As Amazon share prices slide, tech investors are getting restless. Now shareholders are mobilizing and pushing back against management.

Amazon.com (AMZN) shares are down in 2022 by a whopping 37.5%. At the annual general meeting on Wednesday, shareholders plan to push back on executive pay, unionization and tax policies.

Buckle up: This is another headwind for the e-commerce giant.

CEO Andrew Jassy has had a tough start to his tenure. Shares are down 43.4% since July 5, 2021, when he took over for founder Jeff Bezos.

As the former head of Amazon Web Services (AWS), institutional investors believed Jassy would strengthen profitability and leave the overall business less reliant on e-commerce.

Unfortunately, he has spent almost a year mired in the morass of warehouse working conditions, unionization and overexpansion. It’s a mess.

Related post: Shopify Thrives on E-commerce Avalanche

Fifteen shareholder proposals are on the docket for Wednesday’s annual meeting, the most since 2010, according to a report from the Financial Times. During that time, no proposal has garnered enough support to move forward. Then again, that was a different era, when the share price was zooming higher.

Bezos founded the online giant in a suburban Seattle garage. He quickly grew the business into an empire by eschewing short-term thinking.

Amazon.com became an intricate mix of businesses, all interdependent. One of these — AWS — started as the cloud-based data storage and compute division for Amazon.com.

Today, the company claims 90% of the Fortune 100 use its services. It has reported annual sales run rate is $74 billion. About a third of that number trickles to the bottom line as profits. And despite its size, the business continues to grow at better than 30% per year.

Unfortunately, the rest of the business is sputtering.

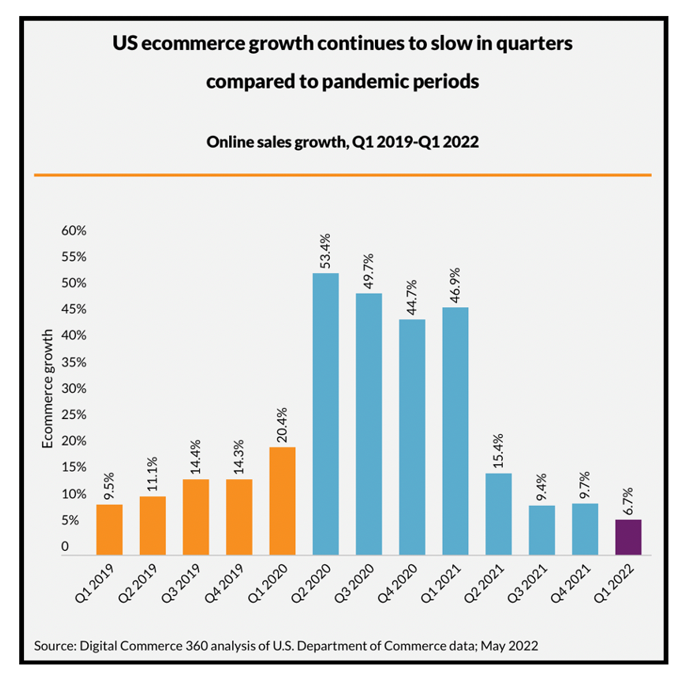

As the pandemic’s effect continues to wane, e-commerce sales are declining and in-store purchasing is rising. Q1 of 2022 marked the lowest growth in online sales in the past 13 quarters.

Jassy spent lavishly in 2021 to take on new warehouse capacity to meet the demand during the pandemic. He also raised wages and ramped up investment in safety protocols to keep warehouse workers healthy.

In March, Chris Smalls, a labor union activist, successfully organized a Staten Island, N.Y., warehouse.

On Wednesday, Smalls will propose that Amazon.com prepare a report detailing policies on freedom of association. The inference is that report will become a roadmap for further unionization.

Related post: Microsoft’s on Cloud 9 After Earnings

Another proposal will ask for an independent audit of warehouse working conditions. And another will ask Amazon.com to detail where and how it pays taxes worldwide.

The Institutional Shareholder Services, an influential advisory group for hedge funds, mutual funds and pension funds, is objecting to Jassy’s $214 million pay package and the contracts of other senior executives.

Shareholders have every right to question executives. Shareholders own the business, after all. And Jassy certainly has made some tactical errors managing the e-commerce component of Amazon.com during the pandemic.

Growing warehouse capacity, when demand was artificially high, is now biting into operational efficiency. Bloomberg notes that excess capacity is going to be a headwind until that space can be sublet.

The problem for shareholders in the near term is most of the 15 shareholder proposals being tabled on Wednesday will hurt future profitability, even if they don’t win enough votes to move forward.

In the past, Amazon.com has met disgruntled shareholders halfway. Previous unsuccessful proposals for environmental impact and racial equality audits have led to future detailed reports.

If Amazon.com moves forward in any way with reports that would make it easier for employees to unionize, it will negatively impact the perceived value of the e-commerce business.

Amazon.com shareholders have had a rough year. Even with the sell-off in 2022, $2,082 shares still trade at 38.6 times forward earnings. The price-to-sales is 2.2 times compared to 0.6 times for Walmart (WMT), 0.64 for Target (TGT) and 0.32 for Best Buy (BBY).

I’m intrigued by the longer-term potential of Amazon.com, especially given the growth prospects for its cloud-based division, AWS. However, investors should strongly consider avoiding shares until they stabilize and begin to move higher again.

And while we can anticipate further headwinds for Amazon (and other tech giants), it’s the unforeseen “Black Swan” events that truly jeopardize AMZN — and the entire U.S. economy. Fortunately, there is a way for investors to protect themselves against the unknown. All the details are in this free investor video. Click here to view it at no cost whatsoever.

Best wishes,

Jon D. Markman