|

When a stock within the Weiss Ratings earns a “Buy” rating …

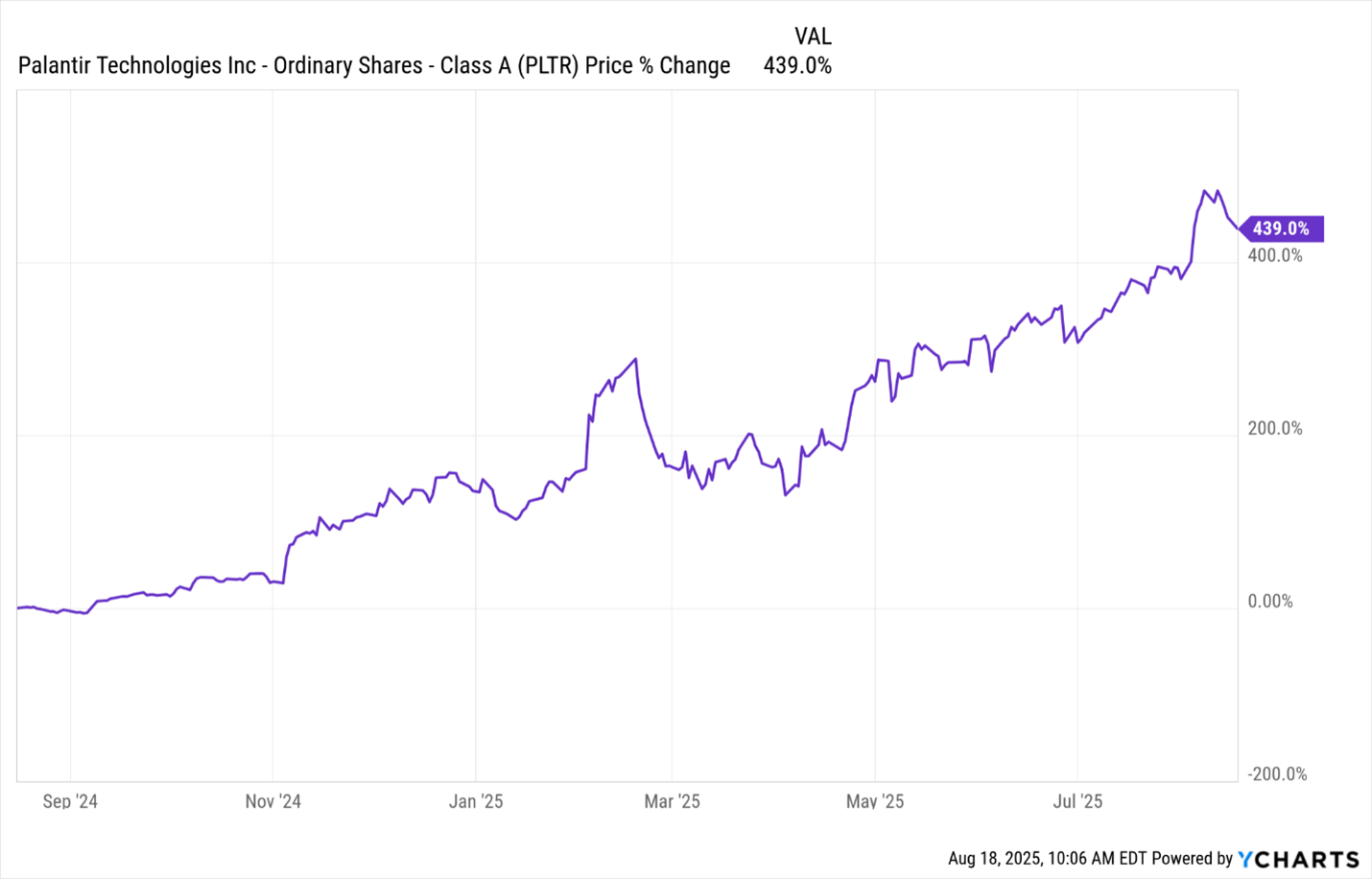

Eclipses a $400 billion market cap …

And is up 439% in just 12 months …

It should get your attention.

