Inflation is beginning to cool down, but there’s another issue on the horizon that could significantly impact consumers.

I’m talking about a potential recession, which could cause more corporate layoffs and stifle consumer spending. Wall Street has been pricing in an early 2023 recession for some time, and the big banks are preparing for tough sledding.

Wall Street banks kicked off earnings season last week. Their results varied, but Wells Fargo (WFC) and Citigroup (C) posted profit declines of 50% and 21%, respectively. Investors look at major bank earnings because they act as a barometer for the broader economy’s health.

Most big banks beat earnings estimates because of greater interest income from higher rates, but they increased their provisions for credit losses in preparation for a weaker economy moving forward.

Delinquencies and defaults are still low, but layoffs could broaden the economic risks. With inflation running hot over the past two years, consumers are already strapped thin.

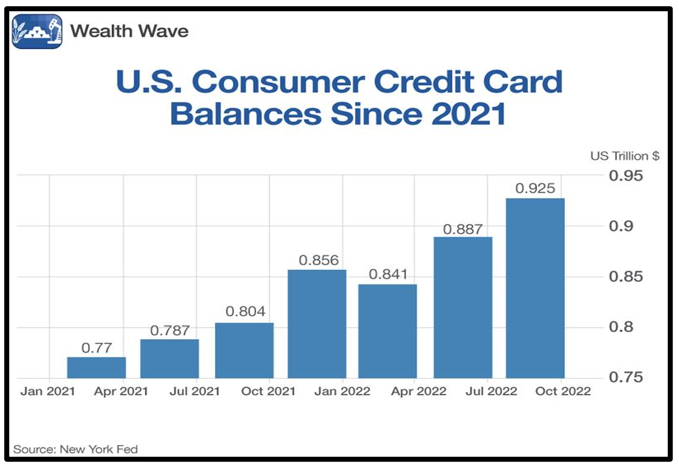

Just look at U.S. credit card balances. Since the beginning of 2021, total balances rose from $770 billion to $925 billion as prices soared.

Click here to view full-sized image.

U.S. consumer credit card balances jumped 15% in Q3, which was the fastest jump in two decades. It doesn’t help that interest rates are higher on these balances after the Fed’s rate hikes.

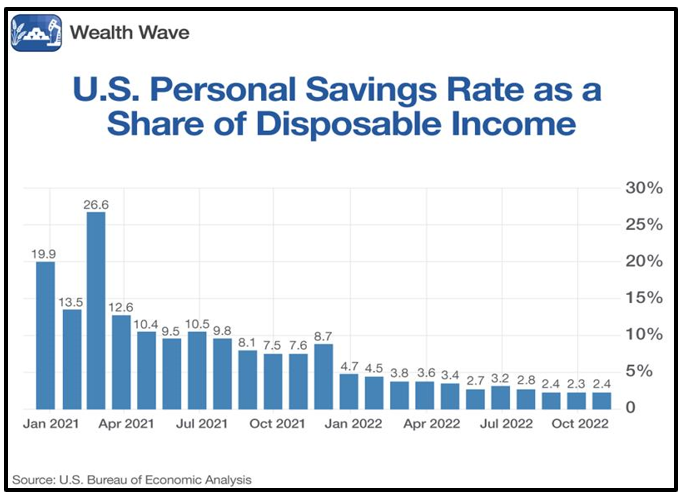

Now consider the U.S. personal savings rate, which has plummeted. Since the beginning of last year, the U.S. personal savings rate as a portion of disposable income fell from about 20% to 2%.

Click here to view full-sized image.

That leaves a much smaller buffer in case people lose their jobs. The broader economy would take a hit as consumers cut back, but some stocks will be more resilient than others.

I’ve talked about targeting sectors such as healthcare and utilities to cushion against a slowdown, and another recession-resistant sector is consumer staples. These companies sell the necessities that consumers buy no matter what.

The consumer staples sector is one of the two sectors that average positive returns during recessions, with the other being healthcare. The sector should see more capital inflows if the economy takes a turn for the worse.

How to Play the Trend

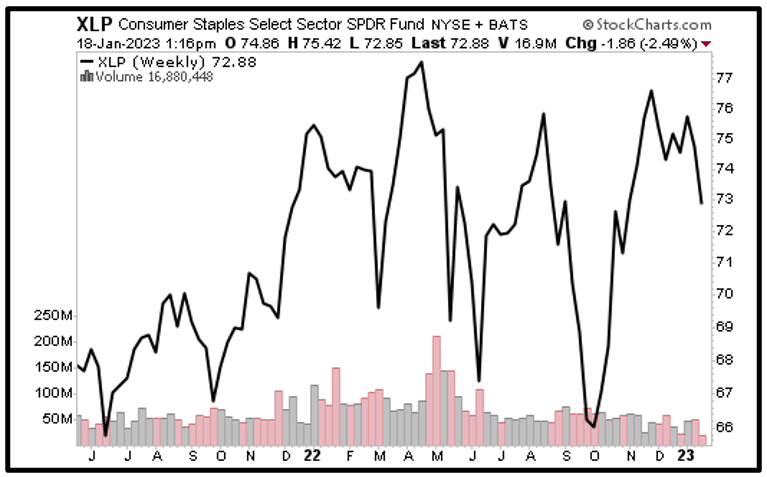

One ETF that should benefit from a consumer staples uptrend is the Consumer Staples Select Sector SPDR Fund (XLP).

The fund tracks the movement of the consumer staples sector within the S&P 500, covering the food and beverage, household product, personal product and tobacco industries.

Out of XLP’s 34 holdings, its top three positions are Procter & Gamble (PG), PepsiCo (PEP) and Coca-Cola (KO). They account for about 36% of the fund’s $17 billion in net assets.

XLP is extremely liquid, averaging daily trading volume of about 9.5 million shares. Its expense ratio is a minimal 0.1% while its dividend recently yielded 2.5%. That’s well above the S&P 500, which only yields 1.67%.

Looking at XLP’s chart, we see that the fund ran into overhead resistance between $75 and $76 per share.

Click here to view full-sized image.

The pullback could offer an opportunity to invest in a sector with positive tailwinds at a discount. I expect XLP to stabilize and outperform as investors further price in recessionary risks. And that generous dividend pays you to wait.

Make sure to conduct your own due diligence before entering any trade, but it could help to position your portfolio into sectors with a history of outperforming during periods of turbulence.

That’s it for today. I’ll be back with more for you real soon.

All the best,

Sean

P.S. If you haven’t yet joined my Supercycle Investor service, now would be the perfect time to do so. In fact, members are currently sitting pretty on open gains of 30%, 7% and 6%!