We received such positive feedback about our commodity crop roundup issue, that we decided to continue the series.

So, what’s the next commodity on the agenda?

It’s one that most of us love: COCOA ... and the chocolate that’s made from it.

But first, a bit of background on the delicious treat …

The Mayans first cultivated the Theobroma Cacao plant — which literally means “food of the gods” — more than 5,000 years ago for use in a ritual beverage.

In the 15th century, Spain began to acquire cocoa, and by the 17th century, its popularity spread throughout Europe.

Today, cocoa is enjoyed in thousands of different ways.

- And with an annual consumption of over 4.5 million tons, cocoa beans are a major commodity in global markets.

While sugar is a basic nutrient that provides energy to our cells, cacao beans contain potent antioxidants called flavanols, which have been shown to “relax” blood vessels, reduce inflammation and lower cholesterol.

And the darker the chocolate, the more cacao — and flavanols — it contains.

The Sweet Side of Investing

The top cocoa-producing countries are all within 20 degrees of the equator.

In fact …

- Over 60% of global production comes from just a few countries in West Africa, with the Ivory Coast being the largest grower.

There are some notable downsides ...

Prices can experience wide swings due to political and civil unrest. The Ivory Coast, for example, has experienced political corruption and instability since declaring independence in 1960.

And like other crops, cocoa prices are subject to the weather: Cacao pods require the right mix of rain and sun to ripen. Drought or heavy rains can cause the pods to dry out or rot.

Compounding the problem is that cocoa is perishable and can’t be stored for long periods.

And since cocoa is grown in mainly impoverished areas with poor infrastructure and roads, supply disruptions are common.

On the plus side, as emerging economies acquire more wealth, demand for chocolate should grow steadily. And developed economies like the U.S. show no signs of losing their love of the treat.

- In fact, the U.S. is the largest importer of cocoa, taking in 1,330,667 metric tons per year valued at over $5.2 billion.

But the largest draw might be that commodities — like cocoa — offer protection during inflationary periods.

And with the Consumer Price Index (CPI) sitting at 7%, investors would be wise to focus on inflation hedges like commodities … and cocoa.

While you can trade cocoa futures, a better option could be the iPath Bloomberg Cocoa Subindex Total Return ETN (NYSE: NIB).

It’s important to note that the index currently tracks just one futures contract, its expense ratio is 0.70% and it’s thinly traded.

But, looking at the one-year chart, we can see it’s in the midst of a very bullish breakout:

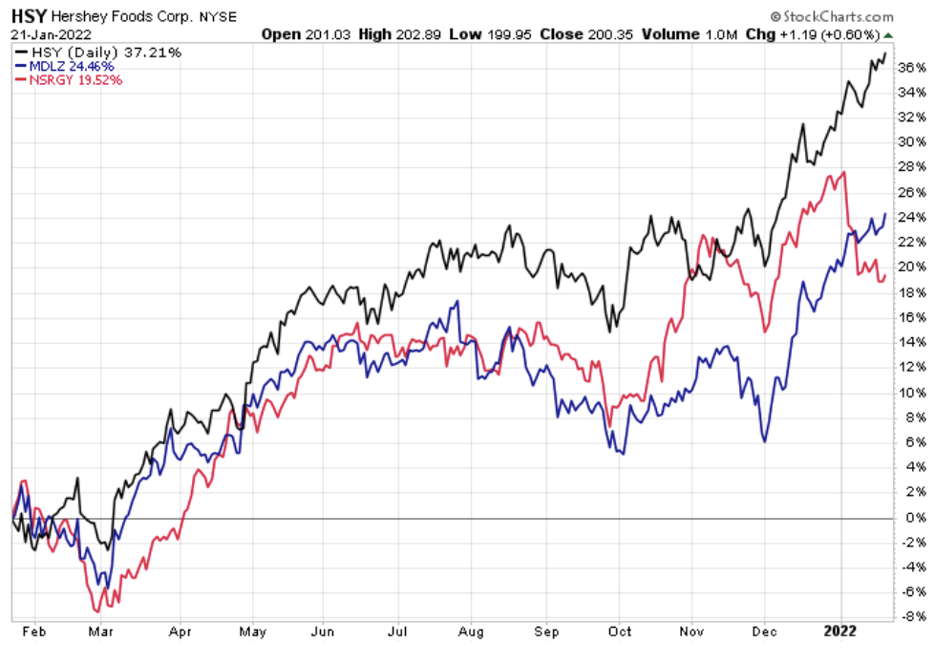

While there are no “pure play” companies engaged in the production and sale of raw cocoa, companies like Hershey (NYSE: HSY) are smart investments with exposure to the sale of the finished product.

Other names include Nestle (OTC: NSRGY) and Mondelez International (Nasdaq: MDLZ), the Kraft Foods spinoff that makes Chips Ahoy, Oreo, Cadbury and other treats.

All three of these companies have done well since inflation has heated up:

Just keep in mind that high cocoa prices impact a company’s bottom line. But that doesn’t seem to be hurting chocolate manufacturers now.

While cocoa prices have risen by more than 8% since December due to high demand and tightening supply (Ivory Coast is sending fewer beans to ports) ... retail sales have been rising by more than 5% per quarter.

Remember to always do your due diligence, but it may be smart to take advantage of any short-term corrections.

Either way, cocoa seems like a sweet play that’s ready to chew down some inflation.

All the best,

Sean

P.S. If you’re interested in megatrend-type investments, I highly encourage you to check out my Wealth Megatrends service.

My subscribers had the opportunity to bank gains of 168%, 77% and 60% in 2021 alone.

I can’t give out recommendations here, but for more information, click here now.