America’s 52 Million U.S. Crypto Holders Should Expect Regulatory Changes

As the cryptocurrency market grows, governments and regulatory bodies worldwide are increasing efforts to introduce new regulations.

If you’re wondering why everyone in the crypto community seems so plugged in to the U.S. election season, this is why.

Over the past few years, central governments and banks’ reactions to crypto have been watched closely. Just look at the multiple conversations that have taken place on X (formerly Twitter) about Federal Reserve Chair Gary Gensler and his alleged anti-crypto agenda.

See, crypto can’t reach mainstream adoption without a clear path forward for TradFi and crypto to interact. But while regulation is needed, overregulation could stifle growth.

Clearly, these impending changes will significantly impact how cryptocurrencies are traded, held and utilized. So, I want to delve into the latest developments and what they mean for you as an investor.

I’ll be keeping my focus pretty strictly on the U.S., as with the election coming up and no clear crypto protocol in place, all eyes are on the States.

But if you’re interested on hearing about regulations worldwide, let me know by using the Contact Us feature on the Weiss Ratings website. If there’s enough support, I’ll write about it in the future.

The Current Regulatory Landscape

The U.S. has been slow on the crypto uptake.

Indeed, as my colleague Juan Villaverde pointed out, most innovation in the crypto industry happens outside of the U.S.

In fact, many DeFi platforms block U.S. residents for fear of violating the current — and unclear — U.S. regulations around crypto. But that could change, as the upcoming election has thrust cryptocurrency regulation into the spotlight as both parties fight for the crypto vote.

Republicans, led by presidential candidate Donald Trump, advocate for regulatory easing to position the U.S. as a global leader in the crypto industry.

Trump has also proposed moving the 200,000 BTC seized by the government into a strategic reserve fund, potentially stabilizing the market.

Meanwhile, the Democrats, with Kamala Harris as their presidential candidate, are showing growing interest and openness to crypto. However, Harris has yet to detail her official stance.

