What to Do When Crypto Markets Correct

• After a two-day relief rally, cryptocurrency prices are dropping again today, trending lower though not yet breaking below Tuesday’s lows.

• Bitcoin (BTC, Tech/Adoption Grade “A-”) has now dropped below its 21-day moving average, opening the gates for short-term bearish action.

• Ethereum (ETH, Tech/Adoption Grade “A-”) has failed to push higher, as the bears hold the upper hand.

The current correction in the cryptocurrency market is proving to have more legs than we originally thought, as prices are dropping across the board today.

We’re here to tell you that this is actually a good thing.

We’ve mentioned many times that 20%, 30% and 40% retracements are typical for cryptocurrencies. This week’s correction, at least for Bitcoin, has only been about 20% from top to bottom.

Using those parameters, we can estimate targets for further downside. This retracement is pushing past 20%, and it may very well extend to 30%. That would be right around $40,000 for Bitcoin. If BTC were to fall to $40,000, it would be an excellent buying opportunity.

As we’ve also discussed, recoveries tend to be swift, and opportunities to buy at “the bottom” are short-lived. At the same time, we’re in a long-term bull market for Bitcoin and crypto; corrections of any magnitude are temporary.

Now, looking at a daily chart, the important change to note is that Bitcoin has indeed fallen below its 21-day moving average. This suggests there may be more room to fall. Important levels to watch are $45,000 and that 30% retracement to $40,000. Expect some volatility between now and Monday.

Here’s BTC in U.S. dollar terms via Coinbase:

Ether has not had a good week. After falling below its 21-day moving average on Tuesday, it’s continued dropping without even testing upside resistance.

The next support level is the previous bull-market high around $1,400. A drop below that level would be a bearish signal for ETH and might lead to a few weeks, perhaps a couple months, of sideways trading before the No. 2 crypto resumes the macrotrend higher. All eyes are on $1,400.

Here’s ETH in U.S. dollar terms via Coinbase:

Here’s my colleague Sam Blumenfeld with the weekly overview of action in the Weiss Crypto Indexes …

Index Roundup

The cryptocurrency market continued its correction from all-time highs, but there were clear winners and losers.

Bitcoin is hovering around $47,000, but it fared far better than many of the mid-sized altcoins. Ethereum keeps bouncing off of the $1,500 price level, and it continues to act as an important trading pair for DeFi tokens.

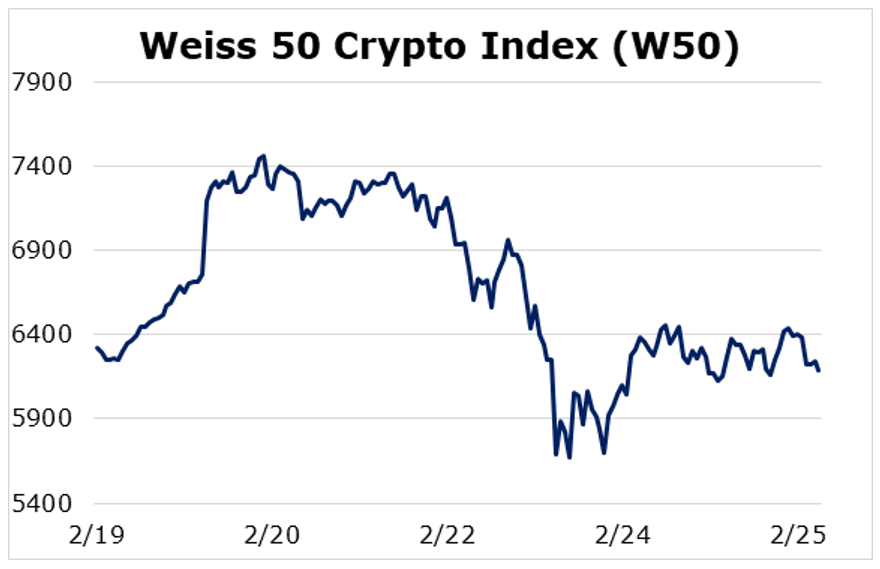

The Weiss 50 Crypto Index (W50) shed 2%, as the broader market traded relatively flat despite spikes of volatility.

