Oil is finally waking up after a period of struggling and it’s no wonder why. Despite growing fears of a recession, demand is strong and supply is tight.

I talked about battery-powered electric vehicles displacing oil consumption in the coming years, but countries in Europe are facing a crisis that requires immediate attention.

The war in Ukraine rages on, continuing to wreak havoc on global energy markets as countries contend with sanctions against Russia.

I also recently mentioned OPEC+’s agreement to cut their target oil production by 2 million barrels today, which should translate into an actual reduction of 900,000 barrels per day.

With OPEC+ not cooperating, the U.S. will need to raise its production as Europe requires more oil for winter.

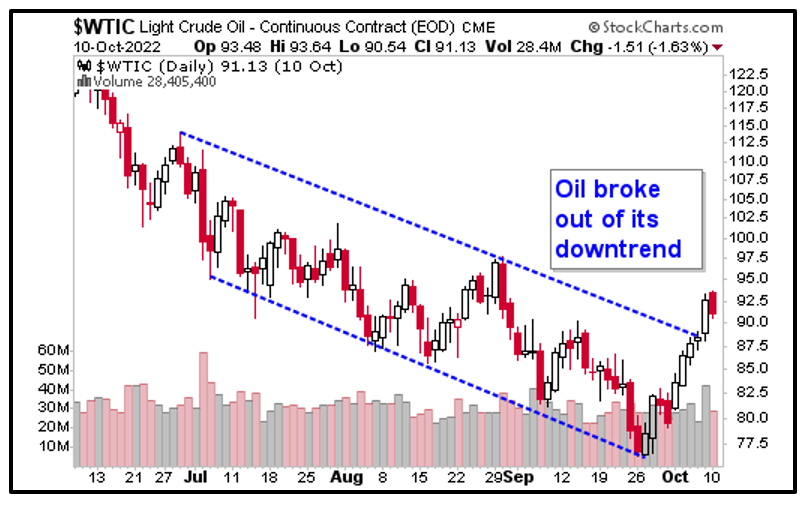

Oil’s chart is looking much better now after breaking out of its several-month downtrend:

Click here to see full-sized image.

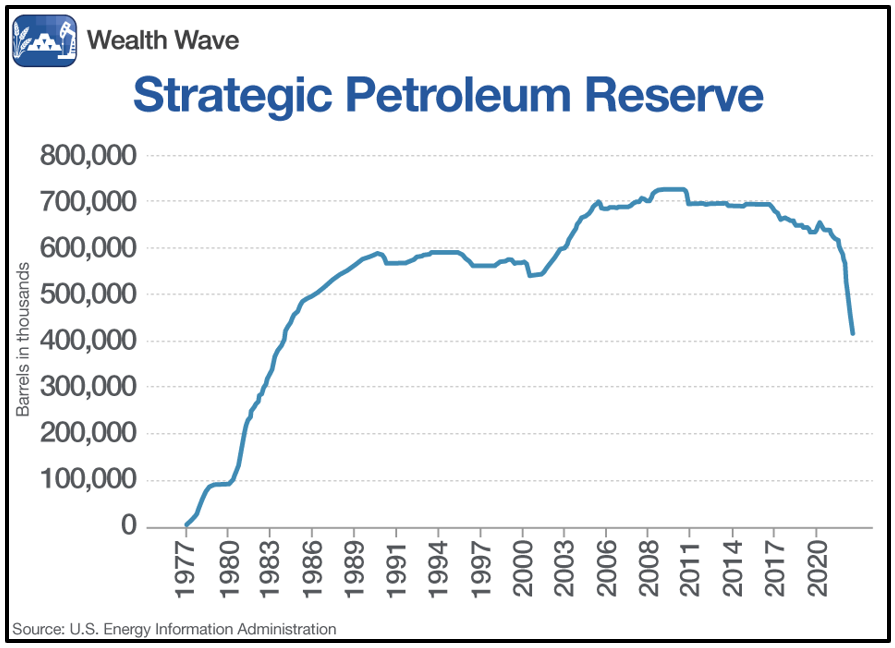

The U.S. plans to mitigate the OPEC+ production cut by releasing more Strategic Petroleum Reserve inventory. The White House already gave the green light to release an additional 10 million barrels next month.

These releases have worked in keeping prices down recently, but it’s just a temporary fix. As it stands, the U.S. SPR currently holds 416 million barrels. That’s 33% lower than a year ago.

The chart below shows the SPR’s depletion to its lowest level since 1984. It reflects the most recent figures released in September:

Click here to see full-sized image.

The U.S. will need to stock up again to improve its energy independence, which should add to global demand that’s already projected to grow 1 million barrels per day despite priced-in recessionary risks.

How Investors Can Play It

I’ve mentioned how the energy sector is historically one of the best places to look during Fed rate hike cycles.

In Wednesday’s Fed meeting minutes, central bank officials doubled down on their willingness to hike and sustain high interest rates until inflation subsides.

With optimism for a pivot dying down, these stocks should continue outperforming.

One fund to look into is the SPDR S&P Oil & Gas Exploration & Production ETF (XOP). XOP tracks a modified equal-weighted index with large-, mid- and small-cap exposure for companies involved in oil exploration, production, refining and marketing.

The fund’s top three holdings are PBF Energy (PBF), Texas Pacific Land Corporation (TPL) and Denbury (DEN), but it also includes bigger names like ConocoPhillips (COP), Marathon Petroleum (MPC) and Valero Energy (VLO).

XOP manages about $4.8 billion in net assets and its expense ratio is 0.35%. It recently yielded 1.4% annually.

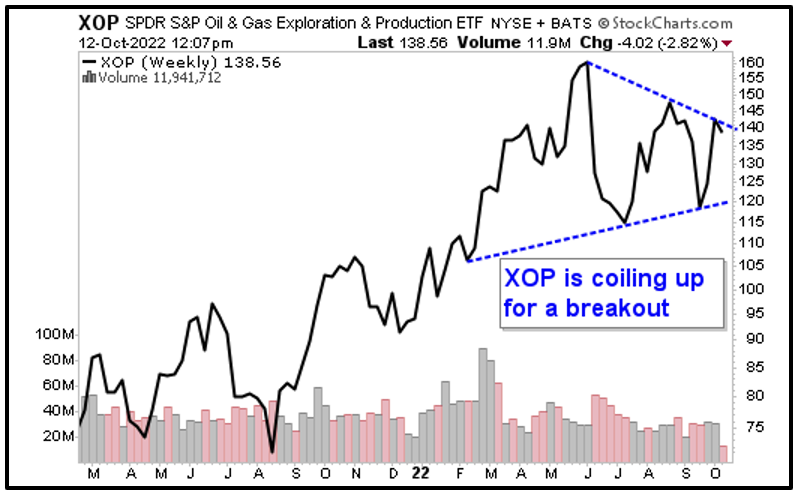

Looking at XOP’s chart, we see that the fund has coiled up since its peak in May:

Click here to see full-sized image.

The S&P 500 is down 25% year to date, while XOP is up 39% so far! I expect the fund to continue showing strength as it benefits from strong positive tailwinds.

Make sure to conduct your own due diligence before entering a position, but with rate hikes continuing while oil builds momentum, it could make sense to add more energy to your portfolio.

All the best,

Sean

P.S. A few weeks ago, Dr. Martin Weiss and a special guest expert who picked the last big bottom showed members how to spot the NEXT big bottom. Find out how by clicking here.