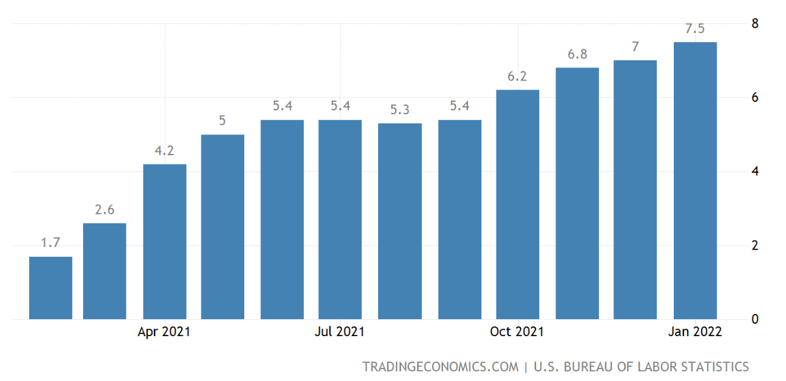

A new month, a new Consumer Price Index (CPI) figure:

January’s CPI measure came in at an astounding 7.5%!

If you’re recognizing a trend here, you’re not alone. Consumer prices are inflating like an airship, and investors are scrambling for solutions.

Fortunately, our editors and analysts have the answers. Here are this week’s top stories from your favorite Weiss Ratings experts.

Ignore Cancel Culture. Focus on the Investment Opportunity.

There will always be differences of opinion that the news amplifies … but at the end of the day, where should you put your money? Research Analyst Kelly Green reports on the Spotify (SPOT) spectacle and why investors should ignore the noise and dig down into the ratings and fundamentals to find out whether companies are worthy of their investments.

Oil’s 52-Week High Is Just the Beginning

The price for a barrel of oil hit $90, pushing gasoline prices to a seven-year high. Senior Analyst Tony Sagami puts that into historical perspective, recalling the 1973 oil crisis, what it meant for his beloved ’68 Camaro and what today’s prices mean for investors in 2022.

VIDEO: Profit From Powerhouse Companies on Sale

The current state of the market is like trench warfare between the bulls and the bears, each alternately winning day to day. This week, Financial News Anchor Jessica Borg interviews Pulitzer Prize winner Jon Markman about major companies poised to profit despite supply chain constraints and market conditions.

AUDIO: Building Business w/ Rob Luna

This week on the Weiss Investor podcast, Kenny talks life, success and big money with Rob Luna, an educator, adviser and strategist to entrepreneurs, CEOs, athletes and others with typically $10+ million in assets.

WSJ Confirms ‘Safe Money’ Stocks Lead the Way

For weeks, Senior Analyst Mike Larson has been telling readers how we are undeniably in a “Safe Money” stock market environment. Now, The Wall Street Journal is jumping on his bandwagon after publishing a story titled “Investors Gobble Up Dividend Stocks During Market Turbulence.” Mike discusses how investors are piling into more consistent, more resilient and dividend-paying companies.

Big Yields Are Still Possible!

Dr. Martin Weiss reports on a little-known strategy that presents the opportunity to earn yields of at least 19.49% on cash-equivalent deposits. With inflation at 7.5% and most savings vehicles yielding a mere fraction of a percentage point, that’s almost impossible for most people to believe. This week, he explains how it is, in fact, a very real possibility.

Until next week,

The Weiss Ratings Team