Despite BlackRock’s Bleak Outlook, There’s a Silver Lining

Executives at the world’s largest asset manager are worried about rising long-term inflation and the willingness of the Federal Reserve to save stock investors.

Last week, BlackRock (BLK) published its Global Outlook for 2023. The report identifies three drivers that you should know about, because they will reset stock and bond prices for the foreseeable future.

The analysis is bullish for ON Semiconductor (ON). Let me explain why.

Related Post: Moderna's High Efficacy Means High Share Prices

BlackRock was an early proponent of globalization —the idea that the global economy would become more peaceful and prosperous if the world’s economies, cultures and populations were more interdependent. The gist was that a world freely trading together would be more inclined to get along, or so the theory went.

In practice, global supply chains quickly became weaponized.

Manufacturing was shipped to Asia, especially China, where leaders sought to leverage global influence in Africa and the less-developed world. Financial capital gravitated to London and New York, where financiers and consultants put together offshoring schemes and tax shelters, while the developed countries of the world binged on inexpensive goods and low borrowing costs.

BlackRock Chief Investment Officer Philipp Hildebrand characterized this period as the Great Moderation, a four-decade period of stable economic growth and low inflation. He now believes that is over and investors should brace for more volatility and stubborn inflation.

In the Global Outlook playbook, Hildebrand points to three key regime drivers that will make life miserable for the world’s central bankers and investors for the foreseeable future. These trends are now set in motion and cannot be easily changed.

First, the world is getting older due to low birth rates, and caring for the elderly is going to be expensive. It’s also going to cause shortages of trained workers, and it’s going to blow out public sector budgets, as it has in Japan since the 1980s.

Second, deglobalization is undoing the global supply chains that brought lower costs of manufacturing. This trend is clear to see in the rush to politicize semiconductor design and manufacturing. Expensive new facilities are being planned in Europe and the United States.

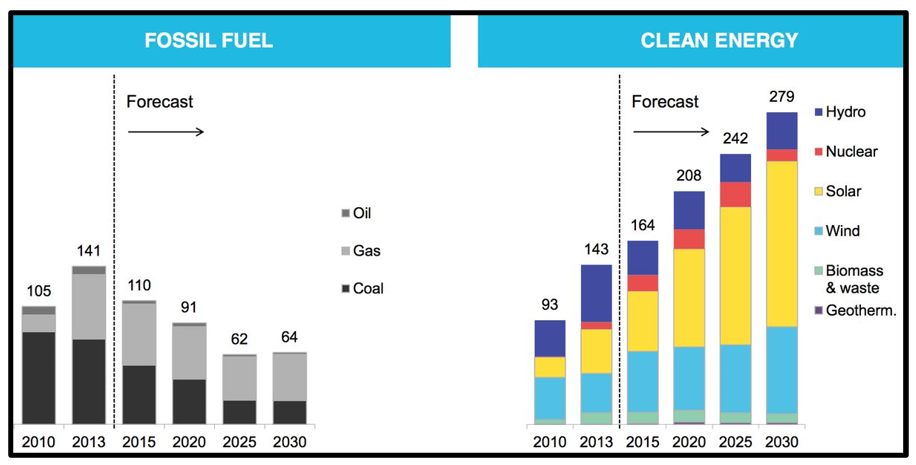

The third regime driver is the rapid transition from fossil fuels to clean energy alternatives.

Click here to see full-sized image.

The war in Ukraine quickened the adoption of non-carbon fuel sources, and it is disrupting ongoing investment in fossil fuels. BlackRock strategists argue that the unorderly transition could result in fuel shortages that will ultimately disrupt global economic activity.

However, there is a silver lining for savvy investors.

Related Post: Invest in the Face of Fear

ON Semiconductoris building a lucrative business supplying chips to all facets of clean energy, including infrastructure, electric vehicles and EV charging stations.

The Phoenix, Arizona-based company has become a major player in the production of silicon carbide, a key material for the next-generation power-switching required for the transition to clean energy.

In the interim, ON Semiconductor is reaping the benefits of its earlier investment in the chips and components needed for the EV transition.

The company reported in early August that robust demand for power management systems and sensors continues to outpace supply. Some customers have taken the unusual step of co-investing with ON Semiconductor to expand capacity. Others have extended existing contracts through 2029 as they clamor to secure supply of the components they will need for future EVs.

BlackRock is not totally on board with the demand picture for EVs … or consumer spending in developed markets for that matter.

Hildebrand says that the Fed will not save investors with lower interest rates when the next recession hits. This behavior would be the end of the so-called Fed put, or the injection of cheap money to smooth over rough patches in economic activity.

Investors should focus on the prevailing trends that are working.

At a price of $65.38, ON Semiconductor shares trade at 14.5x forward earnings and 3.3x sales. This is extremely inexpensive given gross margins of 46.6% and the potential of its clean energy franchise.

I’ll have more for you soon.

All the best,

Jon D. Markman

P.S. In the last crypto bull market, DeFi coins were among the top performers, with returns like 65,586%. Last week, DeFi master, Chris Coney, revealed his top DeFi coin for 2023. Plus, how to start earning stablecoin yields of 9%, his unique strategy for even bigger 44% yields and much more. Click here.