|

| By Bob Czeschin |

The U.S. Federal Open Market Committee was widely expected to cut interest rates on Wednesday, Sept. 17.

But the likelihood of a cut increased even more today after the biggest downward revision in jobs numbers in history.

This may not be a jumbo cut. But even if it’s a small (say, quarter-point) reduction, it could be the start of many.

Central bank moves like this are practically synonymous with liquidity.

Global liquidity is a leading indicator for Bitcoin (BTC) price action. Gold is another.

As Juan Villaverde pointed out a few weeks ago, gold tends to lead Bitcoin by about 24 weeks.

Well, gold has just broken out to new quarterly, monthly and all-time highs. And the VanEck Gold Miners ETF (GDX) broke out to a new high after 14 years.

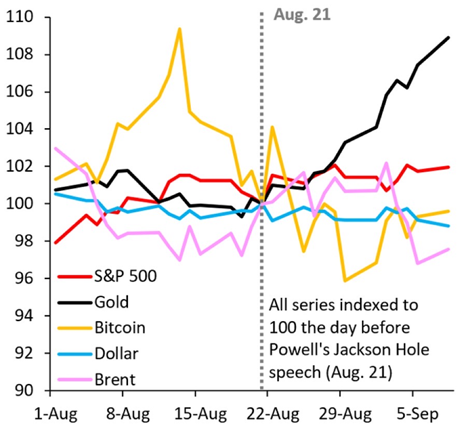

Since U.S. Fed Chair Jerome Powell’s dovish speech last month, here’s how several major assets have performed. Chart below, courtesy of my colleague Sean Brodrick.

Gold (black line) has gone up, while Bitcoin (gold line) has gone down, since Aug. 21.

Again, with gold tending to lead Bitcoin …

And with the liquidity that’s about to wash over the markets that’s also set to drive Bitcoin higher …

It’s clear that gold — the “natural Bitcoin” — as Tether CEO Paolo Ardoino has described it, is on a glide path higher.

So could Bitcoin, which could do even better thanks to three more formidable forces:

First, BTC uniquely fuses the scarcity of gold with the portability of information.

Bitcoin is often called “digital gold” for good reason: There’s a hard ceiling on the total amount of coins that can ever exist.

Inherent scarcity is also the defining characteristic of gold.

God’s not making any more of it — which means total supply is finite and fixed.

That’s hugely important in a world where the buying power of paper currencies gets eaten away by persistent and flagrant money printing.

It’s why people naturally flock to gold and Bitcoin as stores of value.

Gold, of course, is famous for holding its value across millennia.

Archaeologists have found records from ancient Rome showing high-ranking centurions who earned about 38 ounces of gold for a year’s service.

That’s roughly equivalent to the annual pay of a lieutenant colonel in the U.S. Army today.

But gold also has limitations.

- It costs money to store. Bank vaults aren’t cheap. Neither are guards with guns.

- Gold is also quite heavy and not easy to transport in large quantities.

- Plus, governments have a nasty tendency to seize it when times get tough.

This is not merely theoretical. Historical examples abound. (Google “Executive Order 6102,” to read President Roosevelt’s 1933 order confiscating all the gold in America.)

Bitcoin offers the same scarcity benefit as gold, but it has no mass. It is pure information: a long character string, floating weightlessly in cyberspace.

That makes it a lot harder to grab. Lacking tangibility, no police or soldiers can seize it.

Pure information is instantly transportable. You can send it anywhere on earth (via the Internet) at the speed of light.

Information is also memorizable.

Commit the seed phrase of your self-custody digital wallet to memory, and you effectively have a secret Swiss bank account in your head. And, certainly, in your pocket.

With it, you can carry generational wealth across any border. And no one is the wiser!

Second, more than a coin, Bitcoin is also a network. And network effects are exponential.

A couple decades ago, a non-network creature of the analog age — Blockbuster Entertainment — was also a Wall Street darling.

Blockbuster had some 9,000 shops renting videotapes nationwide.

