|

| By Sean Brodrick |

I’ve been pounding the table about gold and miners since January, and most recently made my case for a breakout in the yellow metal. Well, we got that.

Gold is making new highs as I write this. It’s on its way to $2,400 in the short term, and more than $2,900 over the course of a year. If you’ve missed out, I have great news. I’ll tell you how you can catch up to the gold boom!

That’s because there’s something that has lagged in the gold boom … and it’s just now starting to blast off. Right now!

I’m talking about gold miners.

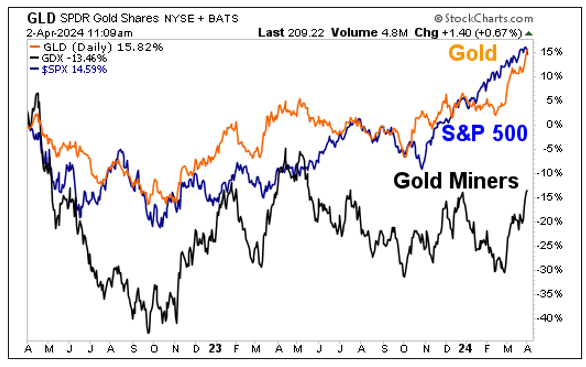

Here’s a two-year chart showing the relative performance of gold, the S&P 500 and gold miners as tracked by the VanEck Gold Miners ETF (GDX).

You can see that the S&P 500 has gained 14.59% over the past two years, just behind gold’s gain of 15.82%. Gold miners, on the other hand, have lost more than 13% in the past two years.

Well, that’s awful. And it’s due to problems I’ve also talked about, including shrinking reserves, rising costs and shareholder dilution. However, we are getting to a point in the gold rally where miners can dramatically outperform gold.

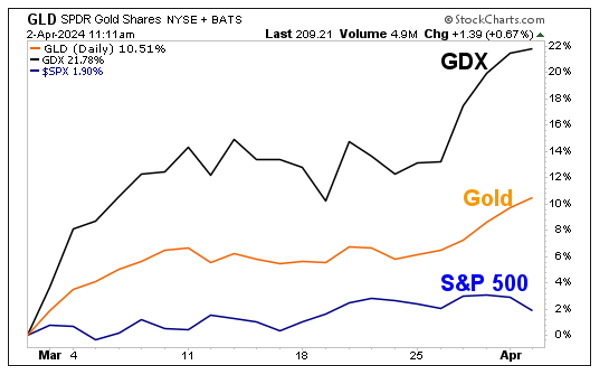

In fact, that’s just what we’re seeing right now. Look at this chart of the one-month performance in gold, miners and the S&P 500 …

In the very short term, the percentage gained in miners is more than DOUBLE that of gold itself. In the last month, gold is up 10.51%, leaving the S&P 500 in the dust. But gold miners are up nearly 22%!

In a real bull market, miners should outperform the metal. So, if you were waiting, the wait is over. The next leg higher for gold has begun.

What’s driving this? I’ve talked myself hoarse about that, but I’ll give you the top three — and No. 3 is most important.

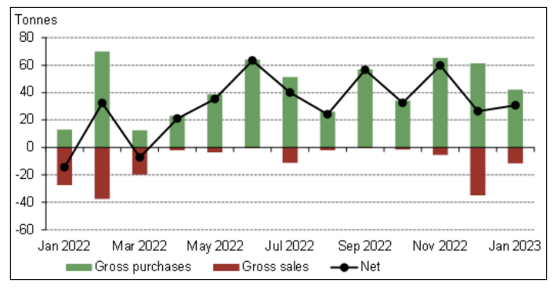

Reason No. 1: Central Bank Buying

The World Gold Council (WGC) reports that in January, central banks around the globe collectively added a net 31 metric tonnes to global gold reserves.

That’s up 16% month over month. That also makes 10 months in a row that central banks are buyers of gold.

Last year was a big one for central bank gold purchases. The WGC says central banks scooped up 1,037 metric tonnes of the yellow metal in 2023. That’s the second straight year central banks added more than 1,000 tons to their total reserves. 2024 looks to make it three in a row. China was the biggest buyer in 2023. Speaking of China …

Reason No. 2: China's Demand for Gold Soars

I’m not talking about the central bank. I’m talking about ordinary middle-class folks in China.

Plagued by a weak stock market, a property crisis and an economy stuck in second gear, the middle class in China is buying the yellow metal with both hands. About 11.7% of China’s middle-class families held gold as their primary financial product last year.

What’s more, China’s domestic gold jewelry consumption surged to a record high of $39 billion in 2023. The WGC expects China's demand for gold will remain strong in 2024.

Reason No. 3: Anticipation of Interest Rate Cuts

To the chagrin of many gold experts, it turns out that inflation doesn’t boost gold prices. Much more important is the anticipation of coming Federal Reserve rate cuts. And the Fed has made it very clear in recent statements that it wants three rate cuts this year.

And THAT is what has lit a fire under both gold and gold miners. I don’t believe the run is done — far from it.

As I said, my minimum target in the shorter term is over $2,400. Longer-term, I expect a gold price over $2,900. And once we get there, it wouldn’t surprise me to see momentum carry gold to $3,000 an ounce.

So, how should you play this?

Well, I come back to the GDX. It has a dividend yield of 1.9% and a “D+” rating from Weiss Ratings. At least part of that low rating is due to its long-term outperformance. We can see that’s changing.

To be sure, you can drill down into the GDX to find individual miners with potential outperformance. That’s what we’re doing in Resource Trader.

The next leg of the gold bull market is charging ahead. I recommend you grab that bull by the horns if you want to ride to potential riches.

All the best,

Sean

P.S. There’s another massive bull rally already in high gear. Even if you missed the first part of this multi-year cycle with Bitcoin, you’re in luck. There are other “new cryptos” that could be looking at 205x the performance of the mainstream cryptocurrency. Click here to check out yesterday’s special presentation for more.