|

| By Jurica Dujmovic |

It’s been another week full of AI hype.

And, as I explained last week, that hype resembles what we saw in the lead up to the Dot-Com Bubble.

I took my time showing the parallels between the two. Based on that, I left you with a question to consider:

Are We Already in the AI Bubble?

Well, economic indicators seem to be pointing that way.

The first economic indicator is the rise in inflated company valuations.

I alluded to this last week. But to recap, a big marker of the Dot-Com Bubble was that investors were more concerned with future potential valuations than what companies were capable of at the time of investment.

This, in essence, sent speculative investments through the roof. As long as a company was internet-related, it was treated as a gold mine off the bat. This creating an unstable foundation for the sector, and the floor fell out from under everyone when the bubble burst.

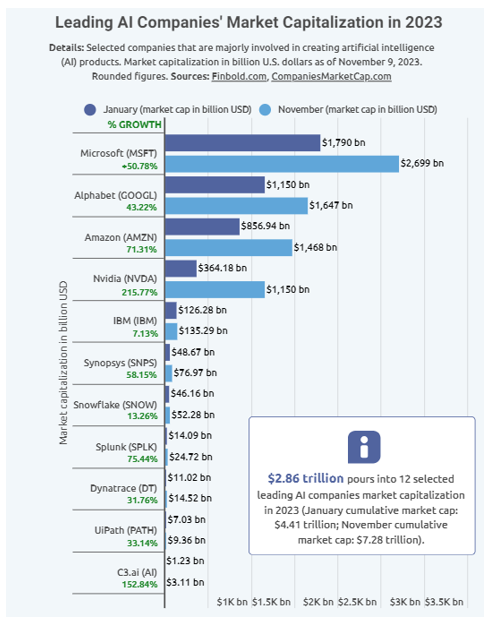

In 2023, the AI industry experienced a significant surge in market capitalization, symbolizing the profound impact of AI technology across various industries. This surge, initiated by the buzz around generative AI tools like OpenAI’s ChatGPT and Google’s Bard, led to inflated valuations of AI companies.

One of the most notable examples is Nvidia (NVDA), a key player in AI. It reached a $1 trillion market capitalization, benefiting greatly from the demand for AI processors.

While I won’t go so far as to say definitively that all of this is speculative, the overall trend in AI has shown characteristics of speculation. We’ve seen a rapid influx of capital into AI startups and established companies. Indeed, over 1,000 startups were founded in 2022 to leverage AI.

And I couldn’t help but be reminded of the Dot-Com era’s investment frenzy.

The second economic indicator is the disconnect between revenues and valuations.

Despite the high market capitalizations and investments in AI companies, there's a noticeable disconnect between the revenues generated by these companies and their valuations.

Many AI startups and companies are yet to demonstrate a sustainable revenue model that justifies their high valuations.

The current trend in AI investments mirrors the patterns observed in previous tech bubbles. Naturally the Dot-Com Bubble, but also the biotech bubble, where investments were made on the promise of a future breakthrough in genome sequencing. In both situations, investor enthusiasm and capital influx were disproportionate to the actual financial performance of the companies involved.

But when those promised advancements and breakthroughs didn’t come through quickly enough, the house of cards collapsed.

Just like those instances — which were driven by expectations of breakthroughs still beyond the horizon — the AI industry is riding on the anticipation of transformative AI applications.

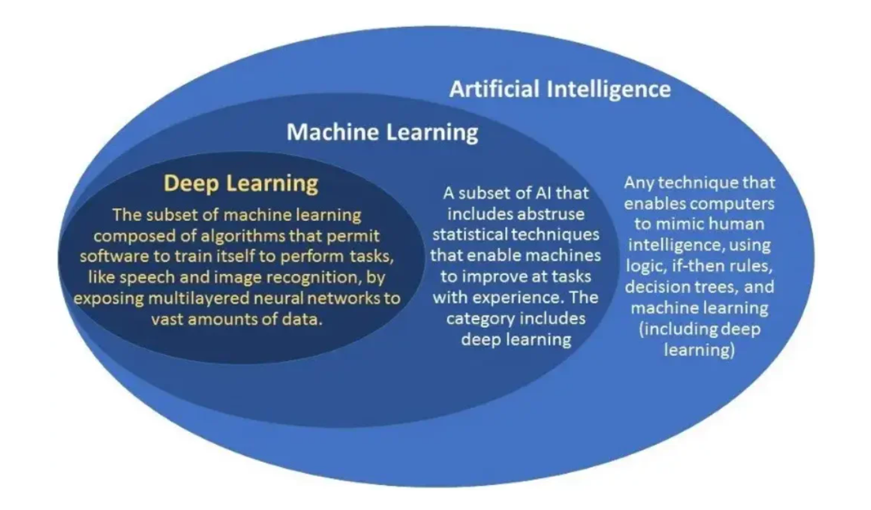

You can see evidence of this in the hype and fear surrounding AI. Heck, it’s evidenced by the fact that we’re calling current applications “artificial intelligence” when, as I explained last week, there is very little if any independent intelligence in any AI model currently available.