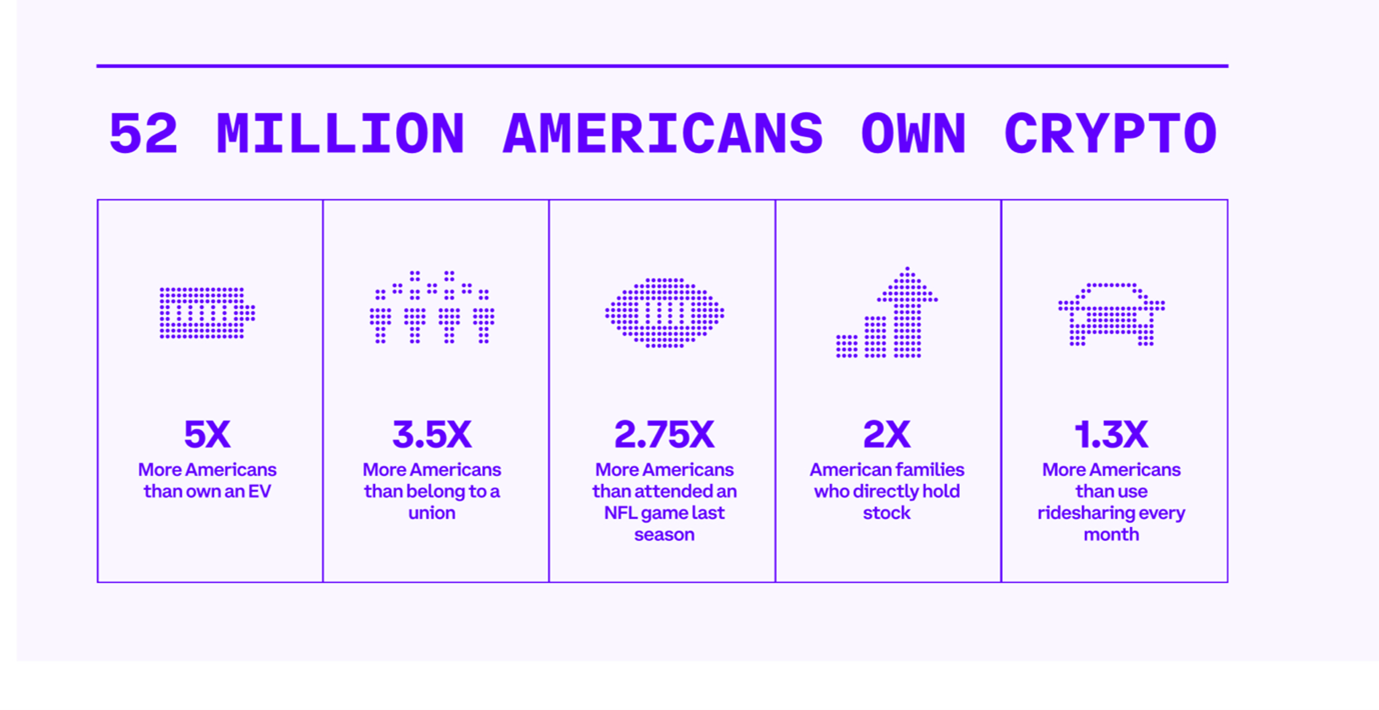

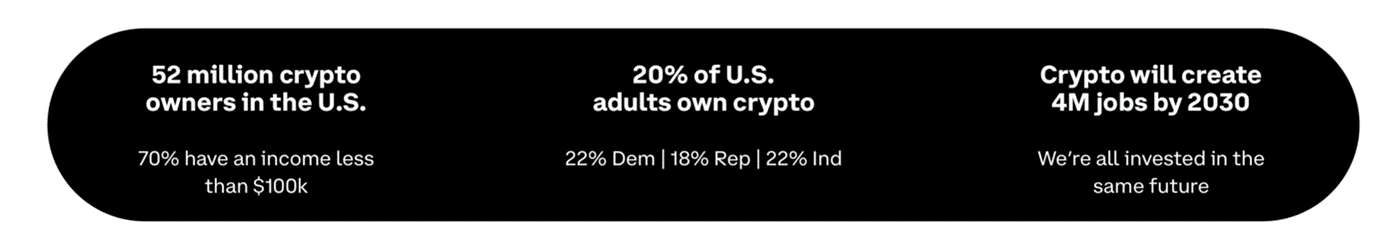

One thing is clear, however: With 52 million Americans owning crypto, bipartisan agreements will be crucial for any practical regulatory framework.

Brian Armstrong from Coinbase (COIN) recently expressed optimism about bipartisan support for comprehensive crypto legislation. He stated, "crypto advocates are making their voices heard as an important voting bloc. Politicians on both sides of the aisle have taken notice, and there is growing momentum to pass comprehensive crypto legislation.”

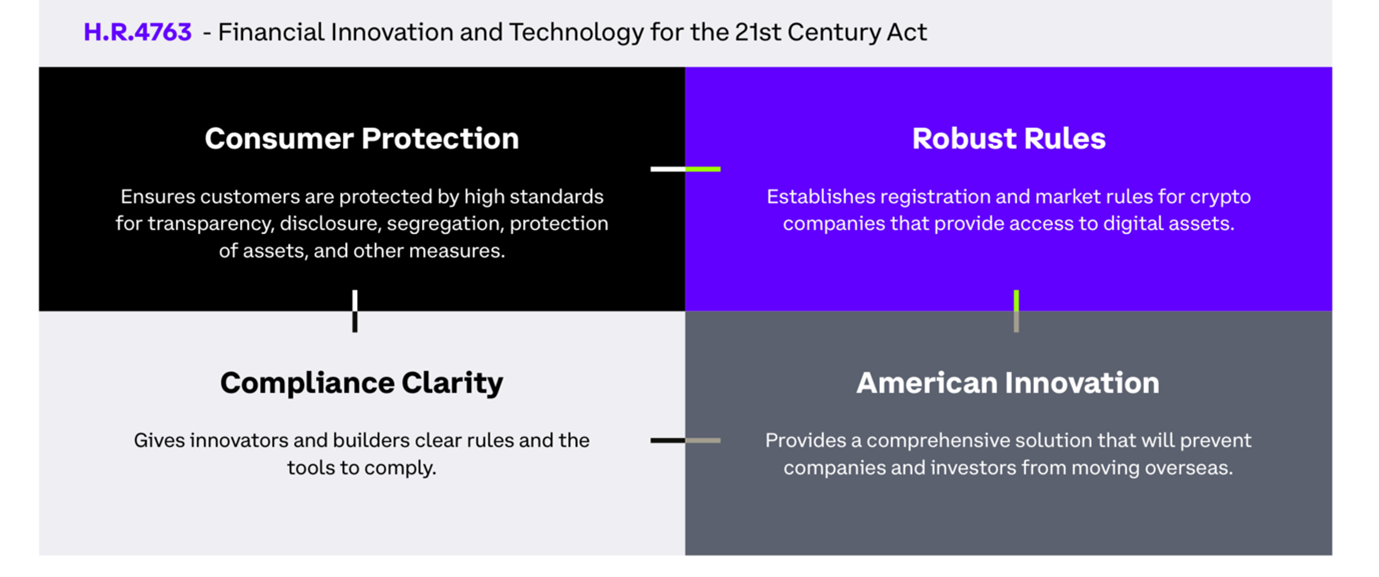

The biggest bipartisan push forward has come from the Financial Innovation and Technology for the 21st Century Act, or the FIT21, bill.

It was passed in May 2024 by the House of Representatives, marking a historic step for the U.S. digital asset ecosystem. Chair Patrick McHenry emphasized that the bill provides the regulatory clarity and robust consumer protections necessary for the digital asset ecosystem to thrive in the U.S., ensuring America leads the financial system of the future and remains a hub for technological innovation.