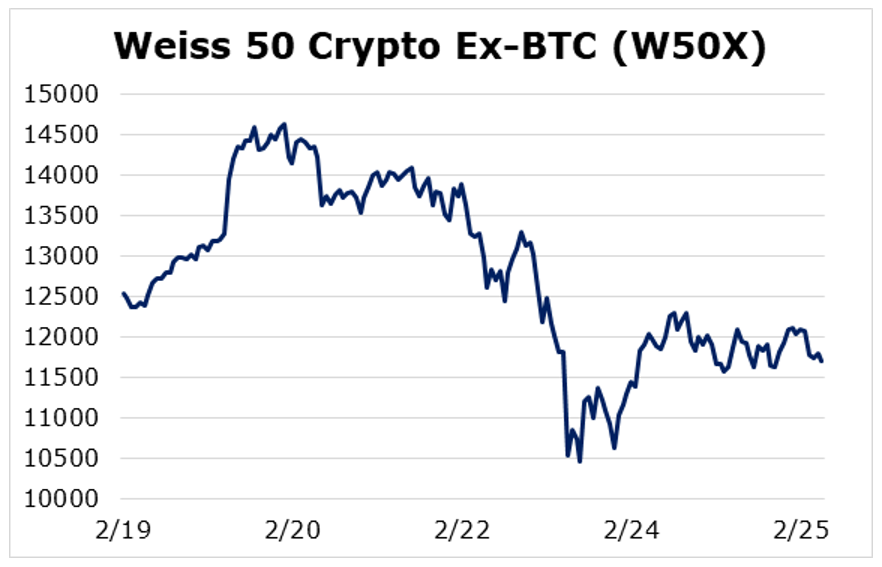

The Weiss 50 Ex-BTC Index (W50X) lost 6.67%. Bitcoin slightly underperformed altcoins this week, but this is normal during altcoin season because it’s used as a trading pair.

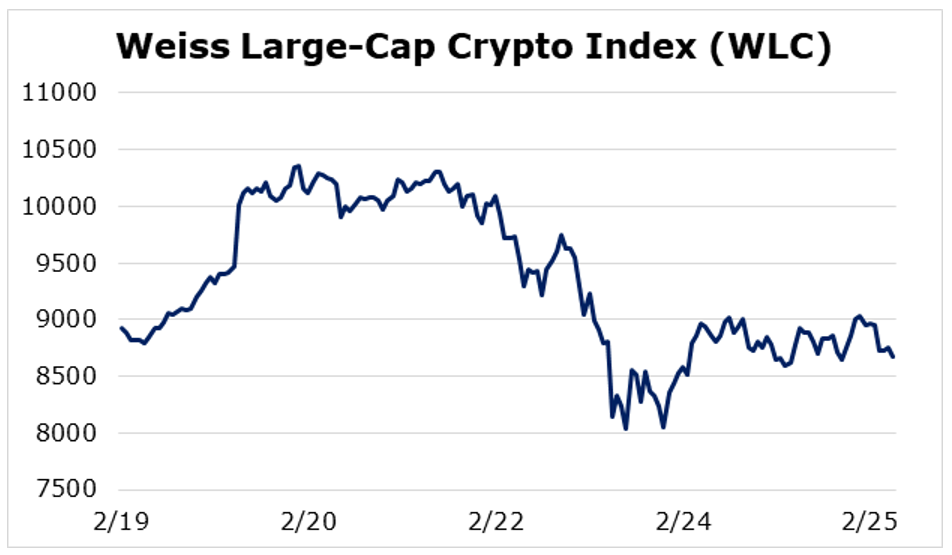

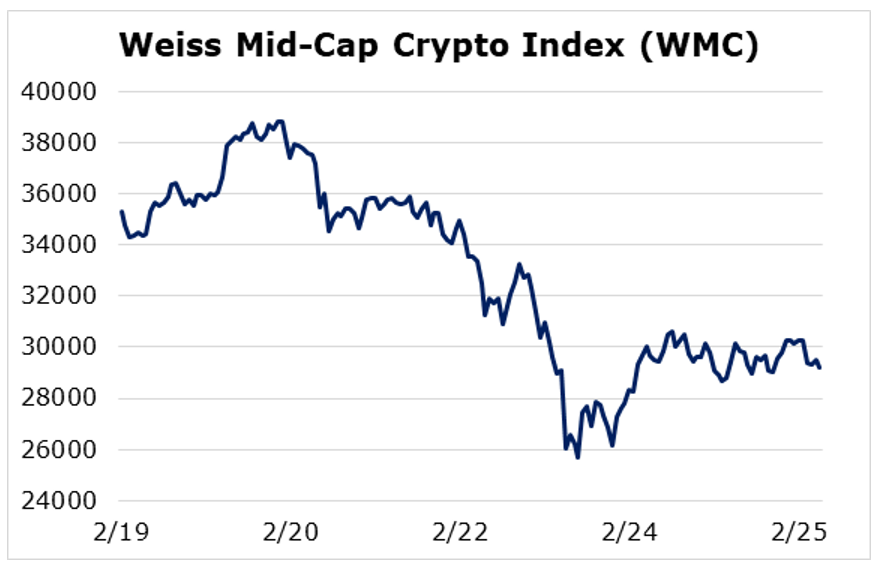

Breaking down this week’s performance by market capitalization, we saw large- and small-cap cryptocurrencies moved very little. The mid-caps struggled much more than their counterparts.

