Bitcoin Still Holds High Ground

• Bitcoin (BTC, Tech/Adoption Grade “A-”) barely missed reaching a new high yesterday and is still less than $2,000 away from a new peak.

• Binance Coin (BNB, Tech/Adoption Grade “C-”) dropped 8% today after a retest of its moving average but is still up nearly 500% since Feb. 1.

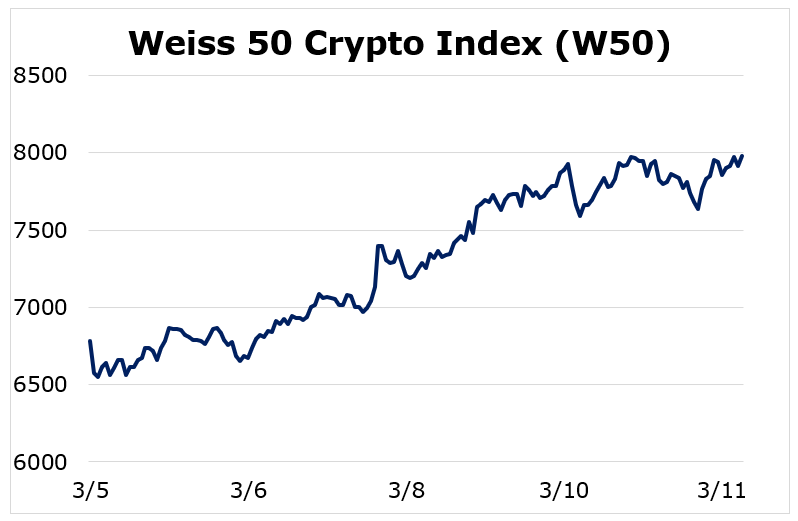

• The Weiss Crypto 50 Index (W50) rose 17.71% during the seven-day trading week ended Thursday.

We noted yesterday that it may take a little while for Bitcoin to actually break above that previous all-time high despite the speed of the recent recovery from the lows of late February. BTC was able to come within just a few hundred dollars of its ATH yesterday but was unable to break that barrier.

It’s trading down about 1.5%, still holding that $57,000 level after a bounce off $55,000 earlier today. We’re not into the clear until BTC sets a new high. But it is up more than 17% on the week and just 2% away from a new peak. So, things are looking quite good for the King of Crypto.

Here’s BTC in U.S. dollar terms via Coinbase:

Binance Coin, as it stands today, is down more than 25% since it hit an all-time high on Feb. 19. It’s still up 490% since the start of February, showcasing just how far and fast BNB has risen.

BNB has now retested its 21-day moving average several times since it hit that all-time high and has held the level each time. Though it has failed to convincingly bounce off that moving average, its performance is fine.

Our key levels are the 21-day moving average on the downside. On the upside, we’re looking at $300 and the previous high of $370.

Here’s BNB in U.S. dollar terms via Binance:

Here’s my colleague Sam Blumenfeld with the weekly breakdown of the Weiss Crypto Indexes ...

Index Roundup

It was a solid week for cryptocurrencies of all sizes, as the broader crypto market continues to move past its most recent correction. Bitcoin is rapidly moving towards all-time highs, and it trades around $56,000 at the time of this writing.

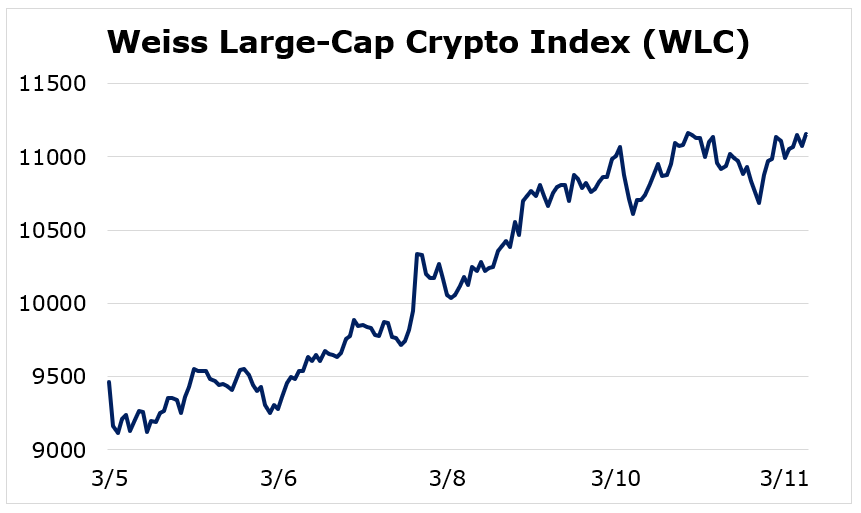

Most of the market moved tightly in-line this week, but Bitcoin was able to outperform as it approaches the $58,000 price level that it touched pre-correction.

The Weiss 50 Crypto Index (W50) climbed 17.71%, as almost the entire market advanced.

