|

| By Bruce Ng |

The crypto market took a bad hit recently with the lawsuits against Binance and Coinbase (COIN).

But rather than get caught up in the fear, uncertainty and doubt sparked by these events, it is prudent to take this time to identify the narratives (aka sectors) in crypto that demonstrated the most resilience against the dump and also the most promising narratives that can recover.

Here’s what I think will do well over the next six months ...

Narrative No. 1: Liquid Staking Derivatives

I wrote about LSDs in May, and I am still bullish on this narrative.

In short, LSDs are platforms that allow you to stake Ethereum (ETH, “B”) for a yield. While your ETH is locked up, you’ll receive a Liquid Staking Token, or LST, for each ETH you deposit. This LST acts as a placeholder for your ETH.

Currently, the LST with the highest market cap is stETH. It is obtained from staking ETH on Lido (LDO, Not Yet Rated). Right now, Lido pays 3.8% annual percentage yield on ETH.

Obtaining stETH allows you to do many things with it, such as:

- Lend it out on other DeFi platforms like Aave (AAVE, “C+”) or Pendle Finance (PENDLE, Not Yet Rated) for even more yields.

- Use it to provide stETH/ETH liquidity on Curve Finance (CRV, “B-”). Here, you would supply ETH and stETH into a pool as a liquidity provider and not experience any impermanent loss.

- Stake it on other yield boosting platforms like Aura Finance (AURA, Not Yet Rated) to add further yields.

All these techniques may require detailed guides to execute. So, if staking ETH is something you are considering, I suggest you research exactly how you would like to stake it and what you plan on doing with your LST.

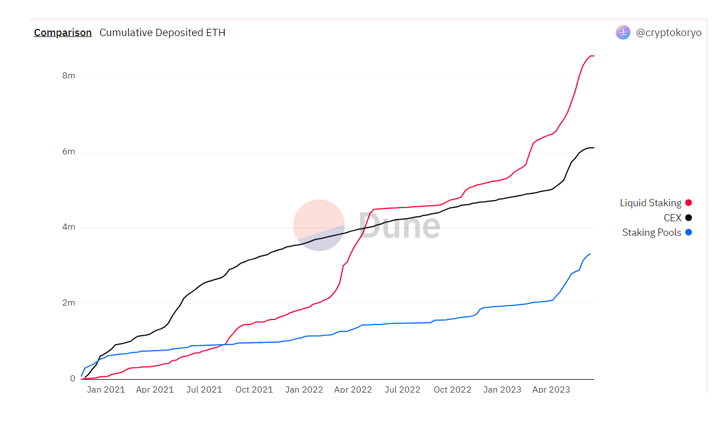

But the main point is that LSDs are continuing to grow as a sector, as demonstrated below:

As we can see, LSDs are the most popular type of ETH staking compared to centralized exchanges and staking pools. Because of this and its strong continued growth, I think this trend will continue into the next six months.

Tried and trusted LSD projects include Lido, Frax Ether (fxETH, Not Yet Rated) and Rocket Pool (RPL, Not Yet Rated).

Upcoming LSD projects with new innovations are Pendle Finance, Lybra Finance (LBR, Not Yet Rated) and Swell Network (SWELL, Not Yet Rated).

Narrative No. 2: Layer-2 Scaling Solutions

When I refer to Layer-2 — or L2 — scaling solutions, I mean solutions that scale Ethereum specifically and not any other smart-contract platform.

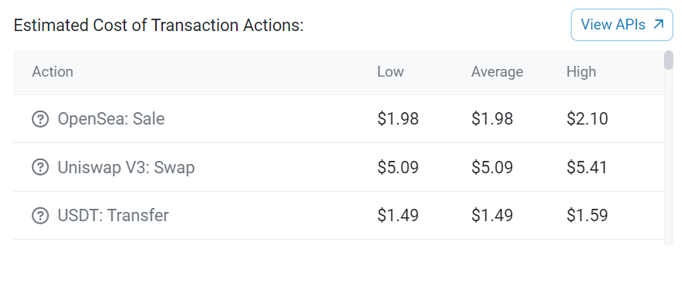

L2 solutions are a necessity for Ethereum because its transactions are slow and expensive. At time of writing, ETH fees are as follows:

Typically, it costs about $5 to do a trade on the Ethereum network via a decentralized exchange, plus $1.50 to send coins.

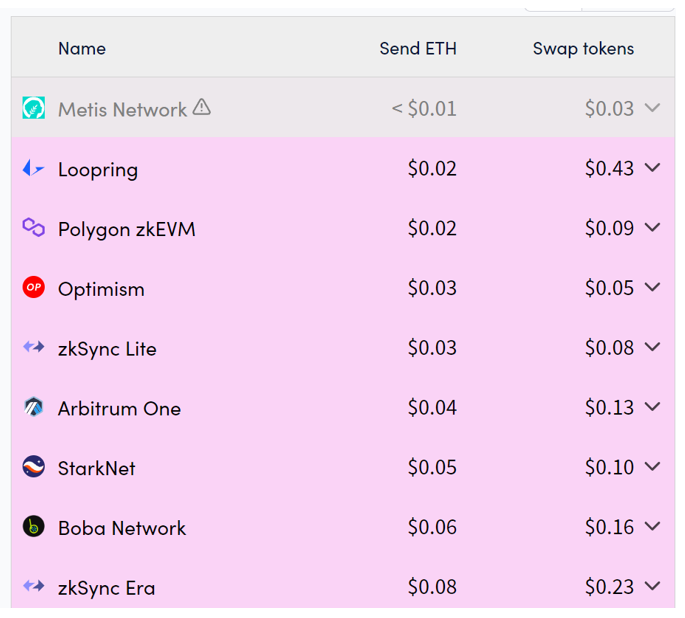

L2s, on the other hand, have way lower fees and are much faster:

