|

| By Sean Brodrick |

Last week saw the Trump rally pause for a bit.

Even Bitcoin, which I told you emerged as one of the big winners of the Nov. 5 election, finally pulled back on Thursday as investors withdrew $1.5 billion from Bitcoin funds in three days.

And that led many to say the top is in for the leading cryptocurrency.

Not likely. The two previous times that Bitcoin ETFs saw such large outflows — on May 1 and Nov. 4 — it marked a local price bottom.

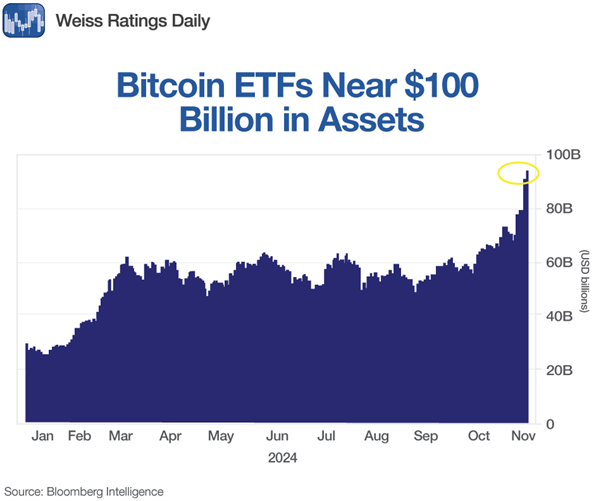

Short-term swings are countertrend moves in a massive flow of assets into Bitcoin ETFs, which are closing in on $100 billion in assets under management.

Considering that Bitcoin ETFs weren’t approved by the Securities and Exchange Commission until Jan. 10, this growth is astonishing.

Assets held by U.S. Bitcoin ETFs are catching up to gold ETFs.

Speaking of gold, one big difference between Bitcoin ETFs and gold ETFs is Bitcoin is much more speculative.

For example, the iShares Bitcoin Trust ETF (IBIT) has a 30-day volatility of 58%, THREE TIMES the volatility of SPDR Gold Shares (GLD), the leading gold ETF.

Anyway, I expect the trend of investor funds flowing into Bitcoin ETFs to continue.

I’ve told you how President-elect Trump likes Bitcoin. Crypto has friends on both sides of the aisle. Those politicians who don’t like crypto are terrified of it.

The crypto industry spent more than $170 million in the election and claims to have helped make the difference in Ohio Senator Sherrod Brown, a crypto opponent, losing his election.

Along with the political forces driving crypto, central banks around the world are easing monetary conditions. That loosens up capital, much of which flows into hot investments … and Bitcoin is a hot investment.

A Bitcoin ETF is the easiest way for the average investor to access the leading cryptocurrency. You don’t have to memorize a long password or worry about losing the thumb drive on which the crypto is stored.

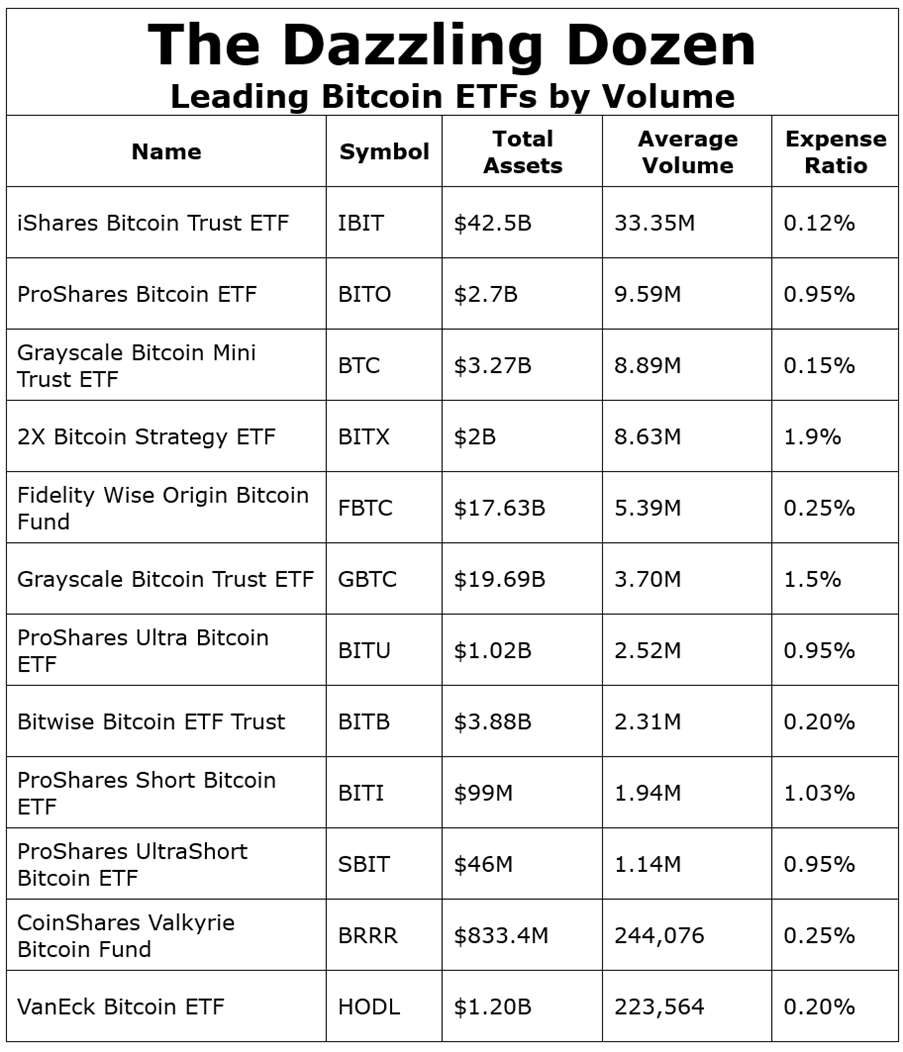

There are plenty of Bitcoin ETFs to choose from. Many people buy one of the big ones. However, you should consider two other factors when purchasing a Bitcoin ETF.

Factor No. 1: Average Volume. The more an ETF trades, the smaller the gap between the bid (made by the buyer) and the ask (made by the seller).

This is important when buying and doubly important when selling. And at some point, you’ll want to sell.

A wide gap between the bid and the ask can eat away at your profit margin.

Factor No. 2: Expense Ratio. The expense ratio is what the fund company charges you for running the fund. These can vary wildly.

Since Bitcoin funds hold the same thing, why pay more than you need to?

Below, I’ve made a list of 12 Bitcoin ETFs with the most volume, showing their expense ratios. You might find it useful.

A few caveats: BITX is a leveraged fund. It aims to track TWICE the daily movement in Bitcoin.

On the other hand, BITI is SHORT Bitcoin, and SBIT is a double-leveraged short Bitcoin fund.

All three funds are only for speculators. And the last two are only for those who think Bitcoin is going down.

Nothing travels in a straight line, but pullbacks in Bitcoin can be bought.

Regular investors can do much worse than buying one of the funds I listed above. Just keep my guidelines in mind.

All the best,

Sean

P.S. Bitcoin isn’t the only asset moving post-election. In fact, my colleague has studied this topic in depth.

After researching what goes up in the first 120 days following every election since 2003, he has a strategy with a 100% success rate.

I urge you to check out his brand-new presentation here.