I’m talking about Palantir (PLTR).

Palantir is a data analytics and AI software provider that’s based in Denver.

The company just reported another quarter of through-the-roof earnings recently — growing 144% year over year.

This stock is up an eye-popping 439% over the past year.

But it’s been on the Weiss radar for quite some time now, despite it defying all sense of stock market gravity.

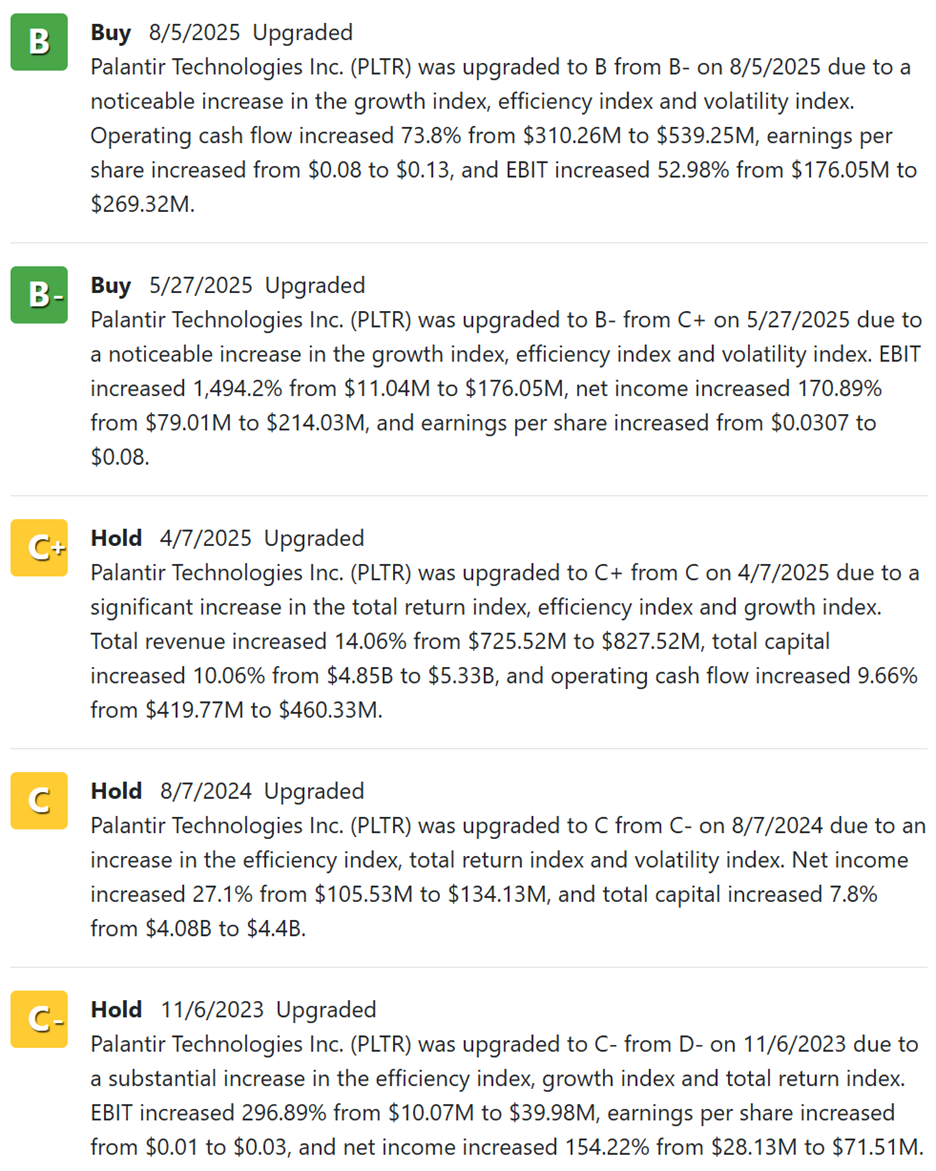

Here’s a look at Palantir’s healthy rating progression since Nov. 6, 2023:

Since being upgraded to “Hold” territory, the stock is up around 806%.