Fees on L2s are typically 500 times lower than fees on Ethereum. Currently, the most prominent L2s are Arbitrum (ARB, Not Yet Rated), Optimism (OP, Not Yet Rated), zkSync Era and StarkNet.

Now, here are some key points to consider:

- Arbitrum still has the most usage and total value locked, with TVL being a measure of adoption. With the token trading just above at time of writing, I think it’s a steal at its current price.

- Optimism recently launched its Bedrock upgrade. This makes its transactions faster and cheaper. Unfortunately, no price appreciation was seen corresponding to the upgrade. This is likely due to bad timing, as it coincided with the announcement of the SEC’s lawsuit against Binance.

In addition, I think that Optimism will lag behind Arbitrum in terms of usage and adoption in the coming months. - zkSync does not yet have an investable coin. It is rumored that they will conduct an airdrop in the fourth quarter of this year.

From a tech perspective, zkSync is better than Arbitrum and Optimism. But fees on zkSync Era (the zkSync testnet) are expensive. Also, adoption is much less than Arbitrum and Optimism. - StarkNet has not made many announcements so far, so we don’t know much about it. But the airdrop of its native token should come before the end of year.

In terms of investment potential, Arbitrum stands out the most. However, I will continue to look out for news on zkSync and StarkNet as their airdrops draw near.

Narrative No. 3: Cross-Chain Protocols

Cross-chain bridges allow you to bridge crypto from one chain to the next, including on L2s.

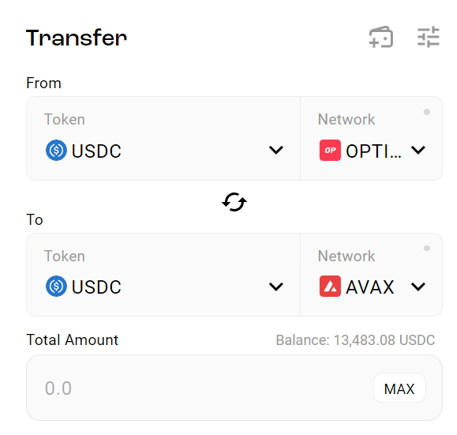

Just check out Stargate Finance (STG, Not Yet Rated) for example:

In Figure 4 above, you can bridge USD Coin (USDC, Stablecoin) from Optimism to Avalanche (AVAX, Not Yet Rated), for example. Stargate then makes money by charging a bridging fee and takes a cut off the amount bridged.

Other bridges include Synapse (SYN, Not Yet Rated) and Orbiter.

Personally, I particularly like Orbiter because it’s cheap and incredibly fast. Bridge transfers take less than a minute to be processed. Though in terms of investment potential, it is unclear whether Orbiter will do an airdrop for users of its service.

Powering cross-chain protocols like Stargate is a communication protocol called LayerZero. It also powers other cross-chain projects like Radiant (RDNT, Not Yet Rated), a cross-chain yield aggregator.

This makes LayerZero a “pick and shovel” type of investment for this sector. At the moment, it doesn’t have a token, but that is likely to change in Q4.

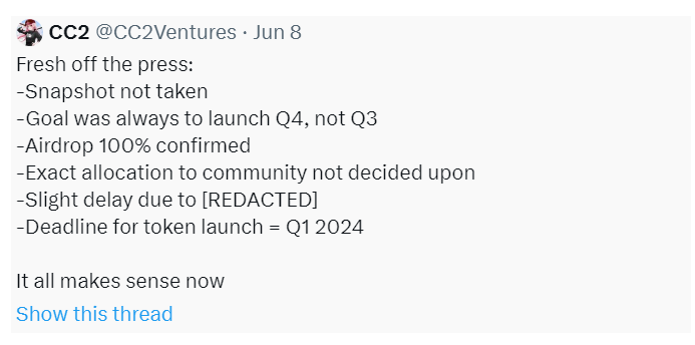

According to @CC2Ventures on Twitter:

The tweet above apparently confirms that the ZRO airdrop will occur before the end of the year.

Of course, take the news above with a pinch of salt. After all, it’s just citizen journalism based on rumors so far.

But if a native token is airdropped, it will be one of the most investable tokens in the crypto sphere.

Stay tuned to your Weiss Crypto Daily issues for updates on all three sectors over the next few months. And for guidance on which tokens to invest in and when to buy, I suggest you check out my colleague Juan Villaverde’s Weiss Crypto Portfolio.

Best,

Bruce