Stocks Suffer as Bond Market Flashes Recession Warning

|

In James Cameron’s Titanic movie, the “Iceberg Right Ahead!” warning comes too late. Nothing can stop the ill-fated ocean liner from its tragic date with destiny.

But in today’s market, it’s the bond market shouting its own warning: “Recession Right Ahead!” So, are there actions you can (or should) take to keep your portfolio afloat?

Before I answer, let’s talk a bit more about this warning. I’m referring to the infamous “inverted yield curve” you may have heard about.

In normal, expansionary times for the economy, yields on longer-term bonds exceed yields on shorter-term notes and bills. That makes sense when you think about it.

When investors buy corporate bonds, they’re betting that the companies who issue them will be able to pay the money back. Or in the case of, say, government bonds, they’re betting that inflation won’t surge out of control and drive the price of their bonds into the gutter.

Naturally, the risk of bad things like that happening are greater over a span of five or ten years than one or two years. So, to account for the increased risks bond investors are assuming when they buy longer-term debt, yields on longer-term bonds usually exceed the yields on shorter-term bonds.

But let’s say you believe the economy is in trouble. Let’s say you think that DEFLATION is a greater risk than INFLATION ... that default risk is going to rise as corporate profits fall ... and that recession is a very real possibility. And let’s say you think that central banks will respond to those risks by cutting interest rates in the future.

What do you do then? You buy the heck out of long-term bonds! You’re betting that with all those bad things happening, rates will be lower in the FUTURE than they are TODAY. So, you want to lock in today’s higher rates for as long as possible.

It’s just like what you might do if you were getting a Certificate of Deposit (CD) at your local bank. If you knew that rates would be lower down the road, you wouldn’t just get a 1-year CD at, say, 2% today. You’d try to get a 5-year CD at 2%.

That way when a year was up, you wouldn’t have to get another 1-year CD that might pay only 1%. You could just keep collecting your 2% for a total of 60 months!

Now, let’s talk about what is happening the bond market today ...

1) The yield on the 10-year Treasury Note just sank below the yield on the 3-month Treasury Bill ...

2) The yield on every major Treasury security outside of 30-year bonds also just plunged through the upper end of the Fed’s benchmark rate target range. And ...

3) Various other yield curve measures are either inverted or the flattest they’ve been in more than a decade.

That’s what has stock investors up in arms. They know inverted yield curves are great recession indicators. And they know that bear markets usually accompany economic contractions.

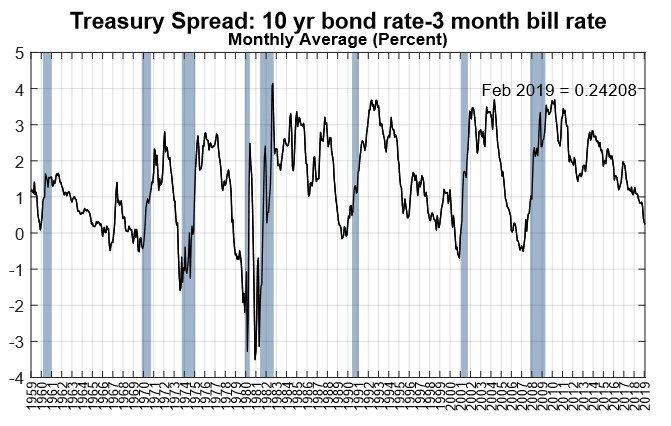

Look at this chart from the New York Fed. It goes all the way back to 1959. What do you see happen when the 3-month/10-year spread inverts (slips below 0 on the left scale)? The economy almost always tumbles into recession (marked by the blue vertical bars).

|

There are only a very, very small handful of times where an inverted curve didn’t signal recession. And stocks typically suffer mightily when the economy shrinks. Data from Charles Schwab shows that in the last half century, stocks suffered maximum drawdowns of anywhere from 17.1% to a whopping 56.8% when the curve inverted and the economy tanked.

So, what do I recommend you do? The same thing I’ve been urging for more than a year now: Play defense!

As you know, I warned in early 2018 that my indicators suggested the bull market was over. I’ve also been saying that economic and market risk was rising ... that sectors like financials would behave terribly as a result ... and that you had to rotate into “Safe Money” investments instead.

I trust you’re very happy if you followed that advice. That’s because utilities, select REITs, and other higher-yielding, defensive investments are crushing it while financials are falling apart. The broader market, for its part, has also struggled for 14 months and counting.

With the yield curve now confirming the rising risk of recession, it’s more important than ever before to follow those recommendations. I also recommend you increase your allocation to “chaos insurance” sectors like gold and gold miners. Maintain a higher level of cash than you did during the March 2009-January 2018 bull market, too.

These moves should help ensure your investments don’t slip beneath the waves during this challenging phase of the market cycle. I’ll follow up with even more recommendations as we roll into the next one, so be sure to stay tuned!

Until next time,

Mike Larson

P.S. I hope you’re enjoying the hard-hitting, actionable recommendations and guidance you’re getting from me here. Now, I’d like to share more insights with you in person.

Specifically, I’ll be attending and presenting at the MoneyShow Las Vegas that runs from May 13-15. You can find out more details and register (for free) by clicking on this link. Or just call the MoneyShow team at 1-800-970-4355 and tell them I sent you. Looking forward to talking with you then!