And it hasn’t had a single setback in nearly two years.

As you can see above, our database absolutely loves its increased operating cash flow, earnings per share (EPS) and earnings before interest and taxes (EBIT).

It didn’t initially receive our coveted “Buy” status right away, however. It had to prove a consistent history of growth.

Now it has.

Palantir skeptics argue that it’s becoming too overvalued, trading at 589 times earnings. But our ratings system believes its price is now justified given its exceptional growth.

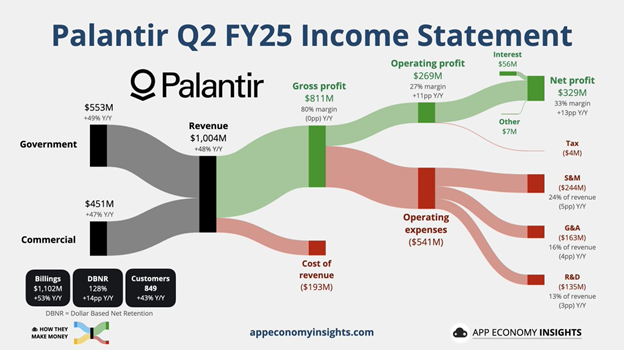

Here’s a look at Palantir’s income statement visualization:

As you can see, the company is still generating a majority of its revenue from the government. But commercial revenue is expected to grow.

CEO Alex Karp said, “I believe we will 10x U.S. commercial revenue over, say, the next five years.”

Though its government-related business is still the important half.

It is one of a handful of companies that has top clearance for military contracts.

And its AI products are becoming more essential as the Department of Defense continues to modernize its information gathering and processing.

Palantir is at the forefront of the AI revolution. Back in April, your tech expert, Michael A. Robinson, wrote this:

“Palantir has split its main offerings into four primary projects:

“Palantir Gotham — This is an intelligence and defense tool used by militaries and counterterrorism analysts.

“Palantir Foundry — This is used for data integration and analysis by corporate clients.

“Palantir Apollo — This platform is used to facilitate continuous integration and delivery of software.

“Palantir AIP — This platform empowers organizations to leverage AI and create AI-driven applications and solutions.”

Notice what these four platforms do.

They leverage AI to allow defense analysts and corporations to classify, dissect and implement data in their solutions.

That’s why we say that PLTR is at the forefront of the AI revolution.

While I believe the AI revolution is just in its infancy stages, the Weiss Ratings have identified several tech heavyweights long before the general market pack.

For example, Weiss Ratings originally rated Nvidia (NVDA) a “Buy” on Oct. 3, 2005.

Brace yourself … since then, shares are up 63,478%!

Oracle (ORCL) was first rated as a “Buy” on June 2, 2003.

Shares are up 1,859% since.

So, the million-dollar question: Is Palantir’s sky-high valuation and massive price run up just too high to buy right now?

Our ratings system doesn’t believe so.

AI is going to continue to impact our lives in big ways in coming years.

And one way the Weiss Ratings is currently using AI is to explore scorching investment opportunities to help you profit.

In fact, we’ve literally created an …

AI Profit Accelerator

Weiss Ratings founder Dr. Martin Weiss believes this technology will be a game-changer for any investor.

How much confidence does he have?

Well, he’s committing $1,000,000 of his own hard-earned money towards this groundbreaking AI-leveraged strategy.

This newly unveiled strategy could have crushed the market 94-to-1 over the past decade.

The numbers speak for themselves.

I urge you to click here while this opportunity lasts. It will close this week.

Cheers!

Peter J. Amirata