Historically, economic bubbles have been characterized by rapid increases in investment and valuation, followed by a significant crash. And with the economic indicators mentioned above, it seems the AI industry's current trajectory, marked by rapid adoption and investor enthusiasm, parallels this pattern.

But there’s one more factor that isn’t as noticeable that contributed to tech bubbles in the past. It’s what companies didn’t do: risk management.

According to a McKinsey report I referenced last week, only a small percentage of organizations are addressing the risks associated with AI, such as inaccuracy and cybersecurity. This lack of risk mitigation strategies could contribute to the instability of the AI market.

So, it is increasingly likely that we are in an AI bubble.

In that case, I have another question for you …

What Happens When the AI Bubble Pops?

As you might have guessed, the possibility of an AI bubble bursting presents a scenario with potentially far-reaching implications. Not just for the technology sector, but for the broader economy and various stakeholders involved.

There are four I want to focus on today:

1. Economic Impacts

A burst could lead to a significant market correction, characterized by a sharp decline in the valuations of AI companies.

This would likely result in substantial financial losses for those who are heavily invested in these companies, mirroring the aftermath of the Dot-Com Bubble burst.

The bursting of the AI bubble could lead to a reduction in venture capital and other forms of funding available to AI startups.

That leads me to the next effect …

2. Interruption to Innovation

A potential burst could lead to a slowdown in AI research and development. With reduced funding and investment, the pace of innovation in AI could decelerate in step. This could potentially delay breakthroughs and advancements even further.

As such, we may even see a shift in focus from ambitious, long-term AI projects to more immediate, revenue-generating applications. In short, the small inflows may be directed to prioritize short-term gains over long-term innovation.

3. Shaky Investor Confidence

Investor confidence in the AI sector could be significantly undermined if an AI bubble truly bursts. More concerning is that this loss of trust could extend beyond AI to impact the broader tech sector.

Investors may become more cautious about investing in new, unproven technologies, potentially stifling innovation in other emerging tech sectors.

However, there is a silver lining. A bubble bursting could lead to more stringent investment criteria and due diligence processes. While that would stem the flow of new investment capital, it would mean stronger protections for investors.

4. Impact on Tech/AI Companies

AI startups and smaller companies will likely face the brunt of the impact.

These entities often rely heavily on external funding for survival and growth. A burst could result in a significant number of these companies failing or struggling to stay afloat.

While large tech companies may be better equipped to weather the storm, they could still face challenges. They might have to scale back AI projects, lay off employees and refocus on core, profitable areas of their business.

A burst would likely lead to job losses, particularly for those working in AI startups or in AI divisions of larger tech companies. This could result in a talent outflow from the AI sector to more stable industries.

Finally, investors — ranging from venture capitalists to retail investors — could face significant losses as these companies’ valuations plummet back to reality.

Now, let me be extremely clear: All four potential impacts I’ve outlined fit into the “worst-case” scenario.

While that is still a possibility, I don’t think it’s the likeliest one.

What’s more likely to happen is a much milder and contained “pop” than a full bubble burst. And in that case, there are a lot more net benefits in the long term.

Again, I’m drawing parallels from the Dot-Com Burst, where the technology was sound and innovative but simply ahead of its time. A similar pattern could unfold in the AI sector.

You see, like the Dot-Com bubble, the issue with the current AI sector is not with the technology itself. Instead, the danger lies with the hype and inflated expectations surrounding it.

AI is still in a phase of growth and development. It needs more time to mature and evolve into a technology that can fully meet the expectations set by the current hype.

If more in the industry are aware of the path they’re on, they’ll be more likely to prevent a large burst. Instead, it is possible that the AI industry could see a "soft landing" as valuations return to realistic levels.

This would mean a gradual market correction where overvaluations are adjusted, and investment becomes more aligned with realistic capabilities and potential of AI. It would still be an economic belt-tightening session for the sector. But the benefit is that it could still inspire a more cautious and informed investment approach in the AI sector without the same fallout as a full burst.

Investors are less likely to be fully scared out of the sector. Rather, they may change gears to focus on sustainable business models and long-term viability rather than speculative gains.

For AI startups, this adjustment could lead to a period of rationalization. Companies with solid business models, innovative technologies and practical applications are more likely to survive and thrive. And on the other hand, those built on hype will almost certainly struggle.

Large tech companies are likely to adapt by focusing on integrating AI into their existing profitable segments and cutting back on overly ambitious AI projects that lack immediate practical applications.

It seems AI is rapidly approaching a monumental decision: adjust or bust.

That’s because innovation in AI is unlikely to halt. The technology's core strengths and its ability to solve real-world problems will continue to drive progress.

The question is whether the drivers of that innovation will learn from past bubbles and adapt to grow at a more measured pace … or keep racing ahead and hope they’ll be the ones to survive.

But that’s just what I think. What’s your take on AI and its future? Let me know by tweeting at @weisscrypto!

Best,

Jurica Dujmovic