|

| By Beth Canova |

Back in February, my colleague Dr. Bruce Ng declared that 2024 would be “the year of AI.”

And he was right. Both crypto and TradFi have been hooked on artificial intelligence.

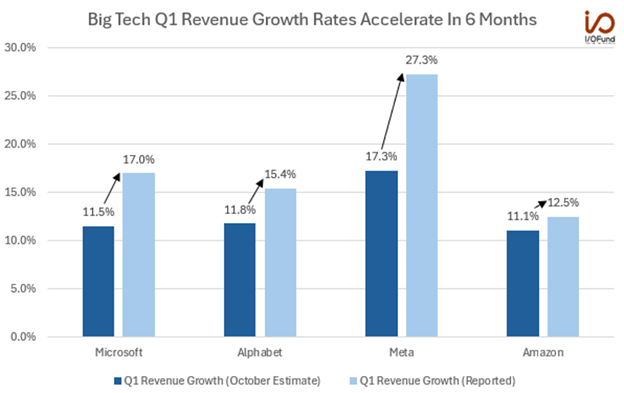

Recent Q1 earnings releases from tech giants, including Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL) and Meta (META), reaffirmed that AI spending will increase through 2024 as companies seek AI-related revenue gains.

That’s because, across the board, Big Tech is benefitting from their AI investments.

These TradFi firms are continuing to dedicate tens of billions of dollars into AI. And in their earnings reports, they were broadly optimistic over the opportunities that generative AI brings.

And they aren’t the only ones.

According to a survey by accounting powerhouse PricewaterhouseCoopers, roughly 54% of companies implemented generative AI in some areas of their business just one year after the launch of ChatGPT.

And now, Weiss Ratings is joining the fray.

But we didn’t just jump on the hype train. In fact, our most impressive AI-powered tool has been in development for ten years: a stock trading system that combines the power of AI technology and the Weiss ratings.

Over those ten years, it has undergone rigorous testing in some of the best and worst conditions.

And in that time, it has beaten the S&P 500 by almost 51-to-1.

Our founder, Dr. Martin Weiss, has just unveiled this technological breakthrough, plus ten stocks it has marked as a “buy.”

If you’re interested in learning more, I suggest you watch our latest briefing, How New AI Beats S&P by 51-to-1.

But that’s using AI. What if you’re more interested in investing in it?

Well, there is no time like the present.

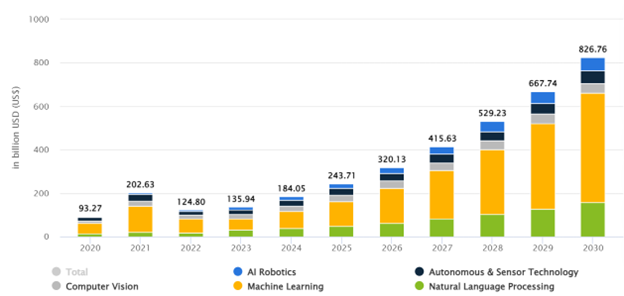

In the first quarter of 2024 alone, the value of the AI market increased by 35%, according to Statista. It is expected to grow to a valuation of $184.00 billion by the end of the year … and $243.71 billion by the end of 2025.

But as you can see, AI is only just getting started.

Its expected growth over the rest of the decade is astounding, with predictions estimating a sector valuation of $826.70 billion by 2030.

Crypto AI projects aren’t just going to get their fair share of that pie. They’re also likely to see outsized growth that could yield the sort of returns crypto is known for.

That’s because in TradFi, giants like the ones listed above are leading the charge.

With their large market caps and high expenses, the potential gains for individual stocks are limited.

If you buy one of those big TradFi institutions, you can make a safe return, sure. But you’d also be owning a very small piece of a very large pie.

And it isn’t likely to get bigger any time soon.

But crypto AI projects have much smaller market caps, and it is easier for retail investors — average folks like you and me — to get in at better prices.

That means more room to grow … and bigger potential profits for you as an investor.

So, that’s the long-term AI outlook.

But more immediate are two upcoming catalysts that could send the AI sector into overdrive in the near term.

The first is the upcoming Nvidia (NVDA) earnings report, set for May 22.

Nvidia is a high-end TradFi semiconductor company whose powerful circuit boards power Bitcoin (BTC, “A”) mining and the computationally intensive training of AI neural nets.

Despite being solidly a TradFi play, Nvidia is still a powerful sector leader. And a bullish earnings report could be enough of a spark to reignite AI investors in the crypto markets.

The second catalyst is the release of the newest latest iteration of ChatGPT 5.0, the natural language-processing website that talks like a real person. That is planned for mid-2024, though the exact date is unknown.

As noted above, the release of ChatGPT at the end of 2022 sparked a wave of AI development and adoption. Can you imagine the boost when a new and improved ChatGPT goes live?

If both events turn out as well as we expect, AI-related coins should do very well.

In fact, some of them have already gotten a head start.

One coin my colleague Juan Villaverde recently recommended to his Weiss Crypto Investor Members just jumped 40% in a week!

Overall, the crypto AI sector has grown 222% in just the first quarter of the year.

And that’s just the beginning. There’s more to come when the next phase of this bull cycle gets underway.

Juan’s strategy in Weiss Crypto Investor is to use his Crypto Timing Model to target the best entry and exit prices on the cryptos leading the top market narratives.

Naturally, crypto AI projects are on the top of that list this year. If you want to learn more about his two favorite AI picks, click here.

So, if you thought you missed your chance to score big on AI, think again.

A rare, second profit window is starting to open.

And you don’t want to miss it.

Best,

Beth Canova