|

| By Bruce Ng |

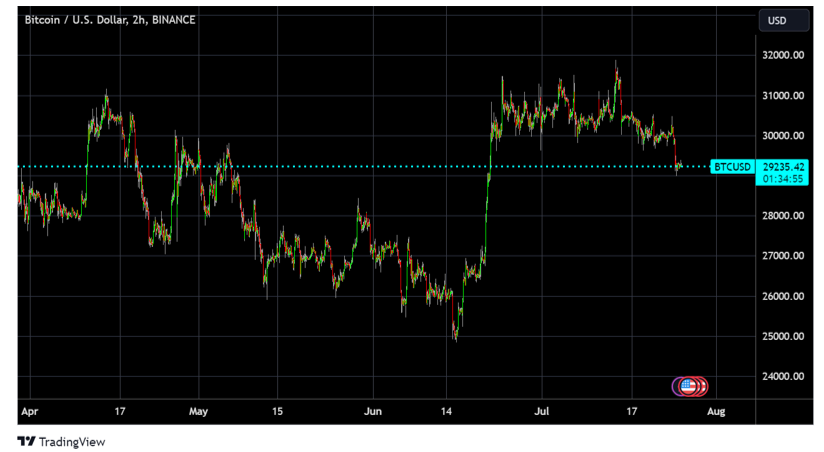

In last week’s issue, I mentioned that Bitcoin’s (BTC, “A-”) could slip below the $30,000 level.

Well, that’s exactly what played out.

As you can see in the chart below, BTC lost support and is now trading around $29,000:

However, this past week is characterized as having incredibly low trading volume. So, in short, not much has happened.

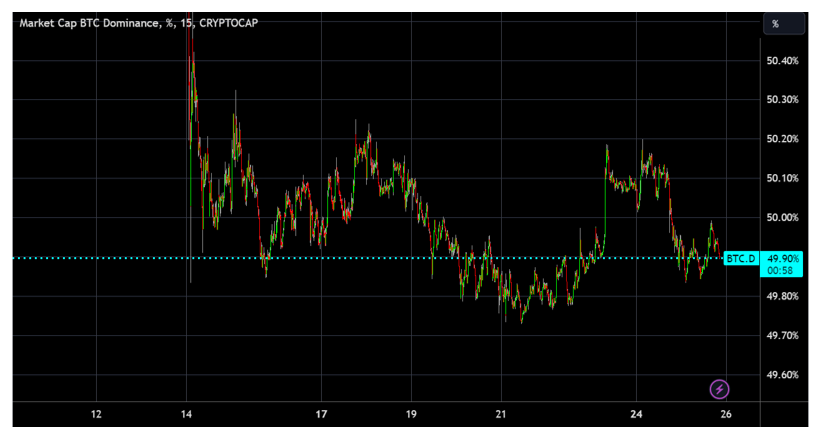

But what’s the outlook for altcoins? Let’s take a look at BTC dominance to get a better idea:

Over the past week, BTC.D traded within a tight range, hitting a maximum of 50.9%. So, it’s not showing signs of picking a direction just yet.

Now, let’s consider one last piece of data to get a better picture of where BTC is headed.

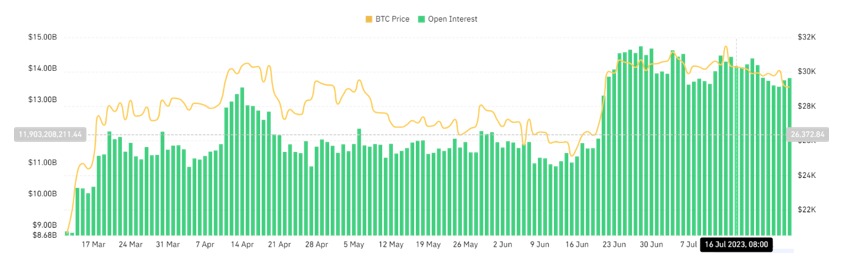

In the chart above, the open interest for futures across all centralized exchanges is displayed in green.

Over the past week, OI also traded within a small range with no significant liquidations.

However, it currently sits at $13.7 billion. Considering the highest OI registered this year is $14.7 billion, its current number is still extremely high.

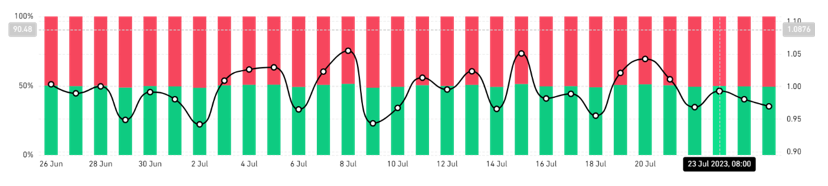

Finally, let’s check up on the long/short ratio to get an idea of what market sentiment is like. The long/short ratio is considered a barometer of investor expectations for future price action, with a high long/short ratio indicating positive investor expectations.

Right now, the long/short ratio sits at 49.2% to 50.8%, indicating that there is hardly any directional bias here.

But if we had to choose a direction, we would lean slightly toward a short squeeze occurring. After all, the market needs some activity, and some players are ready to spark a move in order to make some money.

Overall, BTC is still sitting on a precipice where there is a strong possibility of both shorts and longs getting liquidated.

In other words, BTC’s price action might head down to $28,000 as initially suggested in my article last week.

So, we are looking at two possible scenarios for BTC’s short-term price action:

- BTC heads to $28,000.

- We get a temporary short squeeze. In this case, we can head back above $30,000.

I know this is a tongue-in-cheek way of saying we can either go up or down from here. But what’s guaranteed is that any move will be intense, as it will involve liquidations.

However, it’s important to remember that these are only short-term scenarios. The long-term outlook is that BTC will go up, especially as it heads toward its next halving event in 2024.

For now, stay safe and patient as we wait for this price action to shake out.

And if you would like a more in-depth analysis of high-quality alts to invest in for the long term, I suggest checking out my colleague Juan Villaverde’s Weiss Crypto Investor.

Best,

Bruce