This Weiss Large-Cap Crypto Index (WLC) peeled 2.75%.

Mid-cap cryptocurrencies had a tough week, as the Weiss Mid-Cap Crypto Index (WMC) dropped 17.28%.

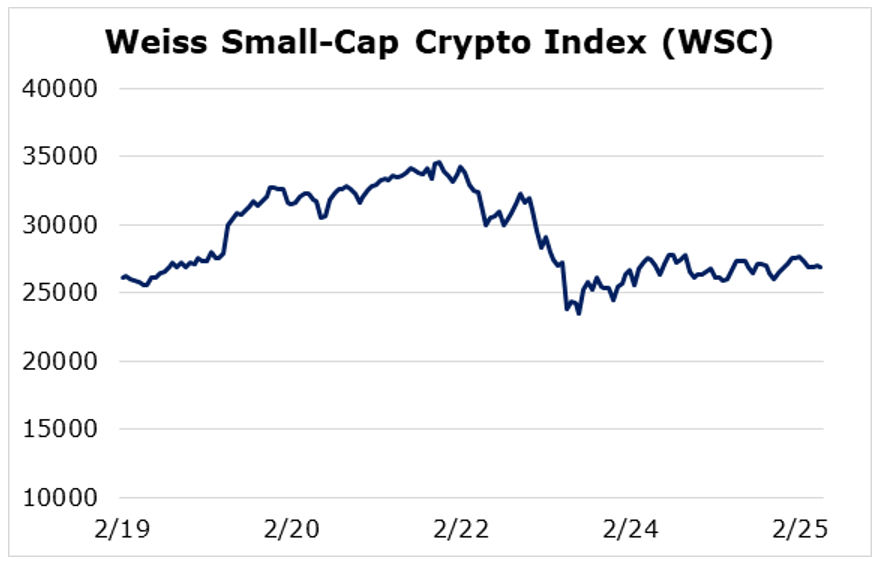

The small caps were the only gainers this week. The Weiss Small-Cap Crypto Index (WSC) rose a modest 2.87%.

This week saw mid-cap altcoins largely underperform the rest of the crypto market, but there were still a few big winners. Remember, corrections are expected and inevitable in the crypto space.

What matters most are fundamentals and macroeconomic activity. Amid growing fears of rising inflation, a rapidly maturing crypto industry is sure to attract more attention from investors wary of leakage and inefficiency in the old-school financial system.

Notable News, Notes and Tweets

• Elon Musk is rumored to be under investigation by the Securities and Exchange Commission over his tweets, again, this time for touting the popular meme coin Dogecoin (DOGE, Tech/Adoption Grade “C+”).

• Anthony Pompliano corrects Henry Blodget’s CNBC hot-take on Bitcoin.

• A few days ago, MicroStrategy Inc. (Nasdaq: MSTR) CEO Michael Saylor noted the possibility that Bitcoin could eclipse gold in market capitalization on its way to becoming a $100 trillion asset, and Pomp explains that Bitcoin would eat away at other assets in its path.

• Although crypto prices may be sinking, it's probably not a good idea to short Bitcoin right now.

What’s Next

At this point, this week has taught us plenty about the inherent volatility of the cryptocurrency market.

Parabolic price runs come hand in hand with swift corrections. It’s much, much easier to swing-trade crypto markets as medium-term momentum shifts between the bulls and the bears than to day-trade them. If you strategize properly, cryptocurrency’s volatility can work to your advantage.

That being said, it’s obviously anybody’s guess as to where prices will go in the short term. Any insider can tell you the market’s direction over the course of five or 10 years. Guessing the direction over the next five or 10 hours is a whole other ball game.

What you can do as an investor is prepare yourself for what might come. In this case, that means readying for a potential drop of another 10% to 20% in Bitcoin and the overall market. Bear in mind, of course, that we’ve also forecast that the crypto market has much room on the upside over the course of the next 12 to 18 months.

In this context, a potential drop of 10% to 20% from here should be treated as a potential buying opportunity.

It will surely be interesting to see where the market goes in the short term. But it’s nowhere near as exciting as where things are going in the long run.

Best,

Alex