The possibility of a recession is our reality. In fact, most corporate leaders now expect a recession as soon as next year.

A survey released on Friday from the Conference Board reveals that 60% of corporate suite officers are convinced the economy will contract by 2023.

Fifteen percent believe a recession has already begun.

It’s a big red flag for investors in the near term. But long-term tech catalysts remain strong.

To understand what’s going on, step back and take a look at the geopolitical landscape that paints a clear picture.

During the past two decades, the world has been busily building most of its factories in Asia, specifically in China.

Related Post: Look for Tech Bargains

At the same time, the rise of environmental, social and corporate governance investing made it difficult for capitalists to invest in fossil fuels, ceding power to Saudi Arabia and Russia.

Unfortunately, none of these countries are especially friendly toward the West.

Now the Chinese government is randomly closing domestic factories, creating supply-chain shortages.

Russia is at war with Ukraine, producing commodity shortages for grain, oil and natural gas. And Saudi Arabia refuses to pump more oil to ease the price shocks.

Interest rates are rising to quell inflation in the U.S., and across the globe.

It’s a complete mess without an easy fix. It is no wonder CEOs are worried.

The Conference Board survey was put to 750 CEOs and other C-suite-level executives.

They were asked about their feelings on the war in Ukraine and how their businesses were being impacted, the risks to supply chains, cybersecurity, contingency planning and innovation. The outlook was grim.

Corporate leaders in ESG-related companies were most pessimistic. Some 42% saw a recession by mid-2022, with an additional 40% expecting the downturn within the next two years, according to the report.

An Unprecedented Era

Only two years after a pandemic plunged the world economy into recession, central bankers around the world are creating another one to halt runaway inflation.

Last week, the Federal Reserve hiked short-term rates by 75 basis points, the biggest hike since 1994. And Fed Chair Powell did not rule out further large hikes at future meetings.

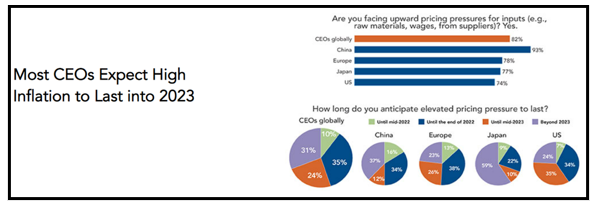

The CEOs see margin compression. They are battling rising interest rates coupled with higher raw material costs.

Worse, they are worried about competing economic blocs as Chinese and American economic interests diverge. The era of lower-cost, Chinese-made goods may be coming to an end, as well as the price deflation that came with it.

But as markets change and times get more difficult, the ways to profit from crises become more timely and vital. In Dr. Weiss’ Crisis Profit Trader, Members are able to capitalize in times like this. Never before in the history of Weiss Ratings has an opportunity been more unique. To learn more, check this out.

Jamie Dimon, CEO at JPMorgan Chase (JPM), warned earlier this month that the global economy faces an economic hurricane.

Jane Fraser and James Gorman — the CEOs at Citigroup (C) and Morgan Stanley (MS), respectively — are more measured. Both see the possibility of recession growing, yet still avoidable.

Tesla’s (TSLA) Elon Musk is somewhere in the middle. In an email obtained by Reuters, Musk told Tesla executives that he had a “super bad feeling” about the economy.

He then directed managers to begin cutting 10% of salaried employees in anticipation.

There’s some good news, though ...

Corporate leaders are still committed to investment in new technologies to automate their workflows and protect digital data.

This means greater investment in cloud-based technologies and cybersecurity. And it’s a strong reminder that the digital transformation is raging behind the scenes.

Together, this is the continuation of the digital transformation wave that was responsible for so much investor wealth creation during 2020 and 2021.

Related Post: The Apple of Big Tech’s Eye

Unfortunately, the underlying tech stocks are nowhere near beginning new uptrends. Most stocks are trading well below all their major resistance levels, including the all-important 200-day moving average.

While I don’t recommend any new investments at this time, investors will be wise to watch sector leaders such as Microsoft (MSFT), Palo Alto Networks (PANW) and MongoDB (MDB), a fast-growing maker of next-generation databases.

If corporate leaders are any indication, the rest of 2022 may be a whirlwind for investors. Storm clouds are definitely on the horizon. That said, the bigger digital tailwind remains in place.

Watch the price action for leaders. When they start rising, the next leg higher looks poised to begin.

Remember to do your own due diligence.

Best wishes,

Jon D. Markman