But there’s still a long road ahead before FIT21 is signed into law. For now, it is awaiting a Senate vote.

What Is FIT21?

FIT21 represents a significant legislative effort to bring clarity, consumer protection and regulatory oversight to the burgeoning cryptocurrency and digital assets market.

Here’s an in-depth look at what this act entails and its implications.

FIT21 aims to foster innovation while ensuring that the next generation of the internet develops within a regulated and secure environment in the U.S. This will be done by creating a robust regulatory framework that addresses consumer protection, national security and operational needs.

This will accomplish three key goals:

- Establish and Enforce Crypto Companies' Consumer Protection: This will be enforced through both the Commodities Futures Trading Commission and the Securities and Exchange Commission through new requirements for transparency, disclosure, segregation of funds, asset protection and more.

-

Update and Expand Regulator Authority: In granting the CFTC new authority to oversee spot markets for digital asset commodities, FIT21 fills a crucial gap in federal oversight. This move is expected to standardize consumer protection requirements and enable more vigorous enforcement against bad actors.

FIT21 also establishes workable registration requirements for digital asset trading platforms under SEC jurisdiction. It ensures high standards for investor protection while maintaining market fairness and facilitating capital formation. This modernization allows the SEC to focus resources on assets under its jurisdiction.

-

Create a Pathway for Innovation: Overall, FIT21 has the potential to construct a registration pathway tailored for developers, builders and innovators. This could ensure appropriate regulation at every stage, recognizing the unique characteristics of digital assets that may evolve from centralized projects needing securities regulations to decentralized commodities.

This bill also represents a crucial step forward in finding a balance between compliance and innovation. That’s necessary for sustainable growth as it provides clarity for companies — both crypto and TradFi firms exposed to crypto — to be able to develop and scale without fear of an honest mistake ending in fines and other enforcement actions.

Industry Support for FIT21

Naturally, many crypto enthusiasts in the U.S. support FIT21.

In a letter to the House of Representatives from Stand with Crypto and undersigned by over 100 companies in the U.S. across 23 states, industry leaders underscored the multifaceted importance of crypto innovation.

They emphasized that, "crypto innovation is not just about technology; it's about jobs, American innovation and securing our national interests. Keeping crypto innovation in America will secure millions of jobs, prevent the shift of blockchain development overseas, and boost America's share of developers."

This collective advocacy highlights the critical role of the FIT21 Act in maintaining the U.S.' leadership in financial and technological advancements.

The letter also pointed out that without regulatory clarity, the U.S. risks losing 2% of its web3 developers annually, which could jeopardize approximately 4 million blockchain-related jobs. Thus, the passage of FIT21 is vital for fostering innovation and ensuring opportunities for growth and security within the United States.

Potential Impacts on the Crypto Market

If signed in to law, the upcoming regulatory changes, including those under FIT21, are likely to have several impacts on the cryptocurrency market:

- Increased Compliance Costs: Cryptocurrency exchanges and service providers may face higher compliance costs as they adapt to new regulations. This could lead to industry consolidation, with smaller players struggling to keep up.

- Enhanced Consumer Protection: Clearer regulations can help protect consumers from fraud and manipulation, potentially increasing trust and participation in the crypto market.

- Market Volatility: Announcements of new regulations often lead to short-term market volatility. Traders and investors must stay informed and be prepared for potential price swings, especially in this already volatile market.

- Innovation and Adaptation: Regulatory clarity can encourage innovation by providing a stable framework within which companies can operate. However, overly restrictive regulations could stifle innovation and push activities to less regulated jurisdictions.

The crypto industry is already responding to the anticipated regulatory changes.

Many major exchanges, for example, are taking proactive steps to comply with upcoming regulations, including implementing stricter know-your-customer and anti-money laundering measures.

Others are leading alliances with regulators to help shape balanced and effective regulatory policies. The Blockchain Association and other coalitions lobby for frameworks supporting consumer protection and innovation.

However, some industry players have decided to challenge specific regulatory actions in court, arguing that they stifle innovation and overreach existing legal frameworks.

For example, ongoing legal disputes involving the SEC and various crypto companies highlight the tension between regulation and innovation.

In short, the road will be bumpy as new regulation is called for, argued and eventually implemented. I anticipate volatility throughout the process.

But in the long term, as regulatory frameworks for cryptocurrencies continue to develop globally, the crypto market will inevitably undergo significant changes.

In the U.S., the election outcome and each party's approach will be pivotal. The potential for a bipartisan agreement on crypto regulations could offer a balanced approach that encourages growth while protecting investors. That could give the U.S. the boost it needs to become a crypto leader in the future.

In this era of regulatory uncertainty, one thing is clear: The crypto market is poised for transformation, and those who can anticipate and adapt to these changes will be well-positioned to thrive.

To keep up with all the latest twists and turns in the crypto world, I urge you to check in with us here at Weiss Crypto Daily.

Best,

Mark Gough