2 More Differences That Can Set Your Memecoin Pick Apart from the Crowd

|

| By Bruce Ng |

According to Merriam Webster, a meme is: “An idea, behavior, style or usage that spreads from person to person within a culture.”

In the age of the internet, memes have become their own language. And in the age of crypto, they’ve even become digital assets — ones that can spread and garner attention from investors like wildfire, going just as viral as the memes they’re based on.

In the last bull market, the viral status sent many memecoins into the stratosphere. Dogecoin (DOGE, “C+”), for example, hit a market cap of $89 billion. Shiba Inu (SHIB, Not Yet Rated), based off the same meme as DOGE, hit $41 million.

Memecoins like DOGE and SHIB are known to be very volatile — even more so than your normal crypto coins.

While gains of 100x aren’t unheard of in a bull market, corrections of 99% also are possible. This is because they have no fundamentals in the sense that memecoins don’t make any revenue and thus trading price can’t be anchored to anything.

Just take a look at this popular video clip from the TV show “Silicon Valley” here to get an idea of what we are talking about.

In other words, the caveat is that no fundamentals mean memecoins can go to zero. But it can also go up to stratospheric heights.

I’ve spoken about memecoins as a sector before. And I’ve given suggestions for how to identify potentially promising projects in the space.

Now, I’m seeing a new memecoin, Bonk (BONK, Not Yet Rated), that’s setting itself apart from the pack in two main ways.

First Difference: Setting Up Base on an Up-and-Coming Base Chain

Many memecoins are built on an already established blockchain. Most of those are on the Ethereum (ETH, “B+”) network.

Makes sense considering Ethereum is the largest smart-contract blockchain.

However, that means all the drawbacks of Ethereum impact the memecoins built on it — namely, the slow transaction speeds when network usage soars, and the incredibly high gas fees that accompany them.

But BONK has done something different: It’s chosen Solana (SOL, "C") to build on.

Since the start of the crypto rally in October, SOL has gone from $20 to $73 as of the time of writing. It has outperformed Bitcoin (BTC, “A”) by many multiples.

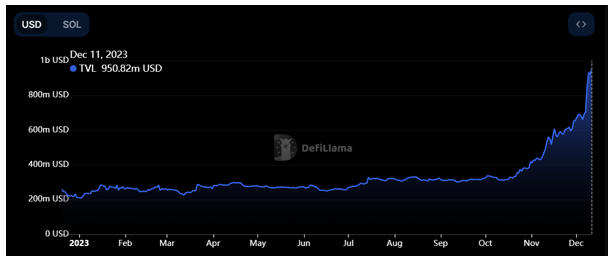

And it’s not just outperforming based on price action. Its total value locked, which measures how much money is deposited into Solana, represents how much usage a chain gets. And as we can see below, Solana’s TVL increased from $250 million to almost $1 billion since the start of the year.

That’s a four-fold increase!

So people are buying SOL, participating in the ecosystem and buying projects on Solana. And considering one of Solana’s biggest promises is its ability to compete with Ethereum for better transaction speeds and cheaper fees, I anticipate Solana will continue to grow and expand as the bull market gets underway.

After all, additional volatility means we’ll likely see bottlenecks on the Ethereum network again.

And with all that excess money sloshing around the Solana ecosystem and limited memecoin options, the one I’m targeting is poised to pick up that risk-on sentiment.

Second Difference: More Decentralized Tokenomics

Tokenomics — the hybrid word of “token” and “economics” — is just crypto speak for “who owns what and how much” of a particular coin.

The latest memecoin to catch my eye started off as an airdropped coin, meaning it was distributed freely to users of the Solana network.

At the time, 50% of the total supply of this memecoin was distributed to all eligible participants. This is considered a fair distribution compared to most crypto coins, where 20% distributed to the community is considered “fair.”

This is important because the more holders there are, the more decentralized the holdings are. And that means there is no single entity that can manipulate price.

Also, more holders mean stronger network effect — i.e., free marketing, which is the backbone of any memecoin project. X’s community is its own marketing department.

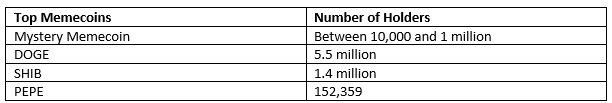

So, let’s take a look at the community size of this memecoin when compared to the big names in this sector:

Holders of this memecoin have yet to reach the 1 million mark, but it is steadily climbing up.

More holders mean more attention. More attention means more buyers, resulting in increasing price. And price increases result in more attention. It’s how the crypto flywheel works.

Could BONK Be the Next DOGE?

It could. Based on its current tokenomics and what we know of the sector, as well as the fact that we’ve yet to see the bull market’s big run, BONK could follow in DOGE’s footsteps to ballon in this bull market.

The same could be said for any memecoin that distinguishes itself the way BONK has.

However, please keep in mind that while previous memecoin darlings saw impressive rallies … they also saw crushing corrections that caught many investors in the crossfire.

I’ll repeat myself as this bears repeating: Please make sure if you decide to enter the memecoin market, that you are prepared for and can manage the risk inherent in this type of investment. And never invest more money than you’re prepared to lose.

If you do have the risk tolerance for small projects like BONK that have significant growth potential, I advise you to check out our New Crypto Wonders newsletter. That’s the bread and butter of what we cover there.

Best,

Dr. Bruce