthquake and tsunami caused the Fukushima disaster in 2011 (which sent the price of uranium skidding lower).

Now, Japan is restarting seven of its nuclear power plants, and eight more have applied for restart permits. That means those plants will need to buy uranium to replace all the inventory they sold off.

Wait, there’s more! The U.S. and other Western nations may ban uranium imports from Russia due to that country’s ongoing invasion of Ukraine. Ahead of any ban, Western utilities are already voluntarily avoiding Russian uranium imports.

Mines Can’t Keep Up. So where is all that uranium going to come from? Right now, it sure looks like the supply/demand squeeze will get worse. Despite a steadily rising price for uranium in the past few years, mine production has barely budged.

We will see new mines come online this year. But as Canaccord Genuity just said in a report, “We do not believe that these projects alone will be sufficient to rebalance the market … prices need to stay at high levels to incentivize the development of these more capital-intensive greenfield projects.”

You probably know that most uranium isn’t sold at the spot price. It’s sold under long-term contracts negotiated between utilities and suppliers. Cameco reports the contract price of uranium was recently $68 a pound. That’s more than double the uranium contract price in January 2021. At these prices, uranium miners would crank up production if they could. And without a lot of new supply, we can expect contract prices to go higher as well.

How High Can Uranium Go?

So, how much higher? Well, April 2007 was the last time the uranium spot price breached $100 per pound. The spot price reached its historical peak at $138 two months later. If you adjust that for inflation, that’s equivalent to $203.20 in today’s dollars.

The question investors should be asking is, will uranium peak in a hurry and then sell off just as quickly? For me, the difference between now and 2007 is that there was more supply, both from new production and stockpiles, that brought the price down. Supply today seems skintight.

Also, though uranium pulled back after it peaked, it traded in a decent range until the Fukushima nuclear disaster sent the price of uranium tumbling for nearly two decades.

We could see another disaster. But I wouldn’t bet on it. I’d bet on supply remaining tight and prices going higher. The price of uranium is only a tiny part of the price of nuclear-sourced electricity. Uranium could easily go to $200 per pound, and it wouldn’t affect demand. For sure, $200 uranium would bring on more supply. But remember, a mine takes years to build.

So, I reckon uranium could go higher for longer than most investors think possible. An easy way to play it is that same fund I mentioned earlier, the Sprott Uranium Miners ETF (URNM). It has an expense ratio of 0.85%.

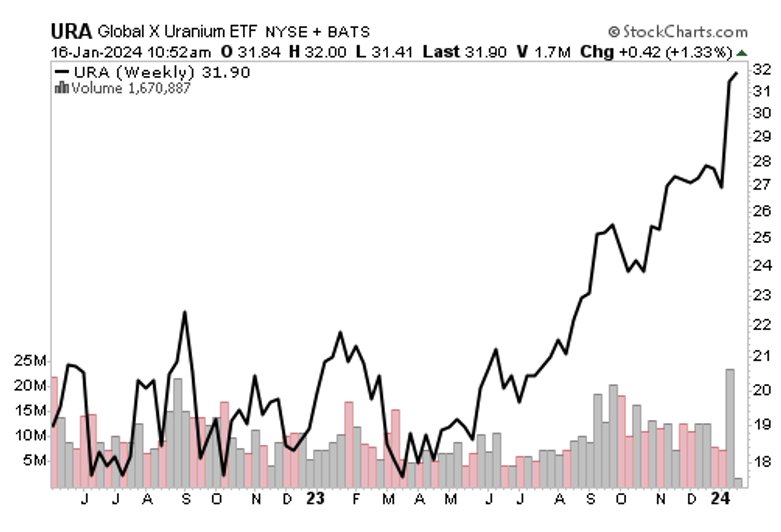

Another idea would be the Global X Uranium ETF (URA). It has a Weiss rating of “C,” an expense ratio of 0.69% and a fat dividend yield of 6%! And it holds a bunch of big uranium names.

My Wealth Megatrends subscribers own URA and are already up more than 18%. My target on it is $60 per share — nearly double from recent prices.

For individual stocks — which can REALLY outperform — you’ll have to do your own research. I recommend a fistful of them in Resource Trader, and they’re all doing well.

Uranium is breaking out. You’ll want to be on board this atomic rocket. Don’t wait another four months before you make your move.

All the best,

Sean

P.S. If you’re interested in more uranium stocks, you may want to read my write-up on Cameco (CCJ) for the MoneyShow’s 2024 Top Picks Report: 90+ Stocks to Buy for 2024. You can find it by clicking here. Not only does it include my Cameco recommendation, it also features dozens of investment ideas from other publishers and independent research firms.