Blue Chips, Altcoins Lead Crypto Market to New Heights

Here’s what’s happening in cryptocurrency markets today …

• The entire market is trending higher, as both Bitcoin (BTC, Tech/Adoption Grade “A-”) and Ethereum (ETH, Tech/Adoption Grade “A-”) crept up and altcoins extended their excellent week.

• Ethereum has held ground this week and is currently trading in what’s becoming a notorious range between $1,800 and $2,000.

• Avalanche (AVAX) has also had a solid week, bursting into the top 25 on a 28% rally.

This week, Ethereum has established $1,700 as a strong support level and has once again crossed above $1,800. The No. 2 cryptocurrency has struggled above this level, so we’re looking at a solid test of the strength of its current push.

If Ethereum can make a significant push from here and cross above $1,900 in the next 48 hours, it just might have the strength to make another run at a new all-time high.

A new all-time high for Ethereum would be a glaring sign of a new altcoin season, especially if Bitcoin continues to trade below its previous high.

Here’s ETH in U.S. dollar terms via Coinbase:

Avalanche has seemingly come out of nowhere to skyrocket into the top 25 crypto assets by market capitalization.

Avalanche is a triple-chain network that also has its own virtual machine for creating smart contracts. It’s an interesting new-age decentralized platform that’s just starting to make some ripples in the space.

AVAX opened the year priced just above $3.00 but shot all the way up to $63 by Feb. 10, a rise of about 1,950% in just 40 days, representing absolutely insane numbers. It then fell about 65% over the next 18 days, bottoming around $22 on Feb. 28. Since then, it’s regained its 21-day moving average and is now trading near $36.

For the day, AVAX is trading up about 8% and is right at the only clear resistance level on its way back to all-time highs. Avalanche is definitely an altcoin to keep an eye on over the next few weeks.

Here’s AVAX in U.S. dollar terms via Binance:

Here’s my colleague Sam Blumenfeld with the weekly breakdown of the Weiss Crypto Indexes ...

Index Roundup

This week was more about altcoins than the King of Crypto and other blue-chip names. While the largest cryptocurrencies stalled, we saw outflows into altcoins from investors looking for growth opportunities.

Still, it’s a good sign that Bitcoin and Ethereum didn’t lose value despite funds flowing into smaller projects.

Bitcoin and Ethereum still trade in the $59,000 and $1,800 price ranges, respectively, at the time of this writing, and it will be important to see if they can sustain a breakout during alt-season.

The Weiss 50 Crypto Index (W50) increased 0.21%, leaving it virtually unchanged from a week earlier.

The Weiss 50 Ex-BTC Index (W50X) gained 0.98%, showing Bitcoin traded in line with the other established cryptocurrencies.

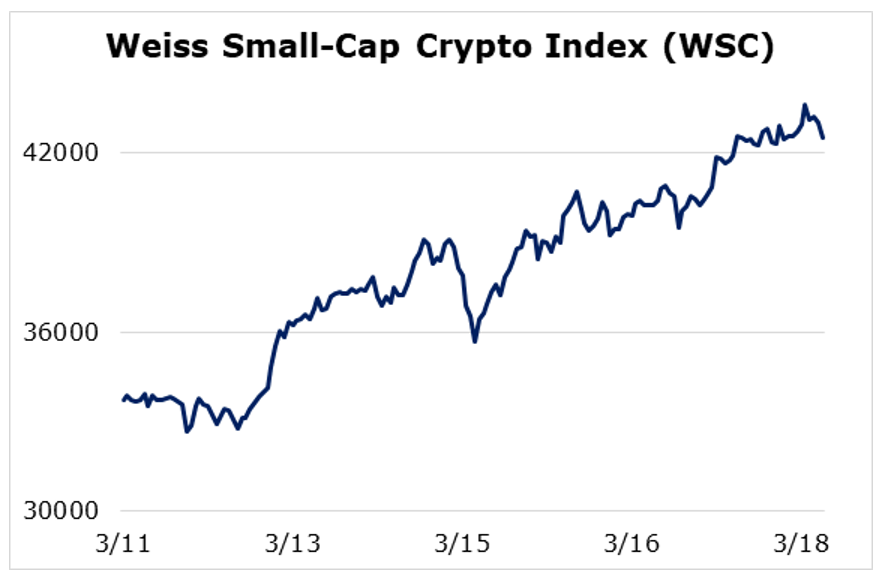

Breaking down performance this week by market capitalization, we see that smaller and mid-sized altcoins outpaced their larger counterparts. While the small- and mid-caps managed to book solid gains, large caps remained stagnant.

