It's no secret interest rates are rising. The Federal Reserved raised rates by 50 basis points this month, and another two 50-basis-point hikes are expected in June and July.

In fact, the market is pricing in a 91% chance that the Fed raises rates by half of a percentage point in June and a 78% chance of the same happening in July.

Notably, the market sees zero possibility of a smaller hike in either meeting!

Investors Are Responding

While growth companies with higher multiples are struggling as discount rates move higher, value stocks are much more resilient.

It's why we've seen the continued shift from growth to value that I've been talking about for months.

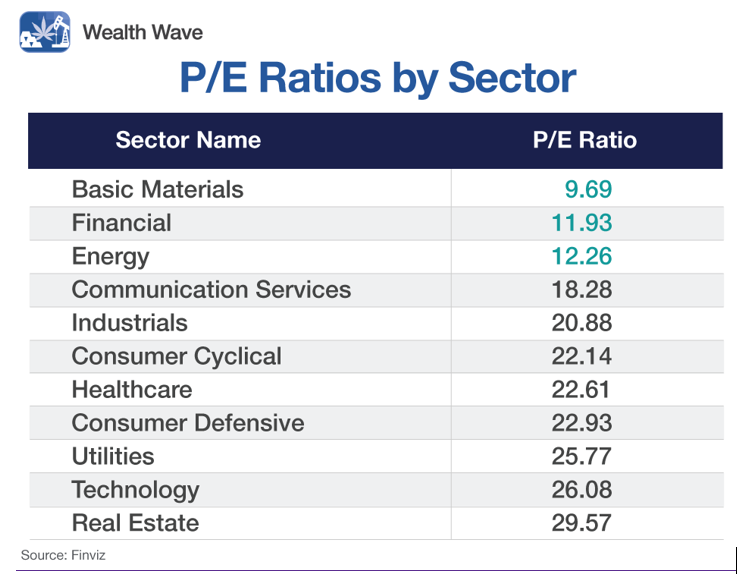

The financial sector is packed with value stocks. Financials have the second lowest price-to-earnings (P/E) ratio of any of the 11 Global Industry Classification Standard (GICS) stock market sectors, making it one of the most resistant to valuation crunches during periods of higher inflation.

The following chart compares the P/E ratios of each stock market sector:

Big banks love it when interest rates move higher because their margins expand. With low rates, banks have a lower spread between their borrowing costs and the interest they charge when issuing loans.

Simply put, the higher the interest rates, the more pricing wiggle room for banks.

Rising interest rates aren't all the banks have going for them. The underlying economy is strong, highlighted by historically low unemployment. The current unemployment rate of 3.6% is well below the Fed's general target of 5%.

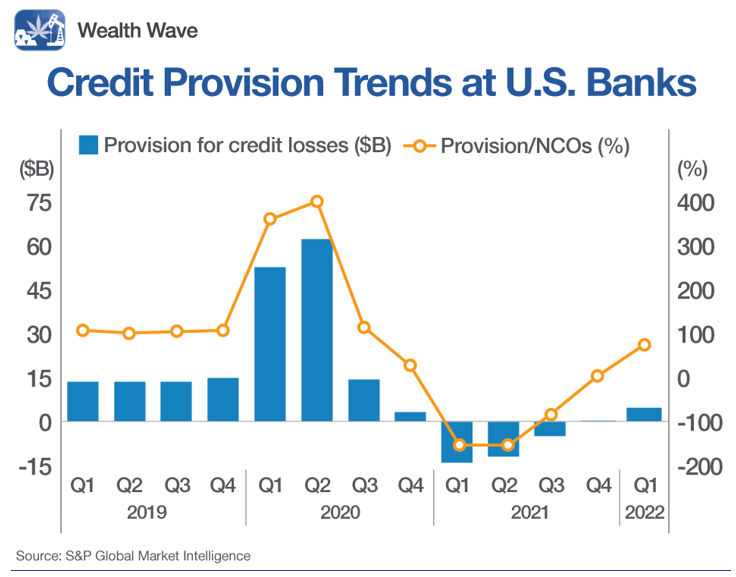

Loan loss provisions are still low despite an uptick last quarter. The pandemic saw provisions for credit losses explode due to fears of defaults, but a wave of fiscal stimulus pushed them into negative territory.

Even though stimulus measures are over and conditions are tightening, loan loss provisions are well below pre-pandemic levels through Q1. That speaks to an adapting economy, which is beneficial for banks.

Low credit loss provisions drive up profitability because less people are defaulting on their loans. When banks have less loan write downs, net income improves.

Big Banking Boom

I expect bank stocks to outperform during the coming period of higher interest rates, and one of my top picks is the Financial Select Sector Fund (XLF).

This exchange-traded fund (ETF) offers diversified exposure to the financials sector while concentrating on the major players. It looks to mirror the representation of that sector of the S&P 500, with a 98.72% weighted towards financials.

That's evidenced by three of XLF's top four holdings:

Together, these three major banks make up over 20% of the fund. Other holdings include Charles Schwab (SCHW), Morgan Stanley (MS) and Goldman Sachs (GS).

XLF trades with a tremendously liquid average volume of over 75 million shares, and it manages over $34 billion in assets. Its expense ratio is a minimal 0.10%.

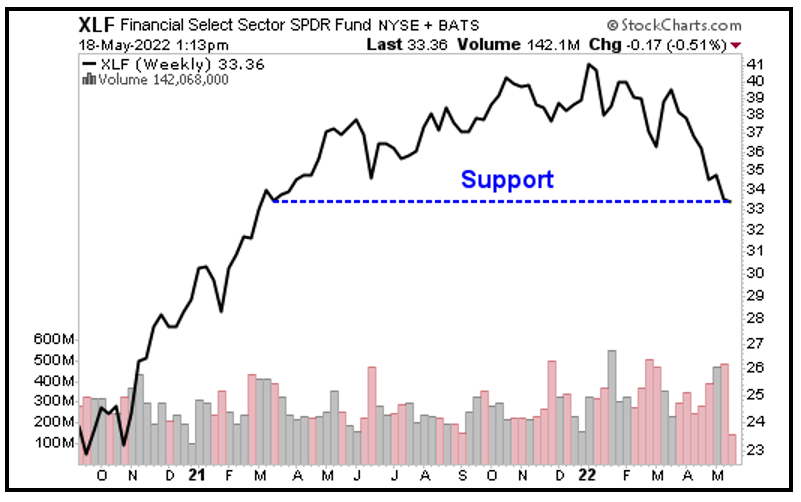

Looking at XLF's weekly chart, we see that financials were caught in the crossfire of the recent market-wide pullback. When prices stabilize, I expect these stocks to get a boost from higher margins.

For now, the strongest banks appear to be trading at a nice discount. I'm looking for a strong bounce off support in the $33 area.

For individual picks in that sector, check out my Wealth Megatrends service. Members are currently sitting on open gains of +92%, +45% and +27%.

As always, do your own due diligence. But these stocks could make a nice run as the market regains its footing.

All the best,

Sean