Tough Times for Tech Investors Could Get Worse

It’s been a rough week for technology investors. Unfortunately, it may get worse.

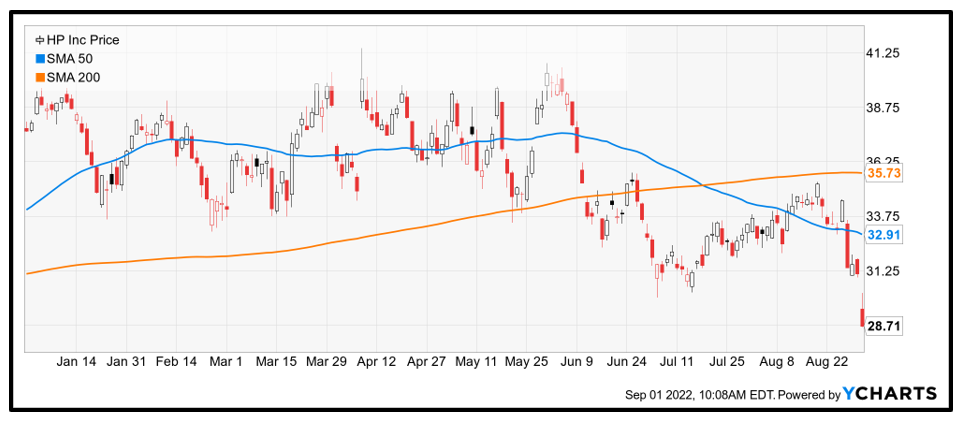

Executives at HP (HPQ) announced Wednesday Q3 revenues slipped 4% from a year ago. Sales of personal computers are facing tough year-over-year comparisons. But that’s not the problem.

It’s the Federal Reserve, and it’s time to protect against more downside.

Related Post: Teen’s Invention Means EV Expansion

It’s easy to miss the bigger picture in tech. There are undeniable long-term trends that often become blurry when markets turn sour with panic.

Vehicles are being electrified. Enterprises are transitioning computing to the public cloud. Chief technology officers are ramping up their spending for AI-enhanced software as they try to make sense of their data. And companies of all sorts are turning to digital ads to finance future growth.

Sadly, investors lose sight of these trends when a brand like HP misses its top and bottom-line forecasts. The knee-jerk reaction is that tech is in trouble, except that personal computers are old tech, largely replaced by mobile devices and the cloud.

This is made worse by software. So much computing now occurs on the network that PCs are often little more than glorified internet browsers. The upgrade cycle is glacial.

The Fed is another problem, though.

Normally, I would counsel long-term investors to look past macroeconomics and focus on buying the best businesses opportunistically. But Fed Chairman Powell inserted the central bank into the mix last week. He talked of raising short-term interest rates to the 4% range by early 2023. They’re currently 2.25%.

Keep in mind, the Fed can’t actually raise mortgage and corporate lending rates through policy. Those rates are set in the bond market by traders. What Fed bankers can do is influence bond traders. This occurs through speeches to banking associations and interviews with CNBC or The Wall Street Journal.

A Fed president has made hawkish comments about rates every day since the Jackson Hole speech. They understand the markets are thin ahead of the Labor Day weekend. Their goal, in my opinion, is to maximize the impact of the Fed’s new ultra-hawkish tone.

Related Post: Small Chipmaker, Big Vision

The HP numbers were bad. That business is shrinking. The Fed commentary could be catastrophic.

It is conceivable that the Nasdaq Composite will soon return to test the June lows at $270, a decline of roughly 10%.

But the future of tech remains bright, and patient investors should be rewarded.

One last thing …

A big bear has crashed the market party. And Martin shows you how to treat it like an invited guest. In a new 33-minute video, he reveals a five-step strategy for selecting the weakest large-cap stocks and transforming their declines into major profit opportunities.

The most profitable trade could have turned $10,000 into $230,000 a single day, while the LEAST profitable could have turned $10,000 into $51,600. Even the AVERAGE gains among these could have turned a $10,000 initial investment into $78,100 in just three trading days.

See how you can put this strategy to work in your own account as soon as today by clicking here.

Best wishes,

Jon D. Markman