The market is at a crisis point.

As often happens, crisis also brings opportunity. In this case, the opportunity is for you to make barrels of profits.

I’ll explain how. First, some background.

The market went on a wild rollercoaster the past couple weeks. It soared during the Santa Claus rally. That runs from Dec. 27 to Jan. 4, and the S&P 500 racked up a 1.9% gain.

- That’s the best Santa Claus Rally since 2012-13.

But the wild ride ended in tears on Wednesday when the minutes of last month’s Federal Open Market Committee (FOMC) meeting came out. The market perceived them as hawkish. The fat cats on Wall Street were particularly panicked by this line:

Some participants also noted that it could be appropriate to begin to reduce the size of the Federal Reserve’s balance sheet relatively soon after beginning to raise the federal funds rate.

To me, that’s not particularly scary.

The Fed has been telegraphing rate hikes for a while. But oh, the panic it caused, especially in tech stocks without any earnings!

Why?

- Wall Street’s fat cats have gotten too used to buying stocks with “free” money.

- And it hurt stocks without earnings because they must borrow money to keep their businesses running. As interest rates rise, their cost of doing business will go up.

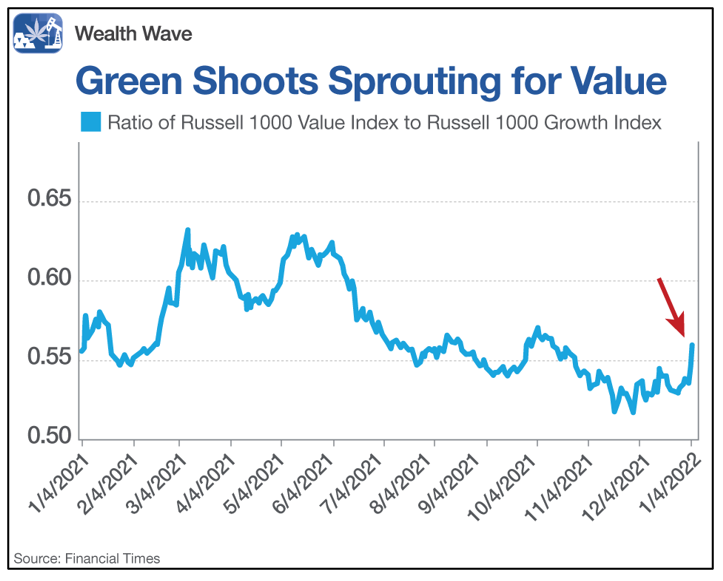

That triggered a stampede out of growth stocks (stocks without earnings) and a move into value stocks (stocks with earnings and often dividends).

This chart demonstrates just that:

What’s this all mean?

- We are just beginning to see value outperform growth. And this comes after growth has outperformed value for more than a decade.

You know I trade megatrends. A market shift from growth to value — or vice versa — can be a really big trend. The amounts of money are enormous … trillions of dollars. And it can play out for years.

So, when does it stop?

Heck, it can go a lot longer and cause a lot more pain in no-earnings growth stocks than you imagine.

- The Nasdaq-100 just had its worst week in nearly a year.

But that ain’t the end of it. There are high-flying tech stocks today that will probably go to ZERO before this thing is over.

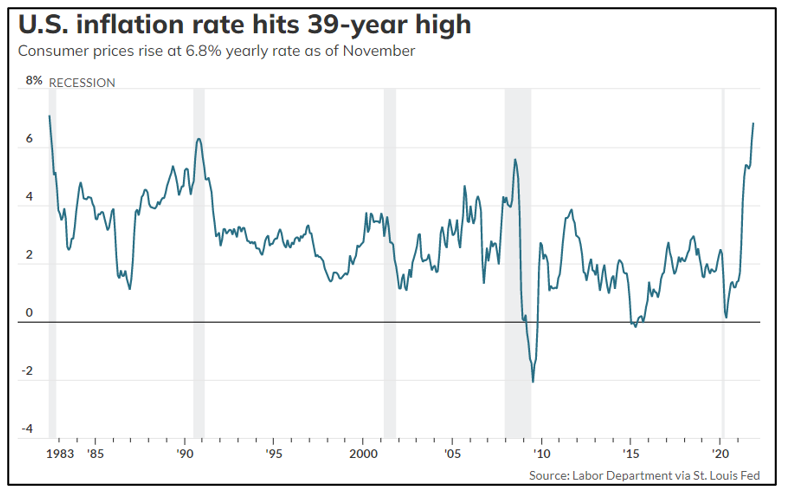

So WHY is the Fed changing its tone about raising the funds rate?

- Because inflation is at a 39-year high.

The Fed and the White House see inflation as a threat to prosperity. They are giving signs that they are determined to stop — or at least slow — inflation, even if it causes short-term market pain.

As the old saying goes, “the beatings will continue until morale improves.”

The thing is, I don’t think inflation is done with us. As I explained in my column back on Nov. 13, it’s likely that we’ll see inflation hit more than 20% before this is all over.

So, as an investor …

- You want stocks that do well in inflationary times and are ALSO value stocks.

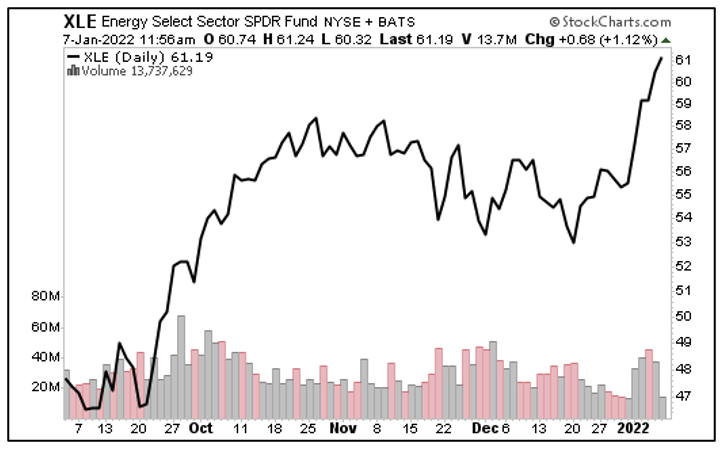

And history shows us that a broad index of energy commodities — including oil and natural gas — are the best performers in inflationary times.

- More good news: Many energy stocks are VALUE stocks.

Now, you can do the hard work of finding individual names. Or you could just buy the Energy Select Sector SPDR Fund (NYSE: XLE).

Hey, despite the recent market turmoil, guess what? The XLE just hit a 52-week high!

Almost as if the market is doing what I said: rotating from growth into value AND preparing for more inflation.

I’ve already recommended a trio of energy stocks to my Wealth Megatrends subscribers. I’ll be recommending more stocks to ride the inflation and growth waves soon.

If you’re doing this on your own, be careful. It’s a tough market. But you can also profit while Wall Street panics.

Best wishes,

Sean

P.S. I want to make sure you’re aware of the upcoming NFT Profit Summit, hosted by Dr. Martin Weiss on Jan. 11 at 2 p.m. Eastern.

In it, he will go over some really exciting information happening in the NFT space, and even if you’re not the most crypto savvy person, I think it will be very informational.

For more information, click here now.