The stock market remains in a funk, yet the cause isn't what most investors believe. A valuation bubble is bursting, and sadly, this process is far from over.

On Thursday, Enjoy Technology (ENJY) announced that the retail startup will file for Chapter 11 bankruptcy, only nine months after shares were listed via a special purpose acquisition company merger.

Yet another special purpose acquisition company bites the dust ... and there are more to follow.

During the height of the pandemic two years ago, SPACs were all the rage. The entire global economy was shuttered, and so-called blank-check companies seemed to offer exciting growth prospects. Sadly, the promise was never real.

Traditionally, companies have earned public listings years after toiling in venture- capital hell. Startups are forced to raise several rounds of funding to stem the tide of red ink as executives grow the business toward profitability.

The initial public offering is the reward for management success. It's also a sign that Wall Street investment bankers are willing to vouch for the credibility of the underlying enterprise.

The opposite is true for most SPACs.

The structure of SPACs circumvents vetting. A stock promoter or financier files for a public listing on a major exchange.

The goal is to sidestep Securities and Exchange Commission filings requirements by holding only cash. A direct listing occurs when this blank-check company merges with an ongoing concern. There is no underwriter. Nobody at all is performing due diligence on behalf of investors.

During 2020 and 2021 there were 248 and 613 SPAC deals, respectively. Many immature companies were being rushed to the public market with little more than an idea and a sales pitch.

Related Post: Amazon Has Lost Its Way

Investors shouldn't be surprised the process ended poorly. It was all a scam.

Speaking with Bloomberg Technology a year ago, Enjoy Technology's CEO Ron Johnson told a different story.

The former Apple (AAPL) executive claimed that Enjoy had clear visibility to profitability. And documents filed with the SEC projected net earnings by 2023 and $1 billion in sales two years later.

It was always a tough ask.

The business of the company based in Palo Alto, California, was delivering mobile phones on behalf of AT&T (T), British Telecom, Rogers Communications (RCI) and Apple, then having Enjoy agents upsell additional products or services.

The model was never profitable, and through the end of 2021, gross margins settled in the red at -34.5%, with losses of $158 million.

Still, in October 2021, Enjoy managed to raise $250 million through its SPAC merger with Marquee Raine Acquisition. The transaction valued the money-losing company at $1.2 billion. Nine months later, the company is filing for bankruptcy.

Sadly, many other SPACs are headed down a similar path. Bloomberg noted in June that 65 of these companies will need to raise more capital within the next year simply to keep the lights on.

Related Post: Pathway to Tech Turnaround

Of the 613 SPACs listed in 2021, 78 now trade at $2 per share or less. Twenty-five of these are trading at less than $1, the threshold to maintain a listing on the Nasdaq stock exchange. Yikes.

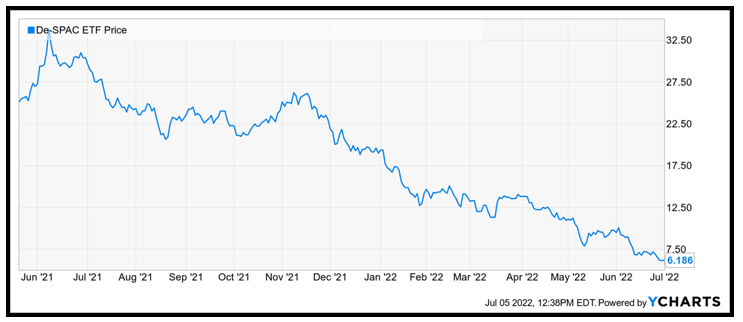

The De-SPAC ETF (DSPC) is an exchange-traded fund that tracks SPACs. The ETF is down 67.7% year to date, and down 78% over the past 12 months.

The Valuation Bubble Has Burst

Wall Street investment dealers and TV talking heads blame the SEC for investor losses. However, that's like blaming the cops for crime. It's smarter to follow the money. Many SPACs never should've become publicly listed firms.

Wall Street, financiers and greedy executives exploited a loophole to push these stocks to unwary investors. The financial press breathed life into SPACs with stories about surging prices.

The story of Enjoy Technology is a tough yet vitally important lesson for investors: Valuations matter, especially with unprofitable businesses. Many SPACs are never coming back.

On the other hand …

A $43 trillion real estate disruption is underway as we speak, creating unprecedented opportunities for savvy investors.

The best part? It doesn't require you to fork over one dollar for an actual piece of physical real estate.

Investing expert Tony Sagami revealed how it's possible to claim outsized profits from the biggest real estate opportunity in 175 years in his recent interview with Kenny Polcari.

If you're interested in learning more, click here to see the full replay while it is still available.

Best wishes,

Jon D. Markman