Way back on Jan. 13, I warned that inflation would get a lot worse before it got better.

In fact, I’ve been warning about inflation since November … way before the Federal Reserve … and way before most on Wall Street. So, let me tell you the good news: The headline consumer price index, the broad measure of inflation, is about to tumble.

The bad news is that the Fed is fighting the last war and it’s likely to steer the U.S. into recession.

We’ll get to that. First, let’s look at the good news.

CPI is about to fall because gas prices have been going lower for so long that it’s going to drag CPI numbers down.

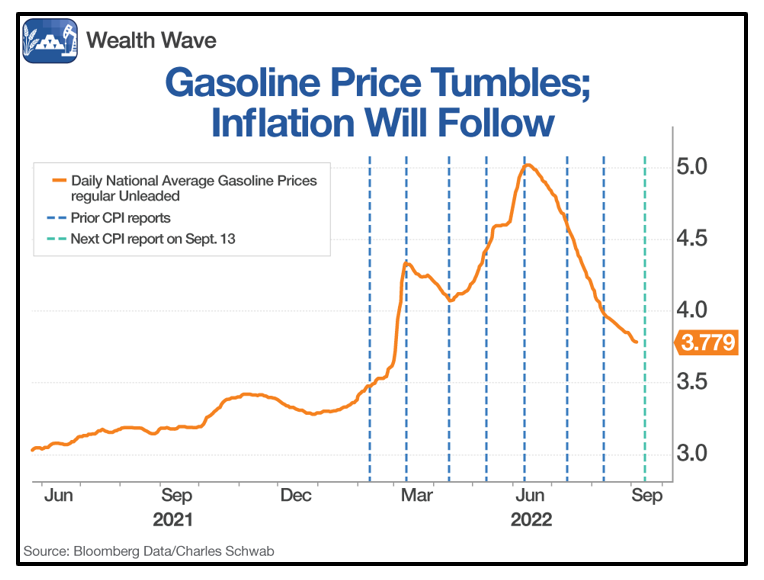

This is a chart of the average price of U.S. gasoline, overlaid with the times of CPI releases. The last release was on Aug. 10, and it covered CPI through July. The release on Sept. 13 covers CPI through August. From July to August, the price of gasoline fell by a double-digit percentage!

That’s not all. The price of used cars fell 1.5% in July, from its January highs. The word on the street is prices will continue to fall as inventories pile up on dealer lots.

Also, new home sales are plunging. This is weighing on prices. Home prices rose 8.2% year over year in July. That seems like a lot, but it was the lowest annual rise since November 2020. It’s likely that home prices will also deflate, pushing CPI even lower if not this month, then next.

So, if we have prices of energy, transportation and shelter cooling off fast, that tells me that the year-over-year CPI — currently forecast at 8.5% — is likely to surprise, to the downside.

That doesn’t mean we’ll see prices go down. But inflation will cool off by a lot.

Will that be enough to change the Fed’s mind about raising interest rates? Absolutely not …

The Fed just leaked a story to the Wall Street Journal. The article says that the Fed will raise interest rates by 75 basis points at its next policy meeting on Sept. 20 and 21.

Will that be the end of the hikes? Probably not. Because the Fed also signaled it wants to raise the Fed Funds rate closer to 4% by year’s end — or about 1.5 percentage points higher than its current level.

But what if I’m right and inflation falls … won’t that change the Fed’s mind?

Nope!

See, the Fed wants a long-term inflation target of 2%. Even if annual inflation falls from its recent 8.5% rate, it’ll still be higher than the Fed wants, probably for some time to come.

So, while inflation will ease, it’ll be higher than desired, and the more the Fed hikes interest rates, the better the odds that the U.S. slips into recession.

That brings the question: What should investors buy for such a recessionary environment?

Buy What the Government Is Throwing Money At

There are a bunch of industries that should be resistant to inflation and recession. One is solar power. First, because the prices of solar components are trending down over time, giving sellers a cushion against inflation.

The other reason is that the U.S. government is throwing money at green energy. That means more sales … plus, fat tax breaks give consumers a cushion against higher prices, which provides cash flow even if a recession bites.

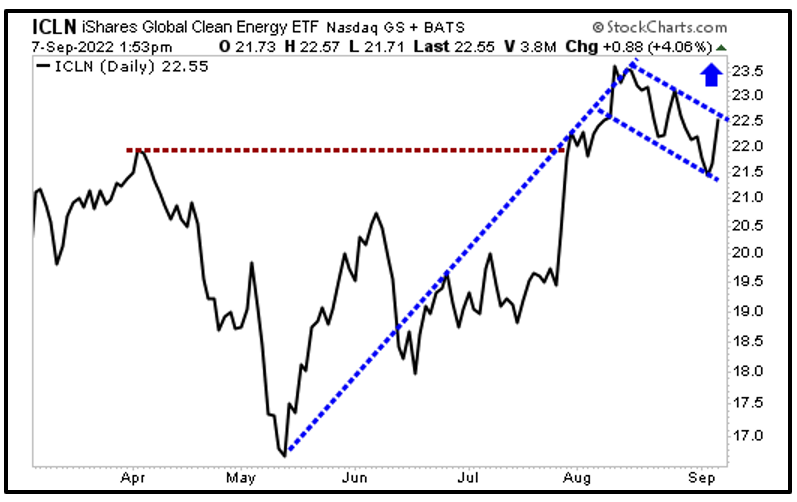

In the U.S., the recently passed Inflation Reduction Act is directing about $430 billion to green energy in the form of tax breaks for consumers and manufacturers. That’s good news for the iShares Global Clean Energy ETF (ICLN). After recently pulling back, ICLN looks poised to head higher again.

You can see that ICLN already broke above old overhead resistance. Now, it seems to be forming a bull flag. The old saying goes, “Flags fly at half-mast.” My target on ICLN is $31.50, a 40% move higher from recent prices.

The bottom line: I expect next week’s inflation number to be cooler, but not cool enough for the Fed. We should continue to expect more rate hikes.

It would be smart to find an industry that’s going to be a big recipient of Federal money — as a cushion against recession — and is actually seeing prices of components trend down even as broad inflation stays hot. Solar power fits the bill.

And if you want to play the other side of the market — the BEARISH side of the market — you should check out Jon Markman’s new bearish option publication, Crisis Profit Trader. Jon’s not only a really smart guy, he’s had years of experience making people money. CHECK IT OUT HERE.

All the best,

Sean