The Market Is Wrong About Inflation and the Fed

On Thursday, the markets panicked about inflation and interest rate hikes. I think the market is wrong, and that opens up an opportunity for savvy investors.

I’m not going to make excuses for Wall Street’s herd of well-heeled weasels, but the freak out was caused by James Bullard, president and CEO of the Federal Reserve Bank of St. Louis and a voting member of the Federal Open Market Committee (FOMC).

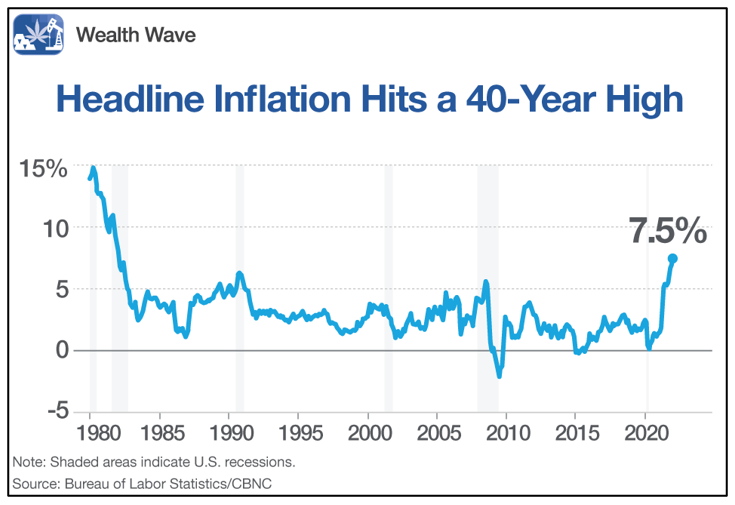

Bullard reacted to the latest Consumer Price Index (CPI) data released for January.

You saw that, didn’t you? Inflation hit a 40-year high at 7.5%.

This should come as no surprise if you’ve been reading my columns.

Last month when inflation hit 7%, I warned that “inflation is going to get a lot worse before it gets better.” Or in November, when I warned readers that inflation could reach as high as 20% before subsiding.

In fact, I’ve been writing about rising inflation for about a year now, and …

- I’ve been right all along. And Wall Street, well … Wall Street has been wrong.

So let’s get back to Bullard and the panic he’s caused ...

After news hit that headline inflation hit 7.5%, Bullard announced that surging inflation had made him much more hawkish about raising rates.

What Did Bullard Say?

The current Fed Funds rate is between 0% and 0.25%. On Thursday, Bullard said, “I’d like to see 100 basis points in the bag by July 1.”

That’s a couple of meetings away, but nonetheless, the market panicked on the news. Their cry? Sell, sell, SELL EVERYTHING.

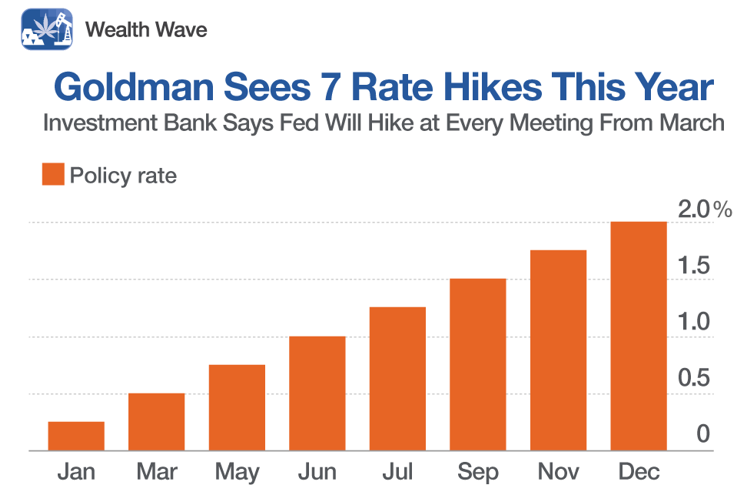

And oh man, did the forecasts for rate hikes jump!

Stocks tumbled on Thursday as traders immediately priced in a 50-basis point rate hike at the Fed’s next meeting in March.

What’s more, the market is pricing in a move close to a 2% federal funds rate (FFR) rather quickly.

Goldman Freaks Out

Some are forecasting more hikes … and faster. Goldman Sachs (GS) sees seven rate hikes this year.

And now Wall Street is sure that the Fed will hike rates sky-high, and this will tank the economy, and that’s why stocks swooned on Thursday.