Revenues hit $5.9 billion, and market cap stood at $5 billion.

Then along came Netflix (NFLX) — the digital network version of watching movies at home.

Today, Netflix revenues run $40 billion. And its market cap ($520 billion) … is 100x Blockbuster’s best.

Metcalf’s law attempts to quantify this explosive potential. It says the value of a network is proportional to its number of users squared.

In other words, doubling the number of users quadruples the value of the network. Triple users, and network value shoots up a whopping 800%.

For investors, what this means is simple. Bitcoin gives you two ways to make money.

Not only does it compensate for fiat debasement — which Macro strategist Raoul Pal estimates is about 8% a year. It also captures the exponentially rising value of growing network adoption.

This is why Bitcoin’s historical compound annual growth rate (CAGR) is dramatically higher than inflation.

Each new round of currency debasement spurs a new wave of adoption. Which, in turn, leads to a self-reinforcing value climb.

With about 300 million users (4% of the world population), crypto is still in the early days of global adoption.

In other words, the bullish impact of Bitcoin’s network is only just starting to kick in.

Third, governments buying Bitcoin are ushering in an immensely bullish paradigm shift.

El Salvador pioneered buying Bitcoin as a reserve asset in 2021 and still buys BTC today. But what really opened the floodgates was Trump’s executive order establishing America’s Strategic Bitcoin Reserve (SBR).

Seeing which way the wind was blowing encouraged 16 U.S. states to introduce Bitcoin reserve legislation of their own.

Among them: Wyoming, Pennsylvania and South Dakota.

And Michigan and Wisconsin use state funds to buy shares in Bitcoin ETFs.

On a global level, the SBR could trigger a kind of “game theory” scenario.

That is, other countries fear being left behind and missing out (double FOMO!) and accelerate BTC acquisitions, accordingly.

For example:

- Despite banning crypto trading and mining, China is likely building up a BTC hoard to rival the USA. But how many coins it has — like the extent of Chinese gold reserves — is a state secret.

- Russia, Iran and Venezuela all use crypto to push back against financial sanctions. So, it’s a safe bet they all have a healthy hoard of BTC. But like the Chinese, they don’t divulge details.

- Persistent rumors say United Arab Emirates is covertly converting large amounts of petro-wealth into Bitcoin — possibly as a diversification measure. If true, other well-heeled oil sheikdoms will not be far behind.

- Japan and the Czech Republic are also mulling Bitcoin investments.

Unlike ordinary investors, governments are a unique class of buyer. The politicians in charge aren’t risking their own money, so they don’t much care about purchase prices.

Nor do they get fired if an investment turns out to be a dud. And because sovereign nations can print money, they have virtually unlimited buying power.

So, as nations wade into Bitcoin — especially if in competition with one another — massive, price-insensitive demand is going to collide head-on with Bitcoin’s rigidly inelastic supply.

The impact on prices is going to be epic. No one knows how high they could go.

Or perhaps they have some idea, as U.S. government officials are starting to telegraph their own interest in crypto investing.

Yesterday, Marija Matic told you about the Trump family’s billion-dollar windfall from digital assets.

Bitcoin is in the mix.

But look at World Liberty Financial — cofounded by Trump’s sons as well as the sons of Steve Witkoff, his U.S. special envoy to the Middle East.

When the WLFI token launched Sept. 1, it created a billion-dollar-plus windfall for the Trump family.

But it barely holds any Bitcoin at all.

In fact, that half-billion-dollar fund is invested almost entirely in altcoins.

Think about that for a second.

The most powerful person in the world — who has access to the best financial advisers, the smartest analysts and classified economic data — is putting his money into altcoins.

If you want to do the same, we suggest doing so before next week’s Fed meeting.

My colleague Mark Gough has counted 43 altcoins that have soared way past Bitcoin recently — as much as 37x better.

To see how you can get your hands on Mark’s top three critical altcoin opportunities for September, watch this video now.

Best,

Bob Czechin