As the market got knocked on its keister in recent weeks by fears about interest rate hikes and a potential recession, one sector remained strong: energy.

Now, we’re seeing oil coil up for its next big move — the next big phase of the energy bull market.

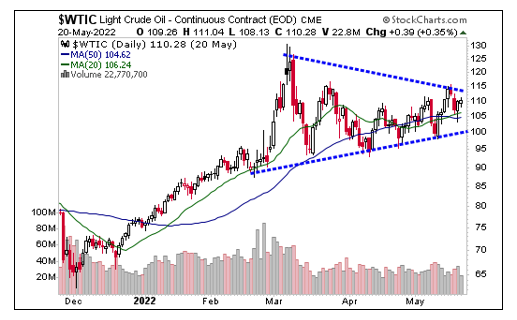

You can see that from this chart of West Texas Intermediate, the U.S. crude oil benchmark, right here …

See how oil is constricting in a tighter range, while making higher lows? A breakout is coming soon. My target remains $138 a barrel. But considering that crude has spent two months building a base, my target may be on the low side.

You can play this with the kind of energy exchange-traded funds (ETFs) I’ve mentioned in articles like this one and this one.

But in this next stage of the bull market, something is changing — and I have just the recommendation for that.

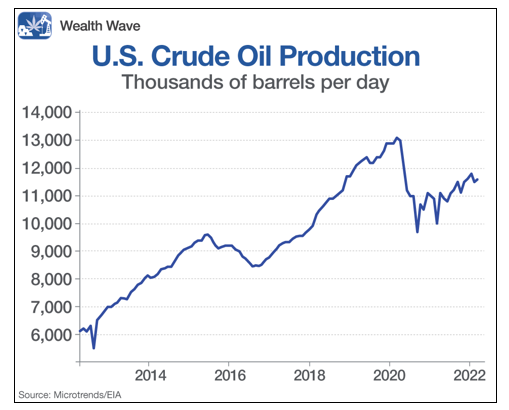

First, let’s look at some facts. U.S. oil production is now at 11.9 million barrels a day. That’s way above the pandemic lows, though still below the peak we hit in 2019.

So, if oil production is up, why are prices so much higher than last year? Because demand is soaring.

The crowd that believes recession is right around the corner wants to ignore this, because it contradicts their beliefs.

That doesn’t mean we won’t have a recession eventually. We always do. But it might take a while. And one of the triggers could be much higher oil prices.

High oil prices mean the major oil companies are raking in cash. In fact, the five biggest Western oil companies reported $39.5 billion in cash flow in the most recent quarter. That’s the highest amount since another oil boom, back in 2008.

And yet, we’ve heard from one oil producer after another that they’re not going to spend more money on drilling new wells this year.

They give reasons for this … mainly that after years of poor returns, they want to return value to shareholders in the form of higher dividends and cash buybacks.

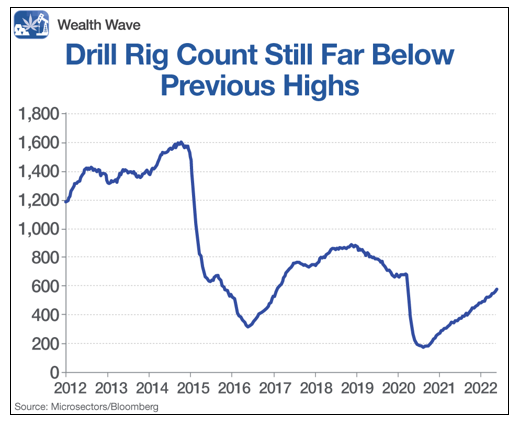

Well, those are the big five. Other, smaller oil companies are starting to drill like crazy. Oil services company Baker Hughes (BKR) keeps a count of drill rigs in the field — and there are now 728 rigs at work in Canada, up 13 in the past week and up 273 in the past year.

That’s the way high oil prices are supposed to work. As prices go higher, oil producers get dollar signs in their eyes and put more rigs to work. Eventually, that leads to higher oil production, which causes the next top.

However … this cycle still has a long way to go. Here’s a longer-term chart of the U.S. rig count …

So, yeah, more drill rigs are back to work. But we’re a long way from a top. The Eagle Ford and Permian Shale Basin are seeing the most new rigs, at least for now.

I don’t have a crystal ball, but here’s an easy one-two prediction …

- Higher for longer oil prices will cause more oil companies to put more rigs back to work.

- U.S. production will approach 13 million barrels per day — last seen in March of 2020 — probably sometime in the next year to 18 months.

So, what happens then? Will more oil production finally provide relief at the pump? Or will prices stay so high, for so long, that combined with other factors, the U.S. slides into recession?

My crystal ball is cloudy on that one. However, it’s not hard to see we’re a long way from a top, and that means you can put more money to work in the oil and gas sector.

Here’s the thing: With so many rigs going back to work, there’s one industry that stands to make a heck of a lot of money: oil services.

After all, they’re the ones with the drill rigs.

And this trend isn’t very difficult to play. There are a bunch of good oil services ETFs.

One of the most popular is the VanEck Oil Services ETF (OIH). Its top holdings include Schlumberger (SLB), Halliburton (HAL) and Baker Hughes (BKR). It has an expense ratio of 0.35%. And it’s channelling higher …

OIH sure looks like it’s going back to test its recent high. From there, I expect a breakout and a rally to $355 a share. That’s a 27% move from recent prices.

The OIH is an easy way to play this move. Or you can drill down into its individual holdings for potentially more return (but also the higher risk that comes with individual stocks).

Energy is a sector that’s benefitting mightily from one megatrend our research and analysis has revealed. To get ongoing insight and guidance around ongoing trend-profit opportunities, consider a risk-free trial to my Wealth Megatrends service. Click here or call our Member Care Team at 855-278-9191 to get access to my Wealth Megatrends for as low as 14 cents a day.

Whatever your investment strategy is, oil prices look ready to blast off, and drill rig counts will go along for the ride.

You might want to go along, too!

All the best,

Sean