Another Way to Profit with Cycles

Editor’s Note: We’ve covered the crypto cycles in our Weiss Crypto Daily issues before. They’re the key to understanding the method behind the madness that is the wild crypto market. And they’re pivotal in understanding our Crypto Timing Model, which our Weiss Crypto team has used to great success multiple times to determine where the market currently stands … and where it will likely be going. But did you know that cycles aren’t unique to the crypto market? Indeed, TradFi has a few cycles of its own. And there is no one better to explain these cycles — and the opportunities they present investors — than our TradFi cycles expert, Sean Brodrick. I’ll let him take it from here … |

|

| By Sean Brodrick |

Not long ago, many believed we were entering a new golden age.

After the fall of the Berlin Wall and the collapse of the Soviet Union, historians began talking about “the end of history.” The belief was that international conflict would diminish as more nations embraced democracy and free markets.

But human nature being what it is, conflicts are once again erupting, escalating and spreading faster than almost anyone expected.

Witness ...

- The Hamas-Israel conflict that began on Oct. 7.

- The Russia-Ukraine war that’s set to enter its second year.

- Constant conflicts in the South China Sea between China and its neighbors.

This is just a small sample of the armed conflicts that now impact every continent except Antarctica.

The war cycles told us that they were coming. And they also show us that more are on the way.

And while wars can seem to be triggered by random events — like the assassination of Archduke Ferdinand before World War I — the truth is they’re the result of social and economic forces that build up over time.

Historians and social scientists have studied these forces for hundreds of years. But in the last century, a few mathematicians, cultural anthropologists and sociologists have noticed something:

There is a regular pattern to the outbreak of war.

In fact, the social and economic patterns that make war likely are almost as predictable as the movement of the sun across the sky or the changing of the seasons.

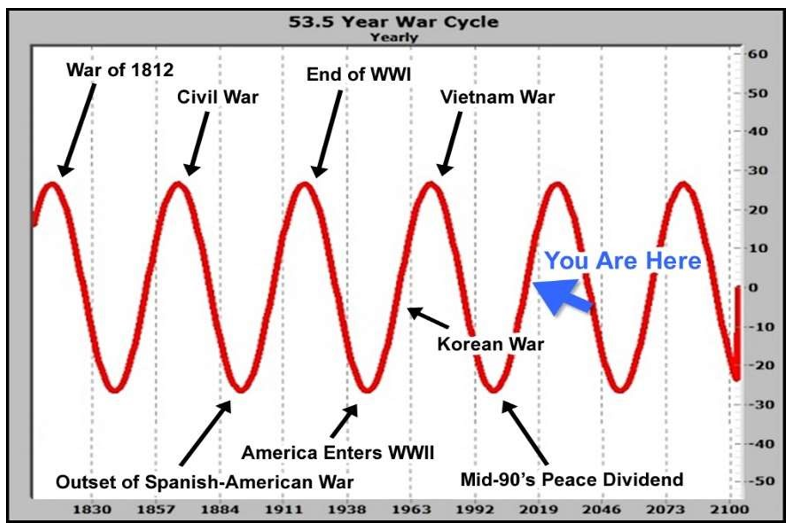

Two war cycles repeat themselves consistently: a 17.71-year cycle and an 8.8-year cycle.

These, in turn, are sub-cycles within a larger 53.5-year cycle.

This 53.5-year cycle is what I call the “Granddaddy of War Cycles.”

But here’s what worries me most:

All three of these proven war cycles — the 53.5-year cycle, 17.7-year cycle and 8.8-year cycle — are converging in a way that hasn’t happened in over 50 years!

And that means we can only expect things to get worse before they get better.

I hate to say it, but war is one of the most bullish trends right now.

As armies prepare to wreak havoc around the globe, military spending is surging and so are military stocks.

In 2024, Congress is funding $831.7 billion in military spending, or about 50% of the country’s total discretionary budget. That breaks down to the Pentagon using more than $2 billion per day.

As an investor, one way you can take advantage of this historic convergence is to play defense in your own portfolio.

One way is to “buy” defense, via an instrument like the iShares U.S. Aerospace & Defense ETF (ITA).

ITA has outperformed the S&P 500 since the end of October.

With the war cycle strengthening, ITA stands to rise much higher.

Nobody wants war, but if it’s inevitable, investors would be wise to look for potential profit in the aftermath of global unrest.

I’d take advantage of any pullback if I were you.

But the war cycles are only one of the many cycles that influence the TradFi market.

And starting just days from now, a technology supercycle sparked by AI is expected to trigger an explosion of new wealth creation valued at $13 trillion.

Starting with our top three stock picks for 2024.

The opportunity is real.

The gains are real.

And as I reveal in this groundbreaking video, we’ve already seen 14 cases of 500% or greater gains with companies related to this supercycle.

So be sure to watch that video to get the facts before the holidays, because we’ll be taking that video down shortly after.

All the best,

Sean