The market's been in a heck of a sell-off recently. Because nothing goes in a straight line, we could see a multiday bounce soon.

I'm here to tell you to sell that bounce.

What's the deal?

Let's look at why the market will bounce. We can start with this weekly chart of the S&P 500 from yesterday morning:

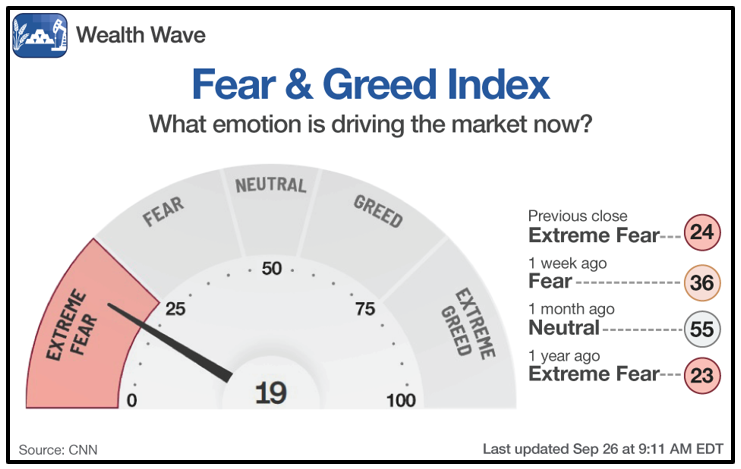

Bulls will say that's a double bottom. Maybe. There's also the fact that the mood of investors is one of extreme fear. Here's the Fear & Greed Index from CNN:

The Fear & Greed Index is a contrary indicator. At times of extreme fear, there's no one left to sell, so it's easier for markets to go higher.

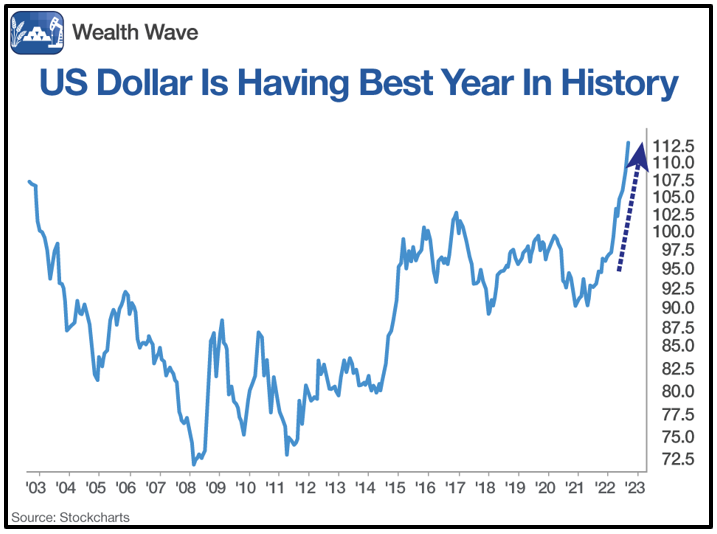

But after a bounce, the odds favor more downside. One of the reasons for that is the U.S. dollar. The relentless rate hikes by the U.S. Federal Reserve — plus America's relative economic strength — are making the U.S. dollar look more attractive.

This is something Dr. Martin Weiss and I talked about in a series of videos months ago: Foreign capital from around the world would flow into the relative safety of the U.S. dollar. Sure enough, that's just what's happening.

As a result of recent and forecast Fed tightening, the U.S. dollar is having its best year ever!

Through Monday, it was up 21% for the year and up more than 25% from a short-term low last year.

This weighs on the stock market because the companies in the S&P 500 tend to be multinationals. As the dollar goes higher, it becomes harder for them to sell overseas in countries with depreciating currencies. And that hurts profit.

A Morgan Stanley (MS) study showed that every 1% change in the U.S. dollar index impacts S&P earnings by about -0.5. So, at the very least, Q4 S&P 500 earnings face approximately a 10% drag on growth.

And that's not even taking into account the impact on S&P 500 earnings from the recession the Fed is trying to engineer. Or that the Fed's quantitative tightening program is sucking the joy juice out of the stock market.

But the biggest obstacle is that the Fed shows no sign of relenting on its rate hikes. For as long as the Fed stays this course, we can expect traders to sell.

History shows us that eventually the Fed will relent. Where will the market be when that happens? Here's a chart that may give us an idea:

The S&P 500 is back down to the midpoint of 2009–22's bull market channel. It's testing that support now. If that support breaks, it gives us a target of ~2900 for the S&P 500.

How Investors Can Protect Themselves & Profit

I'm not recommending you sell long-term bullish positions. We're still holding stocks of companies that pay big dividends. Those outperform in sell-offs anyway and the dividends cushion any short-term pain. And in the long term, this sell-off will look like a speed bump.

I can tell you what we're doing in my trading services, Resource Trader and Supercycle Investor. We're adding leveraged inverse funds that move up when the market moves down. In fact, members of Resource Trader took double-digit gains on one of these positions yesterday after holding the fund for just two trading days.

That's because leveraged inverse funds aren't meant to be long-term holds. You get in and get out.

Investors who simply want to protect their portfolios could buy an un-leveraged inverse fund. For example, the ProShares Short S&P500 (SH) moves the opposite of the S&P 500. It's not leveraged, so you have less risk.

I still wouldn't hold it long term … because in the long term, I'm quite bullish on the market. But if you need short-term downside protection, it's an easy way to get some insurance that lets you sleep at night.

The ProShares Short QQQ (PSQ) does the same thing for the tech-heavy Nasdaq-100 Index.

And then, when the bottom comes, you can sell your inverse funds and use the cash to buy new bullish positions at cheaper prices.

All the best,

Sean

P.S. Dr. Martin Weiss and a special guest expert who picked the last big bottom are getting ready to show our members how to spot the NEXT bottom. Not only is it coming our way, but the list of winners will look VERY different from the last. Get that list and more Wednesday, Sept. 28, at 2 p.m. Eastern. Click here to get your free ticket.