Today’s idea comes from the ancient forests, and it just happens to be the most profitable export crop in the world that you may very well have consumed this morning.

In fact, it’s the most consumed beverage in the world after water and tea.

- And that makes the coffee business worth looking into for you as an investor.

Back to its ancient roots ... it all began in the forests of the Ethiopian plateau.

According to legend, a goat herder named Kaldi discovered coffee after his herd ate berries from a certain tree and became so energetic … they didn’t want to sleep at night.

Kaldi reported this to the abbot of the local monastery who — after making a drink with the berries (or “beans”) — found it kept him alert through the long hours of evening prayer.

By the 16th century, coffee growing reached Arabia, Persia, Egypt, Syria and Turkey.

Coffee houses — called qahveh khaneh —began to appear in cities across the Near East, and people frequented them for all kinds of social activity.

They became such an important center for the exchange of information, they were called “Schools of the Wise.”

And with thousands of pilgrims visiting the holy city of Mecca every year from all over the world, familiarity with “wine of Araby” spread further. European travelers brought back stories of an odd, dark beverage, and by the 17th century, “Schools of the Wise” had spread across that continent as well.

Coffee soon replaced the common breakfast drinks of the time — beer and wine.

Not surprisingly, the quality of people’s work improved. In fact, many businesses started in these coffee houses. For example, Lloyd's of London, for example, was conceived at Edward Lloyd's Coffee House.

Coming to America

By the mid-1600s, coffee and coffee houses had come to New Amsterdam (later named New York) ... although tea continued to be the favored drink until 1773, when colonists rebelled against a heavy tax imposed by George III.

- The Boston Tea Party permanently shifted Americans’ preference to coffee.

This led to fierce competition to cultivate outside of Arabia, like on the island of Java (Indonesia) and the Caribbean island of Martinique, from which it spread to Central and South America.

By the end of the 18th century, coffee became one of the most profitable export crops in the world. So much so that Thomas Jefferson called it “the favorite drink of the civilized world."

- In fact, after crude oil, coffee is now the most sought-after commodity in the world and the most widely traded of the “breakfast commodities,” which include sugar, cocoa and orange juice.

The number one producer of coffee is Brazil, accounting for almost 60% of total production. As a result, coffee prices — already volatile on a seasonal basis — are significantly impacted by the weather in that country and, to a lesser extent, by the relative value of the Brazilian currency, the real.

The second and third largest coffee-producing countries are Vietnam and Colombia:

- Vietnam primarily makes the robusta variety, with its higher caffeine content.

- Colombia (along with Brazil and other major coffee-producing countries such as Ethiopia) produces the more popular arabica type.

Give Your Portfolio a Jolt

The iPath Series B Bloomberg Coffee Subindex Total Return ETN (ARCX: JO) offers direct exposure to coffee futures.

As with any crop, supply and demand are primary drivers of coffee prices.

- While demand is relatively stable, supply — or perceived future supply — can and does vary greatly.

Good weather and bumper crops can send coffee’s price tumbling, while drought or other natural disasters usually cause it to soar.

It’s not unusual to see coffee futures double … or drop by half over a single year!

As far as coffee-related stocks are concerned, the first one you might think of is Starbucks (Nasdaq: SBUX). The behemoth of a chain has weathered many storms over the decades since its founding in the 1970s.

And where other brands struggled during the pandemic lockdowns, Starbucks — with its “B-” Weiss Rating and dividend yield of 1.61% — was able to stay operational and earn healthy revenues due to its seamless transition to take-out and delivery.

Nevertheless, shares are down about 17% in 2022 ... probably due to governments implementing more severe restrictions in response to the Omicron variant and consumers being more reticent about leaving home for a cup of joe.

The market is anticipating bad news when it reports fiscal 2022 first-quarter earnings today after markets close.

But … if it disappoints the pessimists, this could be the pivot point where the stock begins to turn around.

Another smart play? Keurig Dr. Pepper (Nasdaq: KDP), formed from the acquisition of the Dr. Pepper Snapple Group by Keurig Green Mountain in 2018.

Sales of Keurig’s Green Mountain Coffee have particularly seen great improvement in 2021 since many folks are making more coffee at home.

The company holds a “B+” Weiss rating, and …

- Income investors also enjoy a dividend yield of 2.13%.

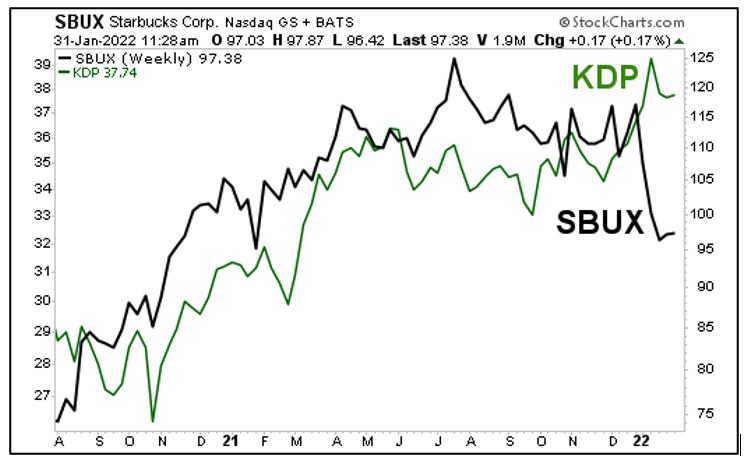

Both stocks have done well over time, but more recently, KDP is outperforming SBUX quite a lot.

This just illustrates that high-flyers can become also-rans quickly. But it also demonstrates that investors can wait for pullbacks before buying.

As always, remember to conduct your own due diligence. But if you find a pick you like, it might just be time to give your portfolio a nice pick-me-up.

All the best,

Sean