Have you seen the latest on oil? It’s like we’re getting a bunch of green flags for higher prices.

Let’s start with the fact that U.S. oil stockpiles fell to 415.6 million barrels. Not only is that the lowest level since 2014 … but it’s just barely enough to cover 21 days of U.S. oil demand.

And this is despite the fact that U.S. crude-oil production rose to its highest since mid-April of 2020.

It. Just. Isn’t. Enough!

You better be ready for what comes next because you can either be left in the dust or be off to the races.

I’ve been pounding the table about America’s looming energy crisis in columns like Stop Fighting the Last War & Win the Next One and Energy Pulls Back, but Not for Long.

Now, let me show you the latest charts …

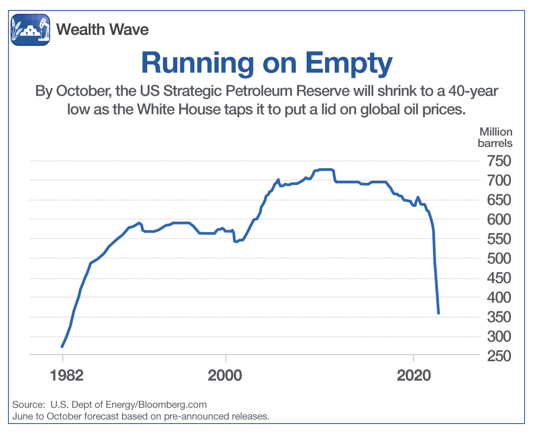

No. 1: Strategic Petroleum Reserve Is Emptying Fast

Over the past two weeks, the U.S. government injected 13.7 million barrels from the Strategic Petroleum Reserve into the market. And yet commercial oil stockpiles still fell 3 million barrels over the period.

Even worse, with the oil we’ve already pumped out of the SPR and future releases already announced, this is what the SPR looks like through October:

Would you consider America’s current energy situation an emergency?

I wouldn’t — prices are high, but accounting for inflation, we’ve seen higher. So, what happens when there’s a REAL emergency?

While you ponder that, I have another chart to show you …

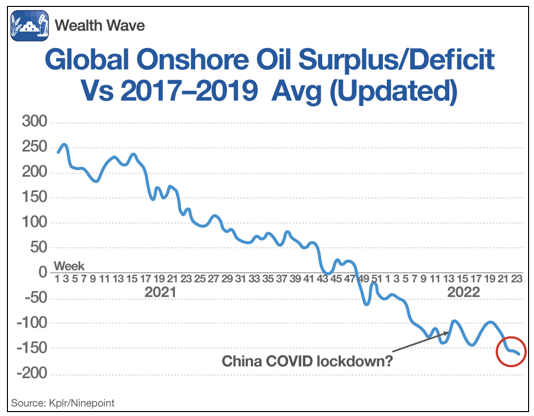

No. 2: The World Is in a Massive Oil Deficit

I’m updating a chart I showed you on June 25, because it’s gotten even more dire!

Not only does the world have a lot less oil available compared with the 2017–19 average … it keeps going down.

This despite U.S. oil production hitting a post-pandemic high, climbing by 100,000 barrels a day to 12.1 million barrels a day, according to the Energy Information Administration. And this also despite OPEC+ raising its production quotas month after month.

This all makes me more bullish.

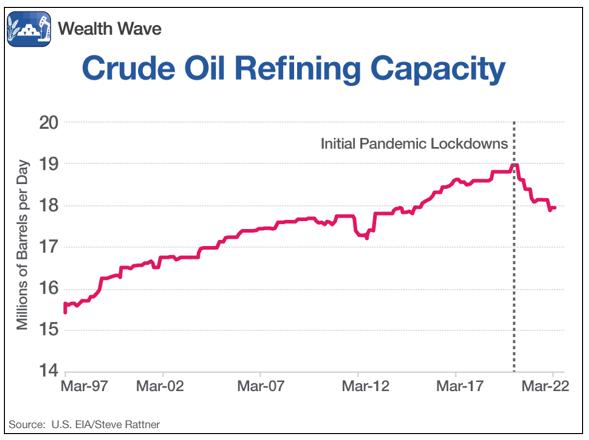

No. 3: A Squeeze in Refining Capacity

With sky-high prices at the pump, surely refiners are producing more gasoline, right?

Yeah, about that … look at this chart that Wall Street economic analyst Steve Rattner made using data from the EIA and weep:

U.S. refining capacity fell by 5.4% (or 1.03 million bpd) to 17.9 million bpd last year since it peaked in 2019 at 18.98 million bpd. This is because companies shut down marginal refiners during the pandemic and are in no hurry to reopen them.

What’s more, the EIA estimates U.S. refinery output will average 16.7 million bpd during Q2 and Q3 of 2022. That’s not going in the right direction!

Meanwhile, across the country, the average price of gasoline is down for three weeks in a row. Americans are breathing a sigh of relief. Enjoy the lower prices … they probably won’t last long.

I’m not saying America will run out of oil in 21 days. I’m saying that our oil reserves are so danged low, in a real emergency, we could run smack head-on into a wall built out of empty oil barrels.

And that means even in a nonemergency but a worrying time — like now — low oil reserves and a good ol’ fashioned supply-demand squeeze could send oil prices much higher than you might think possible.

Members of my Wealth Megatrends are positioned to benefit from higher oil prices. They’re currently sitting on nice open gains of 69% and 29% in two Big Oil stocks.

But if you’d like another idea, I have one for you ...

I’ve mentioned the Energy Select Sector SPDR Fund (XLE) as an effective way to gain exposure for the next upswing. But consider drilling down to the individual stocks in the XLE.

The best ones are not only oil producers; they’re dividend-payers that dwarf the yield of the S&P 500. And rising oil prices are giving producers the free cash flow to raise those dividends much higher.

No matter what you decide, always do your own due diligence.

Best wishes,

Sean