Wow, the major indices have taken a pounding in the last couple weeks, eh?

Just since the beginning of the year, the Dow Jones Industrial Average (DJIA) is down about 6% … the S&P 500 has swooned 8.8% … and the Nasdaq Composite has plunged a whopping 13.3%!

You know what? They’re still not cheap enough to buy.

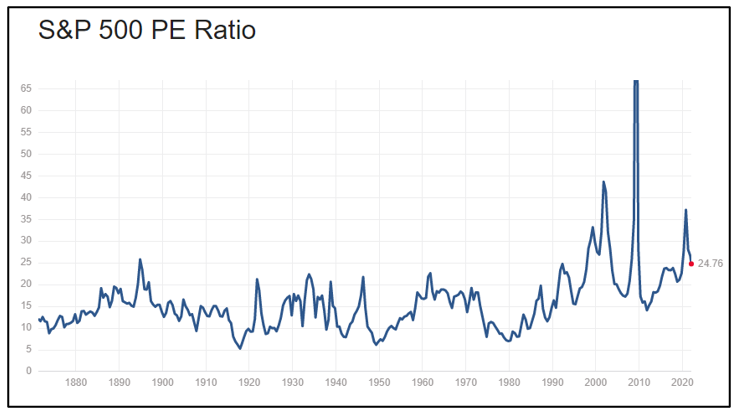

Here, take a look:

Even after the recent sell-off, the S&P 500 still has a trailing price-to-earnings (P/E) multiple of 24.76. The average S&P 500 P/E is historically 13–15.

Now, I’m not predicting where stocks will bottom.

- I can just tell you that the market uses corrections to make expensive stocks cheap. And the major indices are not cheap.

This is partly due to rising inflation and the resulting fear that the U.S. benchmark interest rates will rise a lot. Many of the biggest companies need cheap debt to thrive, and their cost of business is about to go higher.

So, the market sells … and sells … and sells.

- But do you want to know something that is already cheap?

Something that did very well last year, and is probably on the cusp of a big, inflation-fueled bull market?

I’m talking about commodities.

Despite rallying as a group in 2020 and 2021, commodities are still very cheap compared to the S&P 500.

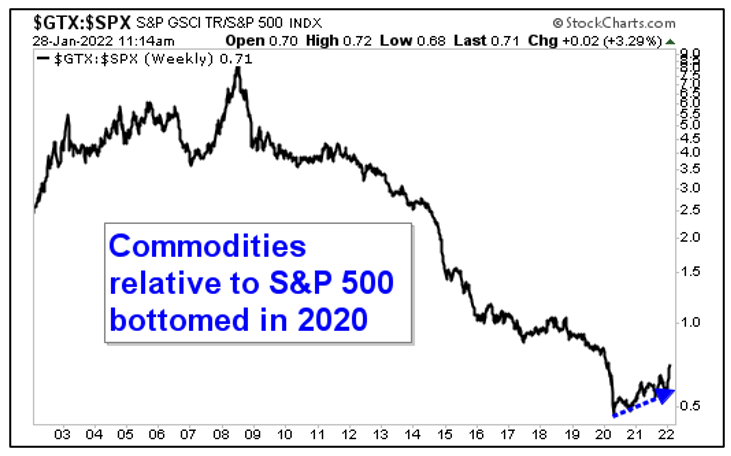

Here’s a chart of the S&P GSCI Index divided by the S&P 500:

The S&P GSCI is a benchmark for the commodity market.

It tracks a basket of 24 of them; it’s weighted by world production and comprises the physical commodities that have active, liquid futures markets.

- And despite a recent rally, you can see that commodities are still on sale.

The S&P GSCI Commodities Index is a basket of the bread-and-butter commodities: wheat, corn and cattle in addition to crude oil, gasoline, natural gas, aluminum, copper, gold, silver and more. In other words …

- All the things that are going up in price as America feels the pinch of 7% inflation.

I last wrote about how cheap commodities are in September. Since then, the bull case has only gotten stronger. Here are some reasons why …

Financial System Risk

I think I’ve made the case that stocks are expensive. The entire financial system is facing stress as interest rates go higher.

Today, Treasurys yield less than 2% while inflation runs at 7%. I made the case on Thursday on how this is bullish for precious metals.

Lack of Exploration

Even though oil prices are hovering around $90 a barrel, companies are NOT increasing production or spending much on exploring for new assets.

The same goes for other commodities, from copper to zinc and more. You can see why companies are wary, though: Parts of China’s economy are in turmoil, boards are demanding more fiscal responsibility and who knows what new COVID-19 variant will come along next.

Outperformance Is Increasing

Let me show you some more charts.

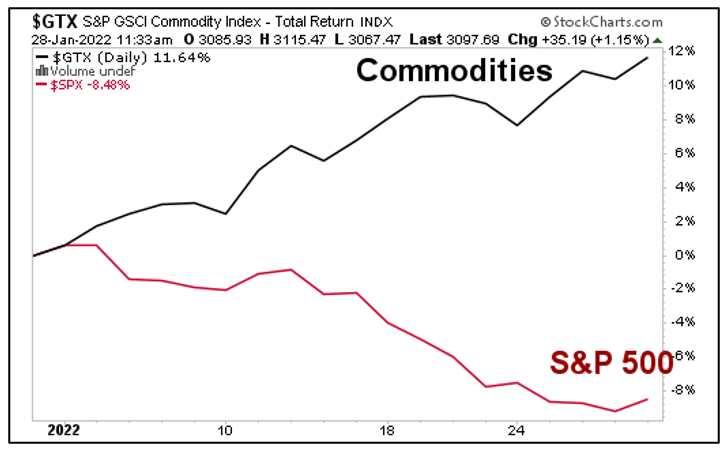

Below is one of the S&P GSCI and the S&P 500 coming out of last year’s pandemic-fueled collapse. They recovered in step until December.

Then, the S&P 500 started to tumble while commodities continued to zigzag higher.

And remember how I said the S&P 500 has lost more than 8% so far this year? Well, at the same time, the S&P GSCI is UP nearly 12%!

Yeah, I’d say commodities are outperforming. To be sure, I don’t expect either of these to move in a straight line.

- But pullbacks in commodities can be bought!

So, how can you play this?

An easy way is the iShares S&P GSCI Commodity-Indexed Trust (NYSE: GSG).

It has an expense ratio of 0.75% and tracks the commodity index I’ve talked about today.

Now, be aware that crude oil, natural gas and other energy commodities make up close to 70% of this fund’s holdings. So, you’re leveraged to oil prices.

But that’s okay.

My Gold & Silver Trader just banked some nice double-digit percentage gains on an oil-leveraged stock this week, and I strongly believe there is a lot more to come.

2022’s big bull is ready. Are you ready to ride?

All the best,

Sean