That’s Wall Street’s story.

On the Other Hand

Now, let me tell you mine. For I am a bear of very limited brain, as Winnie the Pooh would say, I have access to very intelligent people.

First, as my colleague Tony Sagami pointed out in his most recent issue of Stock Options Hotline, other Fed presidents and FOMC members have lined up to say that Bullard is full of s***.

Tony quoted a couple of Fed presidents.

- Thomas Barkin, Richmond Fed president: “Do I think there’s a screaming need to do it (50 bps) right now? I’d have to be convinced of that.”

- Mary Daly, San Francisco Fed President, chimed in saying that a half-point rate hike “is not my preference.”

Indeed, Daly cited the lingering drag of the pandemic, adding that “markets have already priced in the withdrawal of accommodation.”

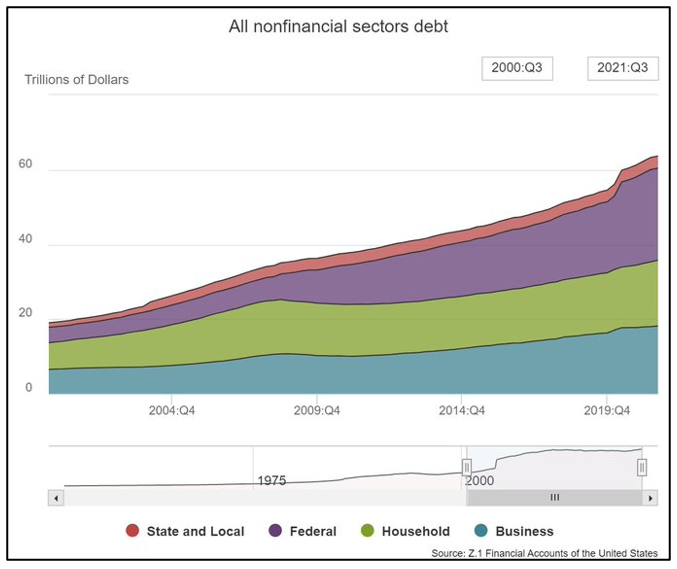

Meanwhile, my colleague Mike Larson, editor of Safe Money Report, has been pointing out that the economy is unable to handle jacking rates way up to what he calls “the yields of yesteryear.”

Mike writes on Twitter: “Private borrowers (corporations, consumers, municipalities) are buried in debt.”

And he showed this chart:

Man, that’s a lot of debt!

Speaking of debt, let me tell you about my own theory:

- The Fed has 30 TRILLION reasons not to raise its benchmark interest rate too much.

I’m talking about the U.S. national debt, sure. And the government is going to keep issuing more debt. And if it raises rates too high, it runs the risk of not being able to afford the interest payments on its debt.

One More Reason Not to Panic

The next FOMC meeting is about a month away, and officials will have lots more of data to look at before they make their decision.

And not just financial facts ...

Geopolitical risks in Europe are adding to uncertainty … China’s economy is dealing with a real estate crunch … and more.

To all this, let me add what happened the last time the Fed raised rates in late 2018.

- It turns out the economy was too fragile to handle a series of fast hikes, and the Fed had to turn tail and ease off.

What an embarrassment! You can be sure the Fed — Bullard aside — doesn’t want to do that again.

So here’s my thesis:

- Inflation will remain high and likely go higher.

- The Fed will raise rates a few times, sure, but will find one excuse or another to not play catch-up.

- Prices will continue to rise.

- And investments that do well in inflationary times will do well.

When I wrote about this last month, I said:

History tells us that commodities perform very well in inflationary times. And an easy way to play a commodity rally is the Invesco DB Commodity Index Tracking Fund (DBC). This fund invests in futures contracts on 14 commodities, including gold, copper, corn, soybeans, gasoline and more.

If you bought DBC a month ago, you’d already be up 5.15%. And …

- Times 12 months, that’s 61.8%. I think you’ll be beating inflation.

Bottom line? Wall Street is wrong to panic and sell everything. Instead, savvy investors should be selling former highfliers that require low-yield debt to stay afloat.

I’m looking at YOU, tech.

And you should be buying value stocks, energy stocks, miners, metals, agriculture — the things that do well in an inflationary environment.

That’s my investment thesis … and I’m sticking to it.

Opportunities await … so be bold! Now is the time to make your fortune.

And remember to always do your own due diligence before buying anything.

Best wishes,

Sean Brodrick