|

| By Sean Brodrick |

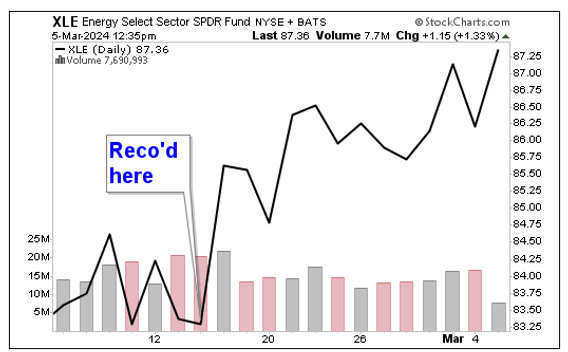

It was just three weeks ago that I recommended you join the profit party in the oil patch. I hope you listened.

My recommendation at that time was the Energy Select SPDR Fund (XLE). It carries a Weiss rating of “B-,” and it has an expense ratio of just 0.09% … and sports a dividend yield of a whopping 3.57%!

Here’s what XLE did after I bought it …

Nice! There is more to come, as I believe oil is on its way back above at least $93, a level it last saw in September of last year. Some reasons why …

OPEC+ Is in No Hurry to Boost Production

The latest out of OPEC+ — the usual suspects led by Saudi Arabia along with a gang of international villains led by Russia — recently extended voluntary cuts of 2.2 million barrels per day, or bpd, to oil production for another three months. The cuts were due to expire at the end of March. Now, they’ll continue until the end of June.

And I bet that OPEC+ extends again.

It’s simple: The ongoing cuts have seen the price of crude rise between 6% and 8%, depending on your benchmark. OPEC+ likes higher oil prices. In fact, the price of the U.S. oil benchmark, West Texas Intermediate, marked the end of last week with the highest price since Nov. 7.

Saudi Arabia is producing 2 million bpd less than it did in October 2022. In January, it dropped its plans to expand its daily oil production capacity by 2027 in a major policy reversal.

And there’s a good reason for that, too: the Kingdom needs an oil price of closer to $100 per barrel to fund the ambitious economic reforms of Crown Prince Mohammed bin Salman Al Saud.

So, you could say I believe oil prices will go higher because the Saudis want it that way. But that’s not all.

Rising Demand

The International Energy Agency predicts oil demand will grow by 1.2 million barrels per day this year. OPEC believes demand will grow even more, by 2.2 million barrels per day.

The way the global economy keeps chugging along, I tend to think OPEC is more right than the IEA. More demand tends to push prices higher.

And speaking of the global economy …

Expect China to Want More Oil

In a meeting this week, China set its annual growth target at about 5%. That’s tough when consumer confidence is scraping bottom, and a housing bubble has burst.

What that target does is boost expectations for China to unleash more stimulus to try to lift confidence and get the economic wheels turning again.

Last year — which was not a good one for China — oil demand grew by 6.6%. This year, the consensus is for oil demand growth of just 3.1%. If China starts stimulating the economy, expect oil demand to shift into higher gear.

What Could Hold Oil Prices Back

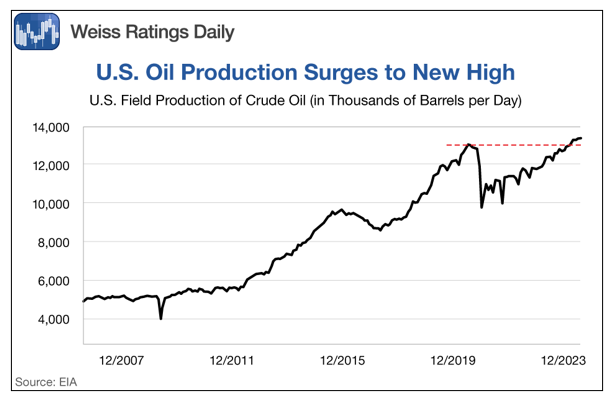

What could hold oil prices back is the U. S. of A! The Energy Information Administration just reported that U.S. crude oil production averaged 13.3 million bpd in December. That is the highest ever!

This is happening despite a decline in the number of U.S. oil wells because of new tech. This new technology is making wells much more efficient and productive.

However, we probably aren’t going to see much more of an increase in U.S. oil production unless there is a significant increase in oil prices. Maybe $10 or $20 per barrel. I strongly believe that can happen this year.

And that brings me back to my price target on oil: $93 per barrel in the next year.

The XLE is still a fine way to play this. Another way would be the Invesco S&P SmallCap Energy ETF (PSCE). It has a Weiss rating of “C+,” an expense ratio of 0.29% and a dividend yield of 2.65%.

One drawback is that the PSCE averages volume of just 28,880 shares per day. That’s too small for one of my publications, but an individual investor can probably trade in and out just fine.

And the thing about the PSCE is it gives you exposure to the smaller-cap oil and gas companies that the big boys like Exxon Mobil (XOM), Chevron (CVX) and Occidental Petroleum (OXY) are buying.

As I mentioned in my previous article, the big companies are buying up smaller oil companies in a bid to expand their resources and lower their production costs.

So, the PSCE could see big moves if there’s more M&A in the oil fields.

Or you can drill down into the XLE and PSCE and buy the best stocks they hold. That’s what I’m guiding my subscribers to do. Individual names carry higher risk but give you more opportunity for knock-it-out-of-the-ballpark potential.

In any case, the oil industry is gushing higher. I hope you join the party.

All the best,

Sean

P.S. There is yet another avenue to profit from the oil boom. That’s with the brand-new technology mentioned above. The best way to do that, however, is to find the startups developing it. Fortunately, my colleague Chris Graebe found something here. Click here to check out a special presentation that just went out for the first time yesterday.