|

| By Jurica Dujmovic |

A few weeks ago, I called stablecoins the “quiet giants” of crypto.

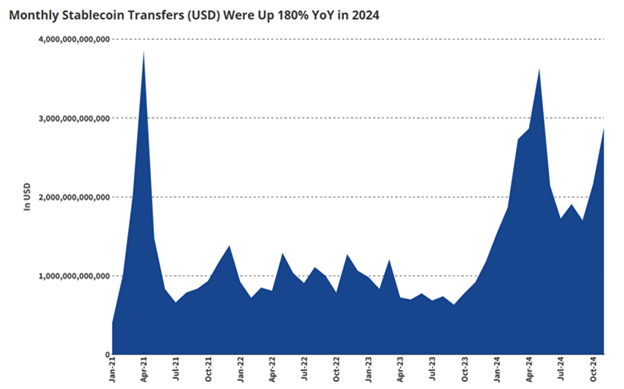

That’s because on-chain activity for stablecoins reached all-time highs in March 2025, with market capitalization reaching over $230 billion.

Industry forecasts from VanEck suggest daily stablecoin transfers could hit $300 billion by December. That’s roughly 5% of the volume processed by major traditional payment networks and significantly higher than the $100 billion in daily transfers seen in 2024.

But go back just three years ago, and this growth would have felt almost impossible.

That’s because, in 2022, a stablecoin-based ecosystem crashed and caused $45 billion to vanish in the blink of an eye.

A project once hailed as DeFi's crowning achievement became its cautionary tale. Two years later, its aftershocks continue to reshape an entire industry.

UST: The Algorithmic Dream

Back in early 2022, Do Kwon was crypto's golden boy.

His company, Terraform Labs, created a blockchain that leveraged fiat-pegged stablecoins, TerraUSD (UST), to power a payment system.

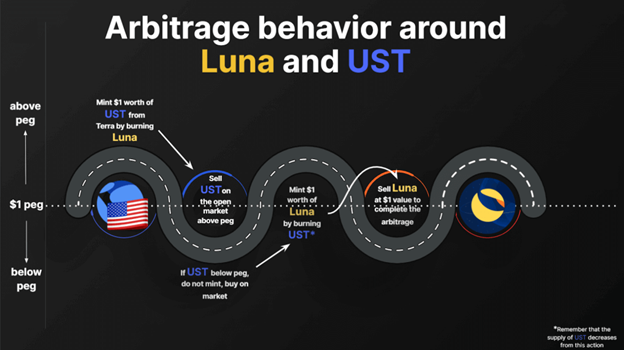

And unlike other stablecoins, which are backed by reserves, UST was an algorithmic stablecoin backed by the blockchain’s native token, LUNA, which was trading above $100 at the time.

That means it maintained its dollar peg through pure algorithm and game theory, rather than boring old collateral. No dollars in a bank account, no overcollateralized vaults.

Just elegant code and the promise that 1 UST could always be swapped for $1 worth of LUNA.

And UST quickly became crypto's largest decentralized stablecoin with $18 billion in circulation.

Anchor Protocol's 20% yields had investors believing they've found the holy grail of crypto — stability and impressive returns, all without the pesky "backing" that traditional finance insists upon.

The sentiment across crypto media and investor circles at the time was unmistakable: Terra was building "the foundation for the decentralized economy of the future."

But that foundation wasn’t as secure as people believed.

A Rude Wake-Up Call

When UST began to slip from its peg in early May 2022, few predicted what would follow. The initial de-peg seemed manageable — just a few cents below $1. Terra had weathered similar storms before.

But what started as a small crack quickly became a gaping chasm. The Luna Foundation Guard deployed billions in Bitcoin (BTC, “A-”) reserves to defend the peg.

That move alone essentially acknowledged that the pure algorithmic model wasn't enough when push came to shove. Markets weren't convinced.

Between May 7-12, UST plummeted from $1 to mere pennies.

LUNA, once worth $119 per token, crashed to effectively zero as trillions of tokens were minted in a desperate attempt to absorb UST redemptions.

The mechanism that was supposed to restore equilibrium instead created a death spiral of epic proportions.

For the crypto community, this was more than just another crash. The collapse of the Terra ecosystem meant the failure of an idea, a philosophy, a paradigm.

The algorithm, it turned out, couldn't defy gravity after all.

The Great Pivot

In the smoldering aftermath of Terra's collapse, surviving algorithmic stablecoin projects faced an existential choice: adapt or die.

Frax Finance was the first to read the room. It had previously pioneered the "fractional-algorithmic" approach — a hybrid model with partial USD Coin (USDC, stablecoin) collateral and an algorithmic component through its FXS token. And prior to the collapse, it had been gradually decreasing its collateral ratio to move toward the algorithmic side of the spectrum.