The Weiss 50 Ex-BTC Index (W50X) slightly underperformed this week due to Bitcoin’s exclusion, gaining 13.18%.

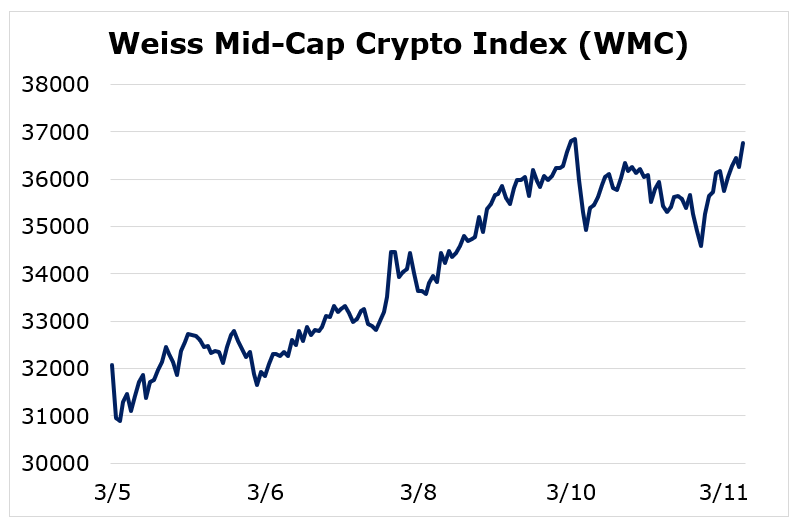

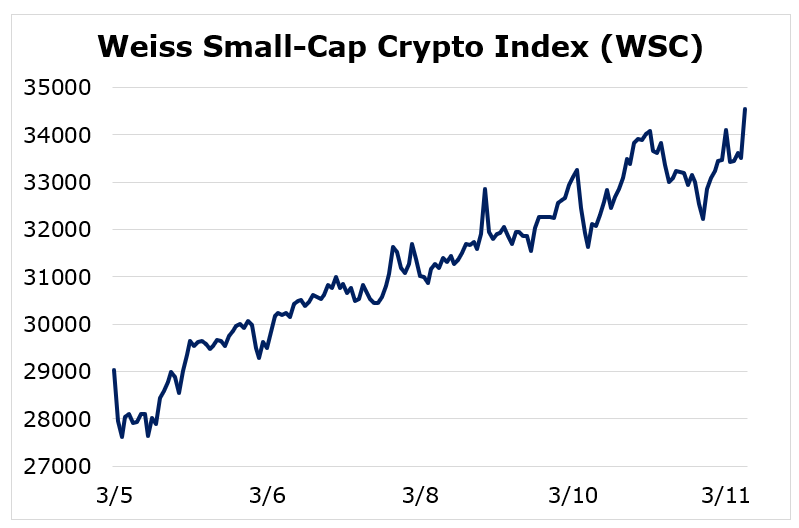

Breaking down this week’s performance by market capitalization, we see that larger and smaller cryptocurrencies slightly outpaced the mid-sized altcoins. Still, most cryptocurrencies managed to lock in decent gains.

The Weiss Large-Cap Crypto Index (WLC) increased 17.94%, led by Bitcoin’s strong rebound.

After setting the pace last week, mid-sized cryptocurrencies slightly lagged behind the large and small caps. They still performed well, as the Weiss Mid-Cap Crypto Index (WMC) rose 14.64%.

The small-caps outperformed the rest of the crypto market, as the Weiss Small-Cap Crypto Index (WSC) soared 18.98%.

The broader crypto market was up this week, and it looks like the recent correction may be behind us. Bitcoin notably led the way, which is good news because it shows there is still high demand despite outflows into altcoins during alt-season.

While more volatility moving forward is inevitable, the long-term bullish trend is progressing as expected. Bitcoin has barely scratched the surface in its adoption potential, and a flurry of institutional investment spells great news moving forward.

Notable News, Notes and Tweets

• Anthony Pompliano marks Bitcoin’s massive 970% growth over the last year.

• Matthew McDermott, head of The Goldman Sachs Group, Inc. (NYSE: GS)’s digital assets division, notes that there’s huge institutional demand for Bitcoin.

• MicroStrategy Inc. (Nasdaq: MSTR) CEO Michael Saylor announced another $15 million Bitcoin purchase, and the company now owns 91,326 BTC worth more than $2.2 billion.

What’s Next

Over the last week, the market has made a significant recovery from the recent correction, with large caps and Bitcoin gaining more than 17% on the week. Still, as was the case yesterday, the entire market is waiting to see what Bitcoin does next.

Money and attention have shifted to BTC right now, and BTC will determine the market’s direction.

Here’s the thing: We sit on the precipice of new all-time highs. And, come Monday, we’ll likely have a good idea about short-term direction and will adjust our strategy accordingly.

Stay tuned …

Best,

Alex