Energy stocks were the talk of the town but they’re finally taking a breather. After their extended climb since the end of 2020, it was about time for a correction.

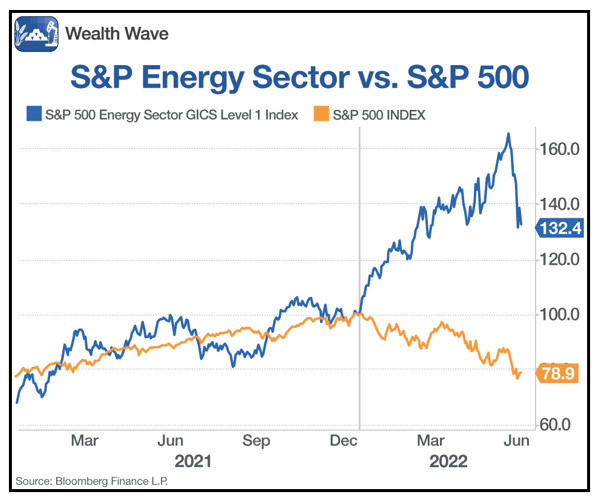

The S&P Energy Sector recently topped out with a 65% gain from the beginning of the year but it sharply pulled back since then.

However, even after losing half of its year-to-date gains since the pullback began, the energy sector is still one of the safer bets during periods of high inflation.

It easily outperforms the broader S&P 500 index despite the recent slide, and the following chart shows the divergence since the beginning of the year.

Oil companies are raking in cash thanks to elevated energy prices. Just look at Exxon Mobil (XOM), which recorded nearly $15 billion in free cash flow in the first quarter.

The oil and gas industry as a whole is expected to bring in $4 trillion in revenue this year, which dwarfs the $1.5 trillion average over the last five years.

Oil companies make more money when prices are higher, and there are several factors that should pressure them over the summer. We may see the short-term correction continue for now, but oil producers could have the last laugh.

Supply should remain tight, and Chinese demand is rebounding after lockdowns were lifted in Shanghai.

With Europe swearing off Russian oil because of the war in Ukraine, someone must pick up the slack. The U.S. and other Western producers are at their limit. Without help from OPEC, relief could be limited.

How You Can Play This

In this inflationary environment, energy stocks have become a stable of cash cows, producing buckets of money for investors.

I’ve told you how inflation is driving a shift from growth to value stocks. It’s one of the major reasons for the performance disparity between the S&P Energy Sector and the broader S&P 500 index.

The energy sector was certainly due for a correction, but I suspect it still has a lot of gas left in the tank.

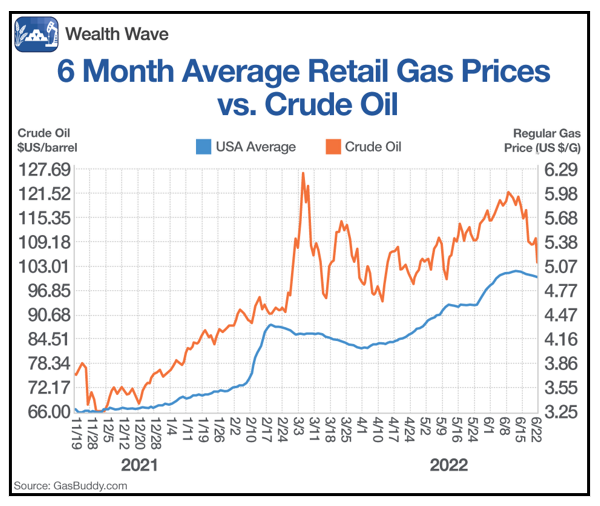

Speaking of gas in the tank, consumers won’t necessarily see immediate relief at the pump.

Prices have tapered off slightly during the correction but not on the same scale as oil’s pullback.

Why is that? Pricing power.

When oil falls, the gap widens between retail and wholesale prices.

In the comparison between crude oil and retail gas prices shown below, we see that gasoline prices have hardly moved in relation to oil’s larger slide.

Demand for gasoline is still high, so operators are able to get away with keeping their elevated prices despite lower wholesale costs.

A similar situation happened in March, when West Texas Intermediate crude prices pulled back 28% over a multi-week period from $130 per barrel to $93. Instead of sharply falling with oil prices, retail gas prices held resiliently.

Energy stocks are pulling back for now, but I don’t expect the trend to sustain over the medium or long-term.

That’s something I’ve made Members of my service Resource Trader aware of for some time now. As a result, the recommended portfolio is seeing outsized gains in oil and energy.

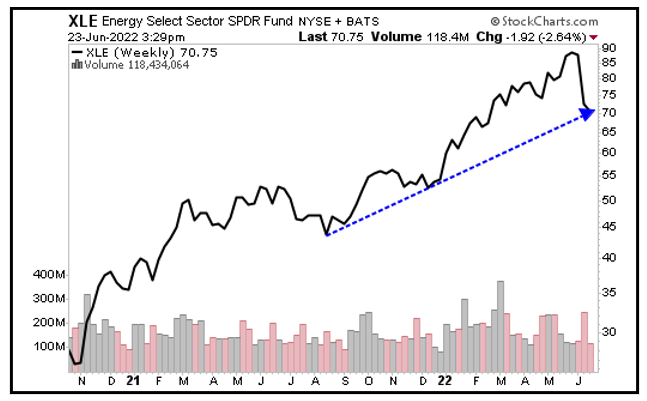

One energy exchange-traded fund to keep an eye on is the Energy Select Sector SPDR Fund (XLE). I’ve mentioned it before, but it could be an effective way to gain exposure for the next upswing.

As a refresher, the fund tracks the energy sector within the S&P 500. Three of its top holdings include Exxon Mobil (XOM), Chevron (CVX) and ConocoPhillips (COP), which account for 49.62% of its holding by weight.

XLE manages $33.7 billion in assets, and its expense ratio is a minor 0.1%. It trades with significant liquidity, averaging about 35 million shares traded per day.

Looking at XLE’s weekly chart, we see that it’s corrected after an extended period of strong performance:

The fund looks ready to bounce off of its positive trendline. Despite the correction, the ETF has seen year-to-date gains of 25.11%.

Considering the strong bullish forces primed to push prices higher after this correction, it could be a nice opportunity to enter at a discount.

As always, conduct your own due diligence before entering any trade.

All the best,

Sean