|

| By Gavin Magor |

It’s extremely hard to be a bank and not make money ... it may be even harder to be a bank and not tinker with your numbers apparently.

Banking is something that society takes for granted. But behind the curtain, there is so much going on with the people handling our hard-earned cash, especially right now as the industry continues to face historic headwinds.

We’ll learn a lot more in the coming weeks about the state of the industry as banks kick off earnings season. JPMorgan Chase (JPM), Wells Fargo (WFC) and Citigroup (C) actually report today.

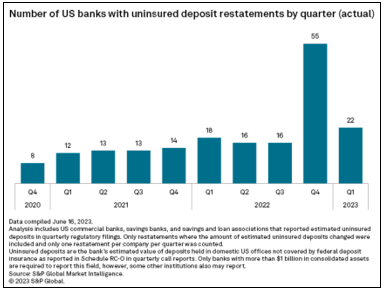

In a recently-released report by S&P Capital IQ, it found that more banks are revising their call reports to adjust their uninsured deposit amounts.

55 banks restated the total amount of uninsured deposits on their Q4 2022 call reports, which is much larger than the amount in recent years. The trend also kept going in Q1 2023 with 22 revisions:

For some additional context, the standard deposit insurance coverage limit is $250,000 per depositor at FDIC-insured banks. Anything up to that amount is insured. Any amount above the $250,000 threshold that isn’t separately insured, however, is what we’re looking at here. It’s not protected from bank runs.

Are banks playing games and suddenly getting overly cautious with their uninsured deposits in response to recent bank failures?

There are certainly new practices taking place, and it’s why we here at Weiss are always cautious when it comes to our analysis, and especially with our ratings.

I’ve said it many times, Silicon Valley Bank’s fallout should not have happened, and was largely due to a lack of prudent management … just like with several other banks that have failed recently.

Are other banks learning from past mistakes, and should these banks be reporting the initial and restated amounts? That is up for debate, and I cannot say whether they should or not, but what I can say is that there certainly is more caution throughout the industry.

It was also reported that 16 companies restated uninsured deposits by at least $1 billion in either Q4 2022 or Q1 2023. Huntington National Bank’s restatement on its Q4 2022 call report was a large decline of 39.9%, and the largest by percentage.

In dollar amount change, Bank of America (BAC)’s downward adjustment of $125.34 billion in uninsured deposits leads the way.

On the flip side, BancFirst’s restatement was a staggering 93.5% larger on uninsured deposits … which is not a good look. It is also a poor reflection on its auditing and accounting team. This is not to say it’s a bad bank overall, as it actually has an “A” Weiss Rating.

One of the major reasons for these massive adjustments is how banks are classifying their “intercompany deposits.” Intercompany deposits are held by one member of a company for another in a sort of “consolidated structure,” like cash of a holding company with its bank subsidiary.

In other words, it seems banks are trying to see which accounts are really insured and which ones aren’t. If that’s the case, it is actually a great reason for these adjustments.

Though, like I said, that is still to be determined. What I can say is that you should be skeptical, and our ratings are always here to help you.

Bank on the Reliability of Our Ratings

It’s great having money in the bank, and what makes it even better is having peace of mind and a sense of security when it comes to who you’re banking with. With Weiss Ratings, that’s not only possible, it’s also free for your convenience.

Our Bank Ratings here at Weiss are very prudent, have been very accurate historically and were actually on the more “cautionary” side well before the bank failures this year.

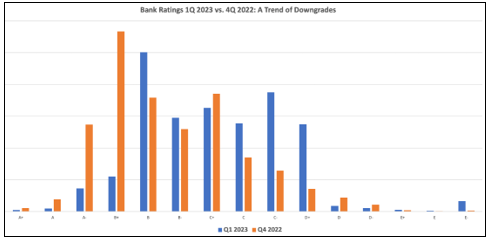

Many of our bank ratings got downgraded between Q4 2022 and Q1 2023, as shown below:

We were skeptical from the start, and you should be, too. Here at Weiss Ratings, we require higher standards than those imposed by many regulators. This hopefully gives consumers a greater amount of trust.

Finally, don’t ever think for a second that we would ever take any money from a bank. We are, and always have been, 100% independent in our ratings. It's a big reason why our subscribers and users rely on us.

Banking shouldn’t be a hassle. Here at Weiss, we strive to make it easier for all, no matter what’s going on in the banking industry and overall economy.

Cheers!

Gavin Magor