But watching UST's death spiral changed everything.

"The costs of being slightly undercollateralized now far outweigh the benefits, especially because it can undermine the perceived safety of FRAX," explained a Frax governance proposal in early 2023.

In February 2023, with 98% of votes in favor, Frax embarked on a journey toward 100% collateralization, essentially abandoning the very "fractional" concept that had defined it.

Meanwhile, MakerDAO, the granddaddy of decentralized stablecoins, was undergoing its own identity crisis. Though it’s Dai (DAI, stablecoin) had always been overcollateralized, unlike Terra's UST, it too felt the reverberations of the collapse.

Rune Christensen, MakerDAO's founder, unveiled a sweeping "Endgame Plan" in late 2022, framing it as a response to the systemic risks and essential for Maker's long-term survival. The plan involved diversifying collateral, creating "MetaDAOs" for specialized functions, and perhaps most surprisingly: rebranding.

This was no mere cosmetic change. It represented a fundamental shift in approach. The ethos had shifted from "how little collateral can we get away with?" to "how can we make our backing so robust that nobody would ever question it?"

The Regulatory Hammer Falls

If market sentiment wasn't enough to drive the pivot away from algorithmic designs, regulatory pressure finished the job.

Within days of UST's collapse, U.S. Treasury Secretary Janet Yellen was citing it in Congressional testimony as evidence that stablecoins needed urgent regulation. Draft legislation in the U.S. House even proposed a two-year ban on "Terra-like" algorithmic stablecoins.

The EU's Markets in Crypto Assets (MiCA) regulation, finalized in 2023, effectively outlawed pure algorithmic stablecoins by imposing reserve and capital requirements that such designs couldn't meet.

Projects that once prided themselves on regulatory arbitrage suddenly found themselves proactively seeking compliance. MakerDAO began investing DAI reserves in U.S. Treasury bonds. Frax started publishing detailed collateral reports. The wild west had been tamed - not by sheriffs with badges, but by the market's newfound risk aversion.

A New Balance

Two years after Terra's collapse, the stablecoin landscape hardly resembles its pre-crash incarnation. Pure algorithmic stablecoins have all but disappeared. The survivors have converged on a new consensus: robust collateralization is non-negotiable.

Yet algorithms haven't disappeared entirely. They've just found a new purpose.

Instead of algorithms creating value out of thin air, they now manage collateral portfolios, optimize yields and fine-tune parameters within safe bounds.

For example, Frax's Algorithmic Market Operations (AMOs) deploy collateral strategically across DeFi to maintain peg stability. And Curve's (CRV, “D”) crvUSD uses algorithmic liquidation mechanisms to protect its overcollateralized position.

This evolution mirrors traditional finance's own journey: Central banks once believed they could maintain currency pegs through mere decree and market operations. Eventually, most learned that substantial reserves were necessary.

Crypto, it seems, has compressed decades of monetary policy learning into just a few years.

Lessons Learned

For investors, Terra's collapse and the subsequent industry pivot offer several enduring lessons:

- Sustainability trumps growth: UST's rapid growth to $18 billion, fueled by unsustainable 20% yields, should have been a red flag. Today, we know to prioritize sustainable growth over marketing-driven expansion.

-

Transparency is non-negotiable: Leading stablecoins now publish detailed collateral reports and maintain on-chain transparency.

In short, if you can't see exactly what backs your stablecoin, that's a problem.

- Diversification matters: Both Frax and MakerDAO have shifted to multi-asset reserves. Gone are the days of single-token backing or purely endogenous value. Rather, stablecoins are expected to be backed by multiple assets to ensure stability.

- The trilemma persists: The stablecoin trilemma — balancing stability, decentralization and capital efficiency — remains unsolved. Post-Terra, the industry’s approach has clearly shifted to prioritize stability, even at the cost of capital efficiency. Projects that deviate should be given a hard look.

- Regulatory reality: Regulatory compliance is no longer optional for projects with scale ambitions. The days of purely anarchic monetary experiments are giving way to a regulated approach, for better or worse.

But perhaps the most important lesson is one that we should have understood from the beginning: Financial gravity still applies in crypto.

The promise of algorithmic stablecoins was that clever code could create something from nothing — i.e., value without backing, stability without reserves.

Terra's collapse was a humbling reminder that there are no free lunches in finance, even with the smartest algorithms.

For a space often criticized for failing to learn from its mistakes, the stablecoin sector's post-Terra evolution offers a counternarrative: sometimes, crypto does learn. Even if it takes $45 billion to teach the lesson.

As market volatility persists, investors will continue to flee into the comparative safety of stablecoins. And they’ll look to stablecoin yields to help them outperform the market.

If you aim to be one of them, I hope you’ll keep these valuable lessons in mind.

Best,

Jurica Dujmovic