|

You never know what the newest “A”-rated stock will be.

But you can depend on stocks being upgraded all the time, in real time, in the Weiss ratings.

That said, one stock just newly earned an “A” rating.

I’ll tell you more about it momentarily.

I can also tell you that the last time this happened, we cashed in on a five-month rally.

A year ago, I ran a screen using Weiss ratings to show you that only one out of the 12,000-plus stocks that we rate was freshly elevated to the prestigious “A” rating.

That marked it as one worth watching.

You see, when we rate a stock an “A,” that means we have the utmost confidence it will perform well in the long term.

It usually means it has low volatility, growing earnings and room for its stock price to grow.

When we upgrade a stock into the “A” range, that means it has momentum, too.

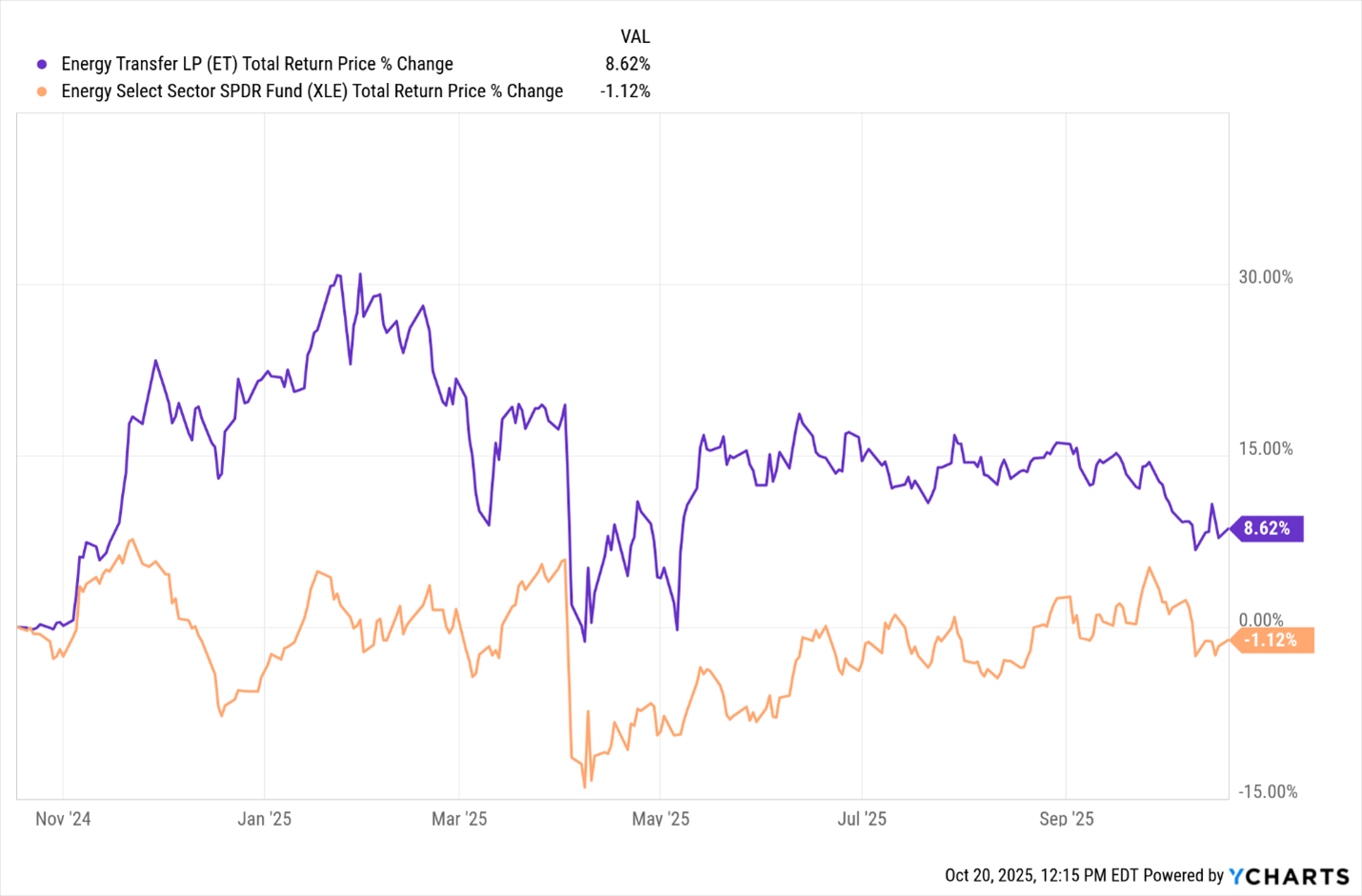

That’s exactly what we found with Energy Transfer (ET) a year ago.

And we were right!

In just the following five months, shares shot up 30%.

