|

| By Bruce Ng |

AI is poised to revolutionize human civilization. And it’s certainly revolutionizing investor strategy.

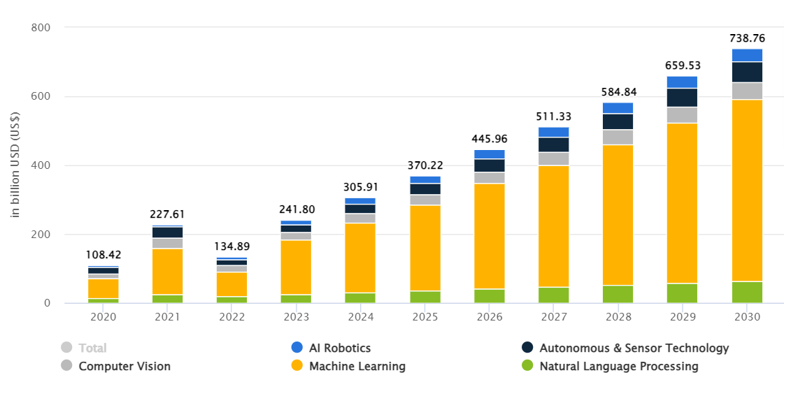

According to statista, the AI market will grow at a CAGR of 17.3%, from $242 billion in 2023 to $585 billion in 2028, doubling in size five years from now.

My colleague Jurica Dujmovic brought up excellent points when determining whether we are already in an AI bubble.

And he followed up with an even more interesting look at what could happen if the bubble bursts … and how to avoid the worst of the fall out.

But while Jurica was focusing on the broad AI sector, I want to zoom in specifically on crypto AI projects.

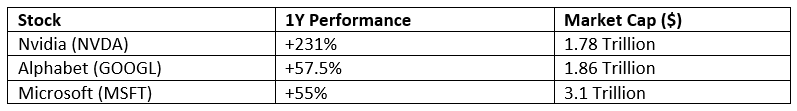

See, despite AI dominating headlines and stealing investor attention, the best opportunities in this sector won’t be in traditional stock picks like Nvidia (NVDA), Alphabet (GOOGL) or Microsoft (MSFT), despite what articles like this one from The Motley Fool say.

Instead, they’ll be in crypto AI projects.

Don’t take my word for it. Just look at the numbers — the one-year performance of the stocks mentioned above:

Don’t get me wrong, these are respectable returns. But we can make these numbers in crypto in days or weeks. Especially in a hot sector like AI heading into a bull market.

Besides that, their market caps are too high.

If you buy one of those big TradFi institutions, you can make a safe return, sure. But you’d also be owning a very small piece of a very large pie. And it isn’t likely to get bigger any time soon.

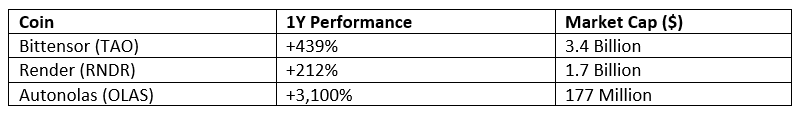

But take a look at the performances of crypto AI projects when compared to the stocks above:

Much higher gains within the same timeframe, yet much smaller market caps. That means more room to grow … and bigger potential profits for you as an investor.

And, as Jurica pointed out in a previous Weiss Crypto Daily issue, the number of smaller, crypto-friendly, open-source AI programs are increasing. That’s because, and I’ll quote Jurica here …

These models operate at substantially lower costs and are particularly suitable for environments where computational resources are limited. Their streamlined architectures enable rapid processing and quick decision-making, making them highly suitable for real-time applications.

Meaning we’re likely to see even more crypto AI projects like these, filling in the gaps of where TradFi giants’ approach to AI falls short.

That means more opportunities.

Recently, OpenAI CEO Sam Altman was trying to raise $7 trillion dollars to overhaul the semiconductor chip industry.

You may remember the semiconductor shortage a few years ago. It wrecked the cell phone, computer and car markets since semiconductor chips are vital to their functioning.

Well, it’s also vital to AI. Computers need faster and cheaper semiconductors to meet the processing demand that AI requires.

If Altman succeeds, the AI industry as a whole will be worth at least $7 trillion. Compared to the 2023 valuation at $241 billion, that’s a big jump.

And honestly, it’s an underestimate.

We think AI will explode this year. And crypto AI projects are like a leveraged play on AI. They will go up more than traditional AI projects.

Of course, it’s not the only trend that will lead the markets this bull cycle.

If you want to learn more about the others — and which tokens are dominating them — I suggest you check out Dr. Martin Weiss’ new urgent briefing. In it, he’ll uncover seven cryptos that have the potential to outperform Bitcoin in this bull market.

Best,

Dr. Bruce Ng