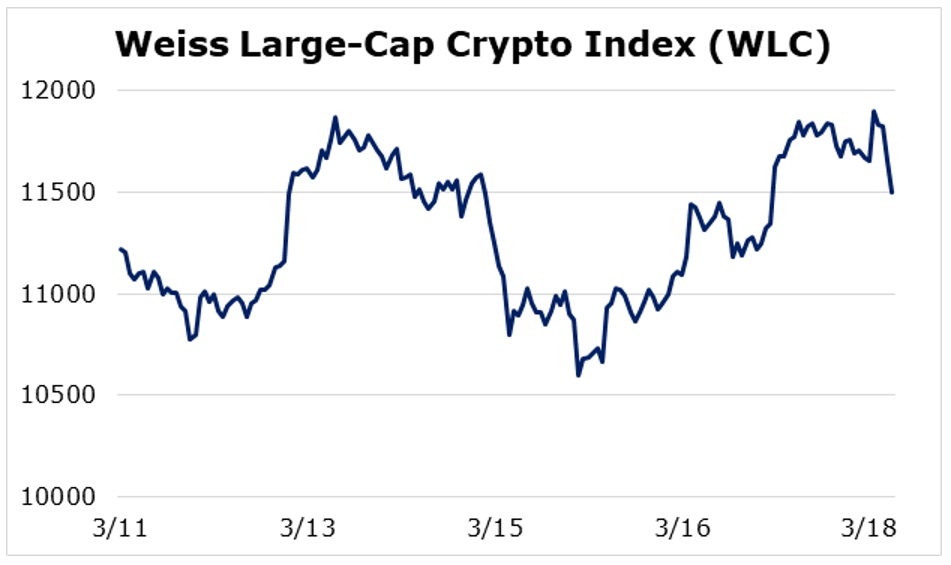

The Weiss Large-Cap Crypto Index (WLC) grew 2.53%, following Bitcoin’s relatively flat trading.

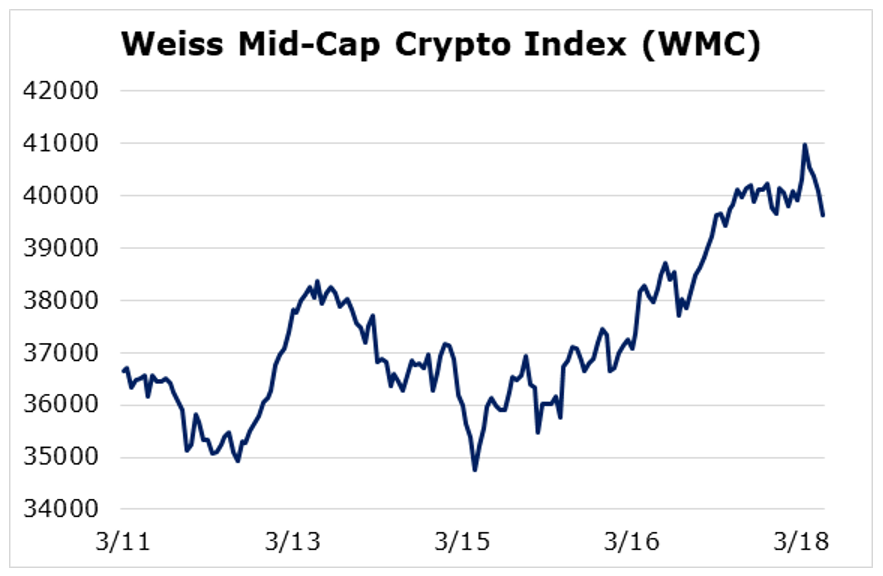

Mid-cap cryptocurrencies performed well this week and outperformed the large-caps. The Weiss Mid-Cap Crypto Index (WMC) rose 8.10%.

The small-caps were the biggest winners this week, as the Weiss Small-Cap Crypto Index (WSC) soared 25.99%.

Despite a flat week for the biggest names in crypto, alt-season is progressing as expected. It’s a good sign that Bitcoin and Ethereum held their ground, and it will be even better if they manage to appreciate in line with the smaller altcoins.

As institutional adoption ramps up, there are several positive catalysts that could propel Bitcoin and Ethereum higher. Fundamentals are stronger than ever, and the current bull market appears to be moving full steam ahead.

Notable News, Notes and Tweets

• In a fascinating coming together of Anthonys and Elon, Pompliano retweeted Scaramucci mentioning Musk’s Bitcoin holdings.

• Tyler Winklevoss notes that the Purpose Bitcoin ETF (TSX: BTCC) now has more than $1 billion in assets under management.

• Dan Held shares his thoughts on the possibility of a Bitcoin “supercycle”.

• After announcing Bitcoin operations this week, Morgan Stanley (NYSE: MS) appears to be jumping right into the deep end.

What’s Next

We’ve hesitated to give a definitive call, but today, with the data from our indexes to back us up, we’re off the fence: It’s altcoin season.

The major takeaway this week is we’ve seen a nice kickstart to trading in the non-majors, with multiple coins seeing huge percentage gains. Interestingly enough, it appears to have been led by the small caps primarily, though mid-caps performed well too.

Ethereum usually breaks out before the big start to altcoin season. The fact that it’s struggled to burst through $2,000 is an interesting development. If ETH can break through that barrier and propel to new heights, that would be a serious shot of adrenaline for this altcoin season.

We’ve highlighted some of the best performing small- and mid-cap altcoins this week to highlight where crypto traders are making their money lately. Now that altcoin season is officially here, we’ll continue to highlight these exciting plays in the space.

Stay tuned for insights on potential winners of the 2021 altcoin season.

Best,

Alex