As the big five technology firms get even stronger, their stock prices are getting slammed, and it's crucial to realize what's going on.

Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon.com (AMZN) and Meta Platforms (FB) in 2022 have shed $2.7 trillion in shareholder wealth as analysts trimmed targets ahead of a potential recession.

Executives at the big five don't seem worried about a downturn, though. And quite frankly, they shouldn't be. Big Tech has inherent strengths that are about to prove invaluable.

A report in The New York Times on Monday notes that Microsoft, Apple and Amazon have committed to pay increases for engineers, while Google is on the hunt to increase headcount. Only Meta, the parent of Facebook, is cutting the number of code writers under contract.

Something bigger is going on.

Related Post: Amazon Has Lost Its Way

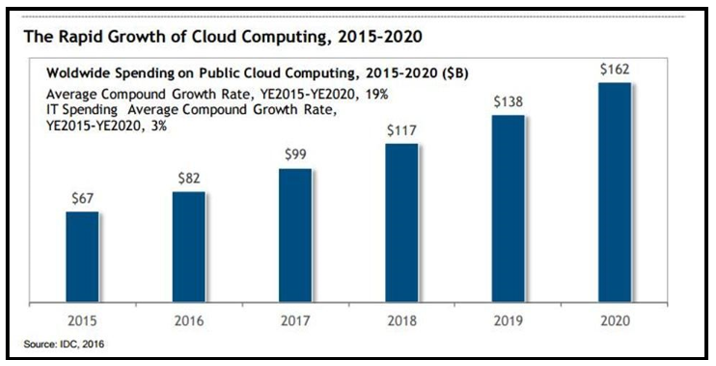

All the corporate world is moving to cloud-based computing. This is a big transition that completely changes the way corporations operate.

In the future, they will use digital data points to influence every aspect of business. It will temper marketing, product development and the supply chain. And there is no going back.

Only a year ago, digital transformation was a viable investment narrative. Cloud was the story. It allowed price-to-earnings ratios for Big Tech to expand.

And in the case of hundreds of smaller technology firms, rising sales was even enough to pull money from investors' wallets. Worries about interest rates and recession changed everything. The narrative collapsed. Stock prices followed.

But this turmoil leads me to my main argument that ...

Digital Transformation Is Still Thriving

Amazon, Microsoft and Google — the three biggest players in cloud infrastructure — have announced big increases in spending for new gear to power their data centers.

Those centers are the backbone for the transition to cloud-based computing. Those centers also support profitable empires in e-commerce, business productivity software and internet search.

And those empires provide the free cash flow execs are now using to invest regardless of the economic cycle. This is a luxury smaller, unprofitable firms do not have. It's the crux of the opportunity ahead of the Big Five.

During the Great Recession of 2008, Apple doubled its employee count. The acquisition of P.A. Semiconductor, a chip designer, accelerated the development of its current best-in-class line of MacBook computers.

Related Post: Steer Into the AV Rev With Intel

Google bought AdMob, another key component of its huge digital ad network. All-in, the Big Five bought 100 smaller companies between 2008 and 2010, the Times notes.

The ability to gobble up smaller competitors during bear markets is a big deal. It's how big companies maintain their edge. And it's how they innovate and grow earnings while keeping competitors on the defensive.

This doesn't mean the stocks can't decline. While the business end of the big five is solid, sentiment remains extremely poor.

Investors are simply no longer willing to pay higher multiples for the growth narrative. In my experience, this looks transitory.

That said, I recommend waiting until the stocks bottom and stabilize before considering new entry levels.

Avoiding new purchases until shares retake their respective 200-day moving averages seems prudent.

V-shaped recovery rallies from bearish cycles are rare. New investment now could be dead money for several quarters.

One thing rings true: Big Tech is alive and well. The core businesses remain solid.

In the meantime, meditate on this old market truism: Bear markets return stocks to their rightful owners.

This means that smart money investors are profoundly aware of the real value of public companies, and they wait for moments like this to take shares away from their terrified, ill-informed counterparts at earnings multiples that in some cases are scraping the lowest levels in a decade.

But while smart money investors move to reclaim shares, it's a fine line. While wealth analysts trim targets ahead of a potential recession, the economic forecast is a known factor. What investors must watch for now are the UNKNOWN factors. We are one unknown event away from a market stumble that could cause those smart money investors to find themselves in a bad position on the other side of that fine line.

For guidance on how to protect yourself and your portfolio from these "Black Swans," watch this free investor broadcast now.

Best wishes,

Jon D. Markman