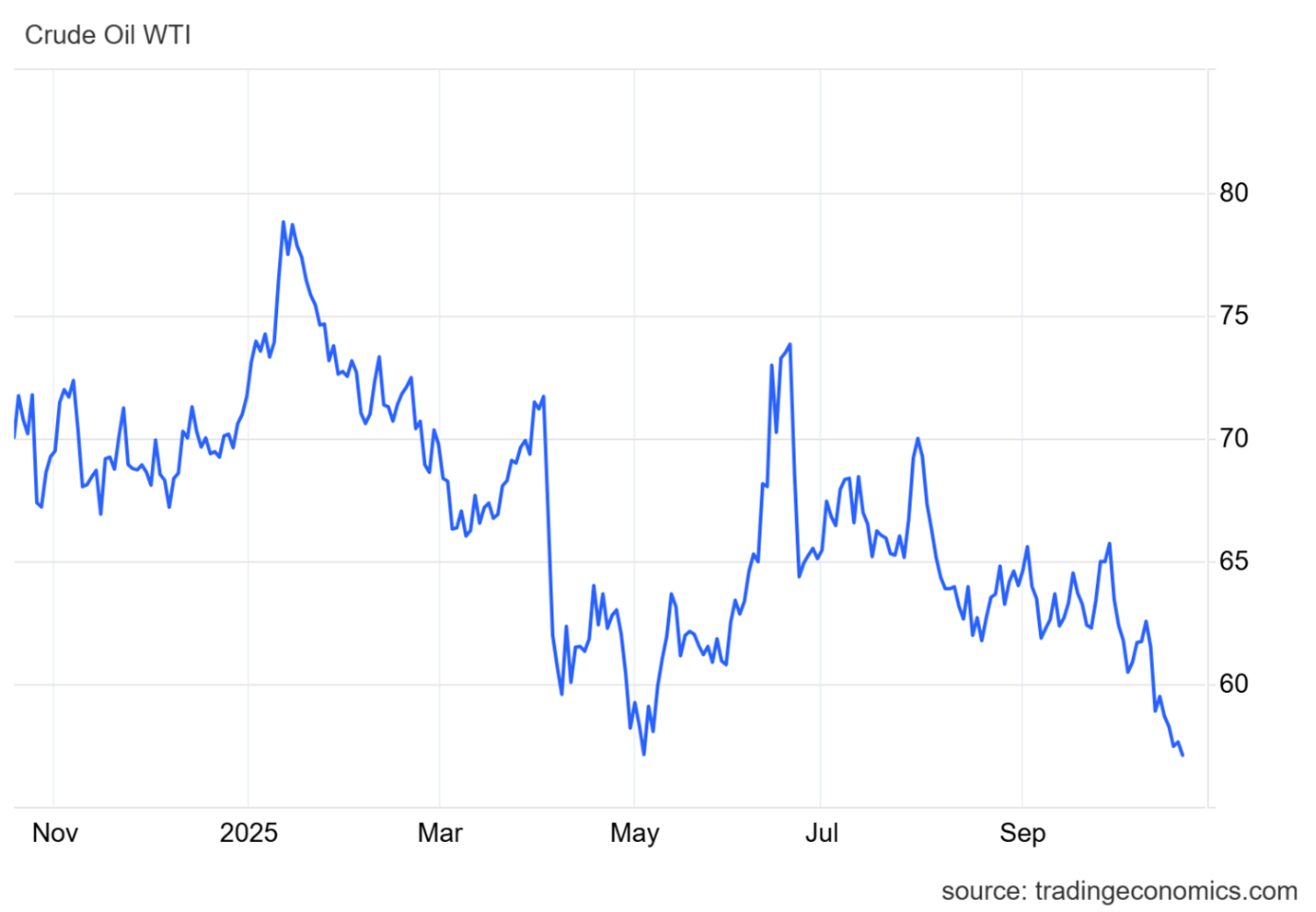

Oil prices, however, turned south after that rally …

Still, as we pointed out in that article, ET was special because it had another factor oil and many other energy stocks didn’t — a boatload of income.

So, when you factor in its — at the time — 7.9% dividend, Energy Transfer shares still performed well over the full 12-month period.

Here you can see how it outperformed its sector — measured by the Energy SPDR (XLE) — because of its large dividend.

We’ll get back to that in a moment.

First, I want to show you what just popped up on my screen.

Your New Upgraded ‘A’ Stock

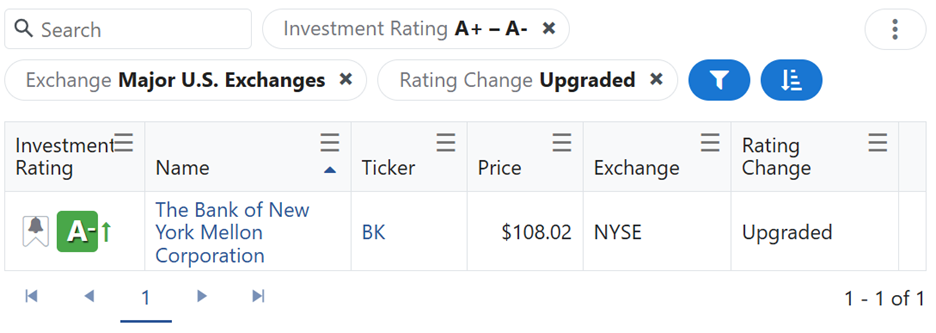

I ran the same screen yesterday morning. Here’s what I found:

Again, only one out of more than 12,000 Weiss-rated stocks was recently upgraded to the “A” range.

Well, only one easily purchased on a major exchange.

The Bank of New York Mellon (BK) is probably not a new name to you.

After all, it carries a $74 billion market cap and — according to its website — “oversees more than $57.8 trillion in assets” for its clients.

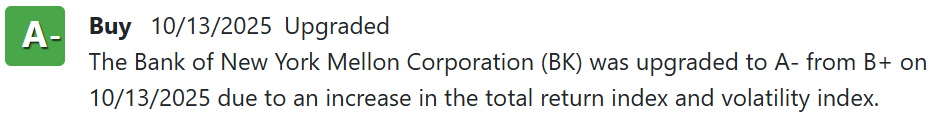

As you can see, it was upgraded because of its total return and volatility indices:

These are our proprietary ratings factors that we use to assign our ratings.

Clearly, those factors pushed BK into the same status as ET was one year ago.

We expect it to perform just as well, especially in the next few months.

But The Bank of New York Mellon lacks one aspect that made Energy Transfer so sustainable even after its upgraded rating slipped back into the “B” range — income.

BK does pay a dividend, even a decent one — 1.8% compared to the market average 1.2%. But it’s not very high.

I don’t know about you, but I wouldn’t be happy with just a 1.8% return on my capital.

Fortunately, my fellow analysts are preparing something special for this exact problem.

They are hosting an “All-In Retirement Income Challenge.”

In fact, at this event, you’ll see how investments not known for producing income — gold, cryptos, even private equity — can be forced to pay you.

BK’s 1.8% yield will look pathetic after you watch this event.

Heck, you could even use it to force an income yield out of BK that’s even bigger than ET’s was.

I urge you to grab your seat for this event right now.

Cheers!

Gavin Magor